The GBP/JPY pair rallied in the short term and now is located at 164.21. The rate ignored to the near-term resistance levels, signaling further growth. Still, after its leg higher, a retreat is natural. A temporary drop or a consolidation could confirm further growth.

The bias is bullish, but the Japanese data could change the sentiment in the short term. Prelim Industrial Production may report a 2.9% drop, Retail Sales could increase by 4.2%, BOJ Core CPI is expected to report a 3.1% growth, while Housing Starts could increase by 1.0%. Positive Japanese data should lift the JPY.

GBP/JPY strongly bullish

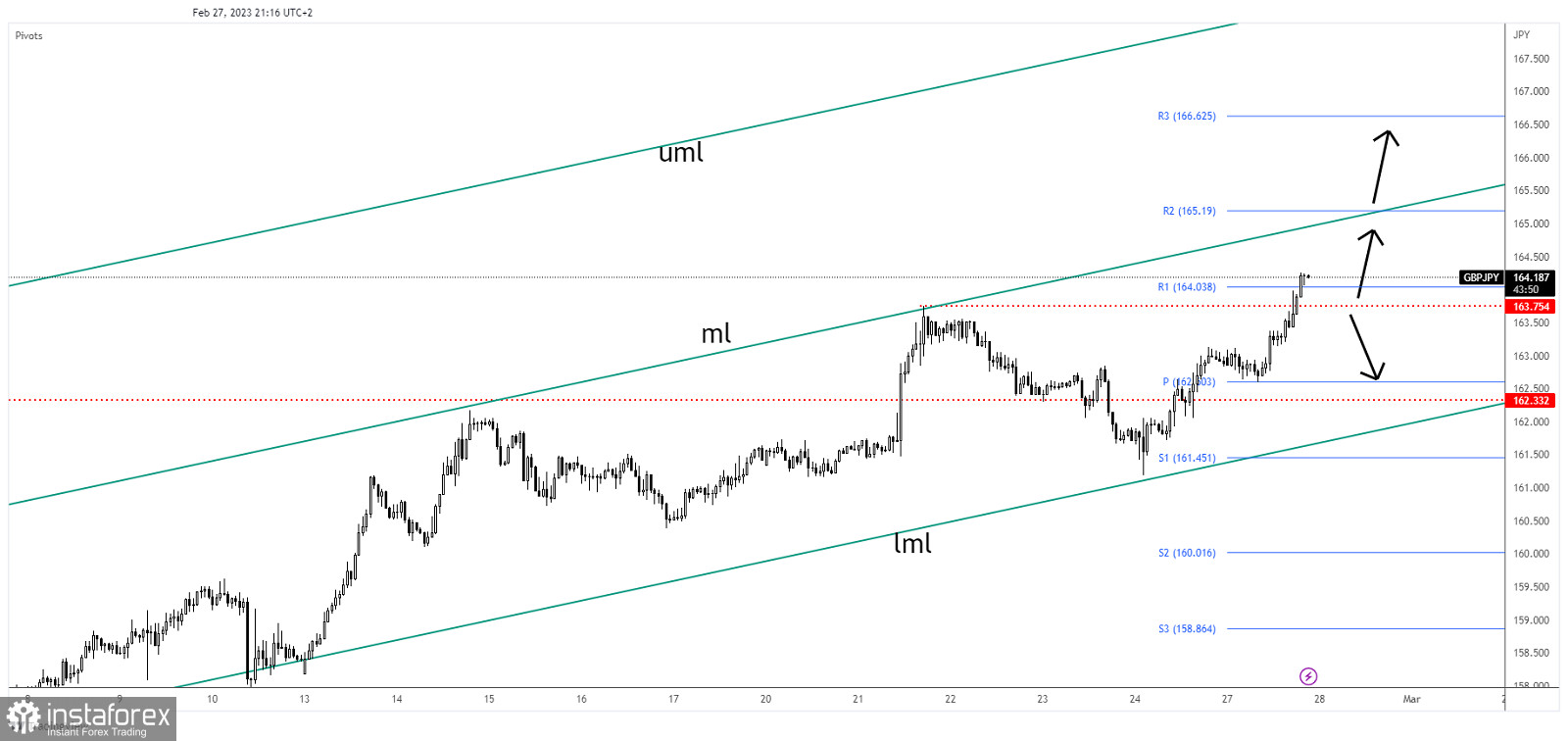

Technically, the GBP/JPY pair ignored the 163.75 former high and the R1 (164.03). These represented upside obstacles. The next upside target is represented by the median line (ml) of the ascending pitchfork.

The fundamentals should drive the markets. Also, after its growth, the rate could come back to test and retest the broken resistance levels before extending its growth.

GBP/JPY forecast

Consolidation above 163.75, testing and retesting the broken level confirm further growth towards the median line (ml) and up to the R2 (165.19). This represents a new buying opportunity.