Analysis of Wednesday's trades:

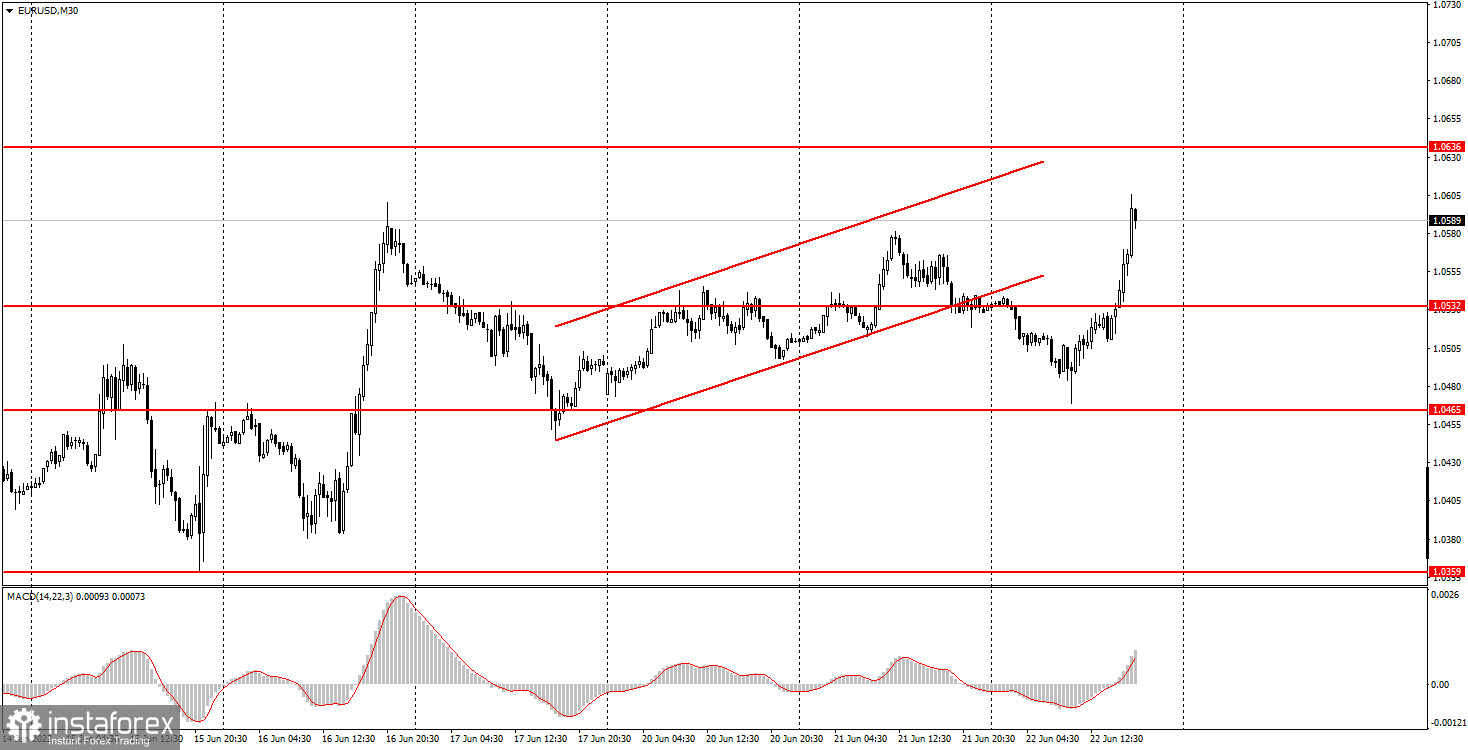

30M chart of EUR/USD

On Wednesday, the volatility of EUR/USD totaled about 140 pips. On the one hand, there is no surprise in that as it was the day when Fed Chair Powell testified in Congress. On the other hand, his testimony had the opposite effect on the pair. Before the testimony, the instrument traded rater actively. But as soon as it started, the dollar instantly plummeted by 70 pips. Markets were unimpressed with Powell's speech in Congress. He once again stressed that the Fed's main goal was to bring inflation to the 2% target, which means monetary tightening would continue. On this hawkish rhetoric, the US dollar should have shown growth but it fell instead. The situation was similar to the one after the FOMC meeting when it was also supposed to go up but it actually went down. Thus, an increase in the euro on Wednesday can't be explained from the point of logic. All in all the uptrend goes on.

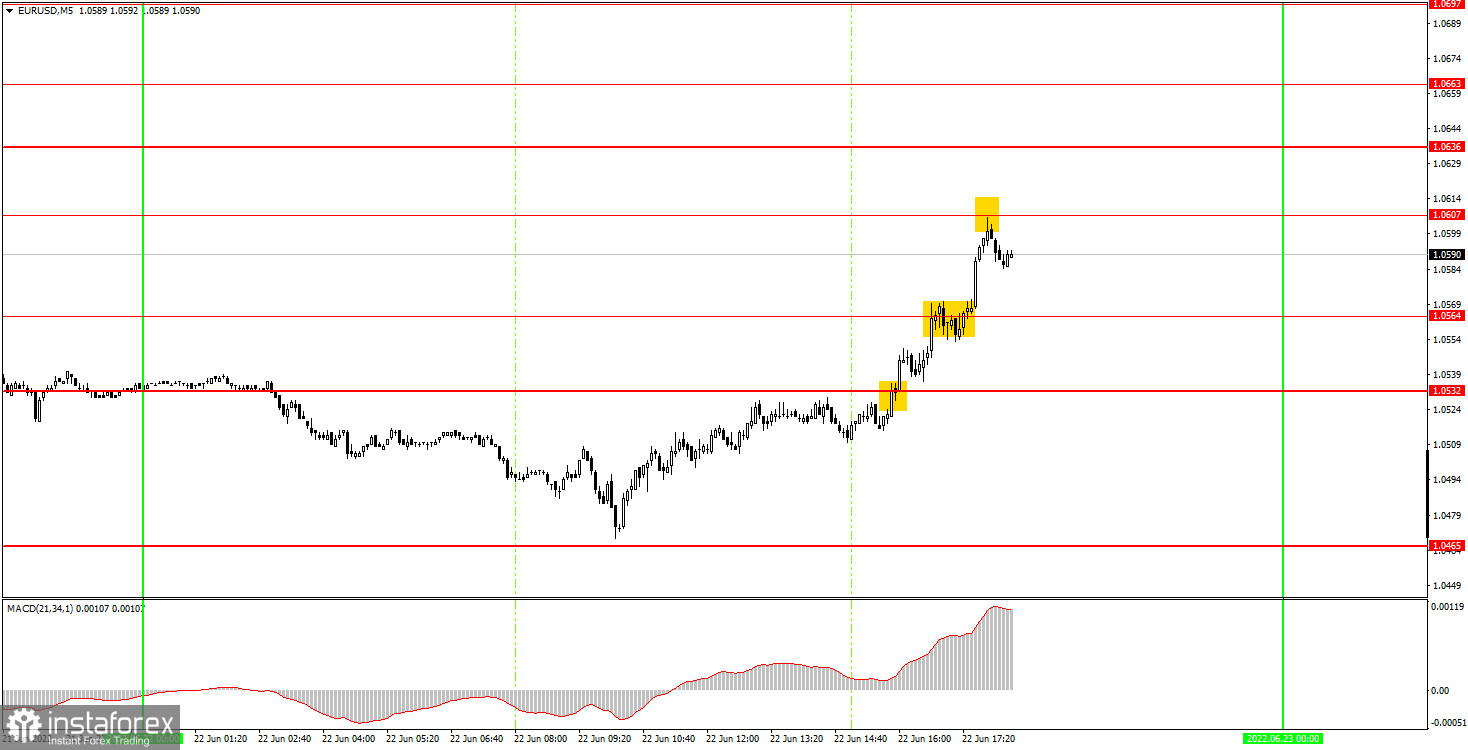

5M chart of EUR/USD

In the M5 time frame, the pair mainly moved in the trend. No buy signal was unfortunately made around 1.0465 as the pair failed to reach the mark. Otherwise, traders could have earned more. The first buy signal was created only after the price had broken through 1.0532. Further, the quote broke through 1.0564, tested 1.0607, and bounced from it. And then it was the time to close long positions. Profit totaled about 50 pips.

Trading plan for Thursday:

In the M30 time frame, the pair was in an uptrend on Wednesday, and it was a rather uncertain move. Therefore, there was no point in building a trend line or a channel. In the M5 time frame, levels 1.0465, 1.0532, 1.0564, 1.0607, 1.0636, 1.0663, and 1.0697 stand as targets on Thursday. A stop-loss order should be set at the breakeven point as soon as the price passes 15 pips in the right direction. On Thursday, the eurozone will see the release of business activity data in the services and manufacturing sectors. Similar data will be published in the United States. The market might react to the results should one or several indicators differ from economists' forecasts. Fed Chair Powell's testimony in Congress will continue on Thursday.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to the Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or produce no signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to interpret charts:

Support and resistance levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.