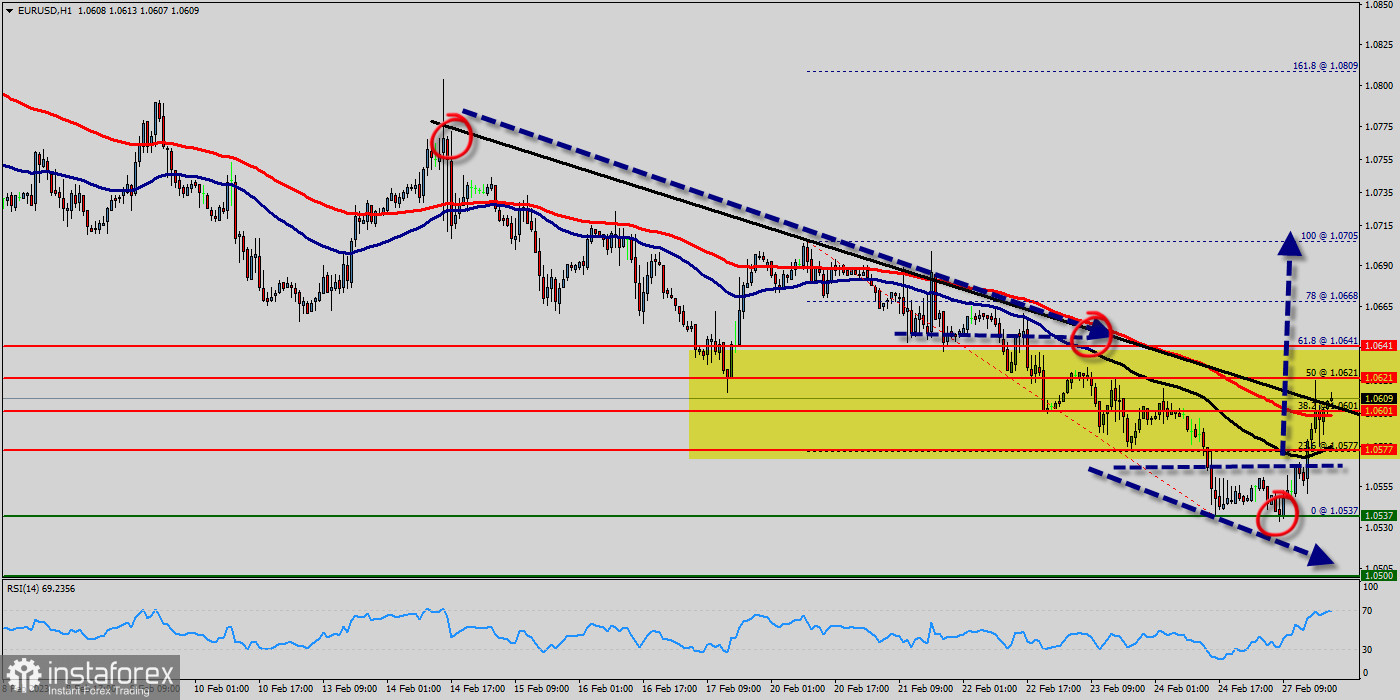

The EUR/USD pair broke resistance which turned to strong support at the level of 1.0577 yesterday. The level of 1.0577 is expected to act as major support today. From this point, we expect the EUR/USD pair to continue moving in a bullish trend from the support levels of 1.0577 and 1.0601.

Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Consequently, the first support is set at the level of 1.0577 (horizontal red line).

So, the market is likely to show signs of a bullish trend around the spot of 1.0577 and 1.0601. In other words, buy orders are recommended above the spot of 1.0577 or/and 1.0601 with the first target at the level of 1.0641; and continue towards 1.0668 (the weekly resistance 1).

This would suggest a bearish market because the moving average (100) is still in a positive area and does not show any trend-reversal signs at the moment.

On the other hand, if the EUR/USD pair fails to break through the resistance level of 1.0668 this week, the market will decline further to 1.0577.

So, we expect the price to set below the strong resistance at the levels of 1.0668 and 1.0670; because the price is in a bearish channel now. The RSI starts signaling a downward trend.

Consequently, the market is likely to show signs of a bearish trend.

The pair is expected to drop lower towards at least 1.0537 with a view to test the weekly double bottom. Also, it should be noted that the weekly pivot point will act as minor support today.