Bitcoin has stabilized around $20k. The asset now trades in the $19k-$21k range owing to the beginning of the accumulation stage. Over 776k BTC is held by addresses with over 100k BTC. Over the past month, investors have withdrawn more than 82k BTC coins from exchanges. In other words, as soon as bitcoin stabilized around the important psychological level of $20k, the flow of investments in the digital asset resumed.

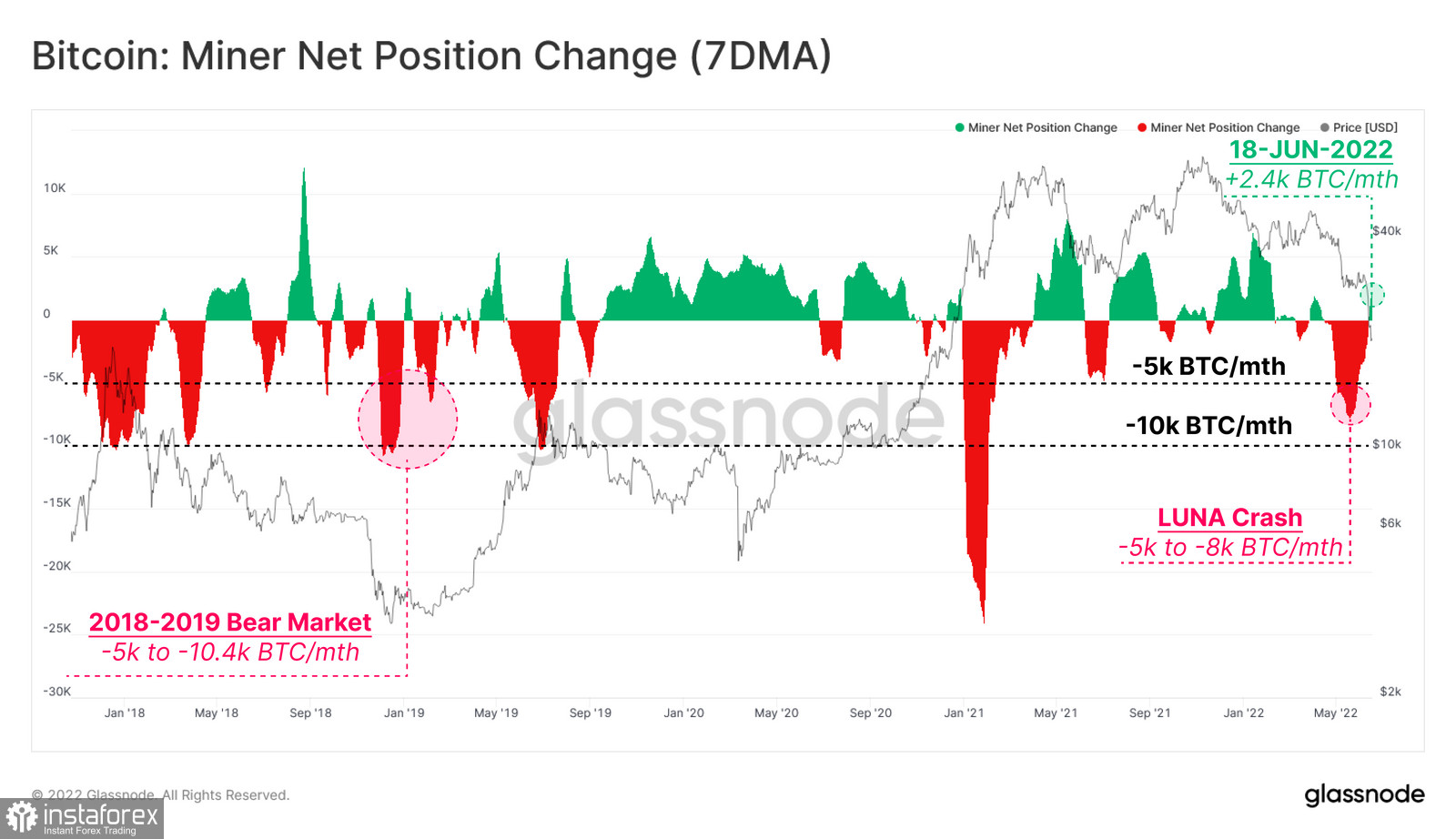

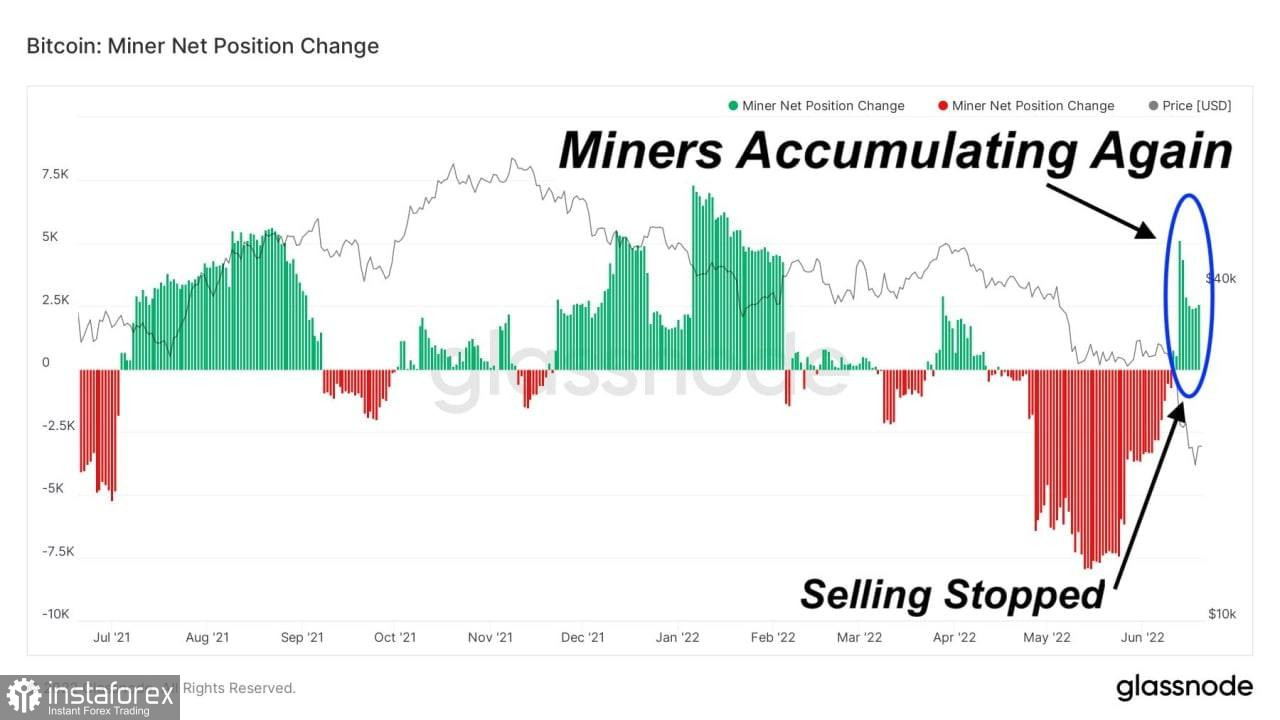

Bitcoin plunged last week. Crypto miners have sold all BTC accumulated in May over the past two weeks. The monthly volume of bitcoins sold by miners reached 5,000-8,000. Accordion to Glassnode, it is the beginning of an accumulation process that helped BTC stabilize around the $20k mark. In this light, the effect miners have had on BTC/USD in the current bear market could be compared to the actions of institutional investors.

Miners were simply trying to find liquidity when selling BTC. Shares of the largest mining companies have fallen, and small players are slowly sinking into oblivion. Selling bitcoin is the best way to get necessary liquidity. Due to the lack of additional funding, miners and other institutional investors have to sell coins.

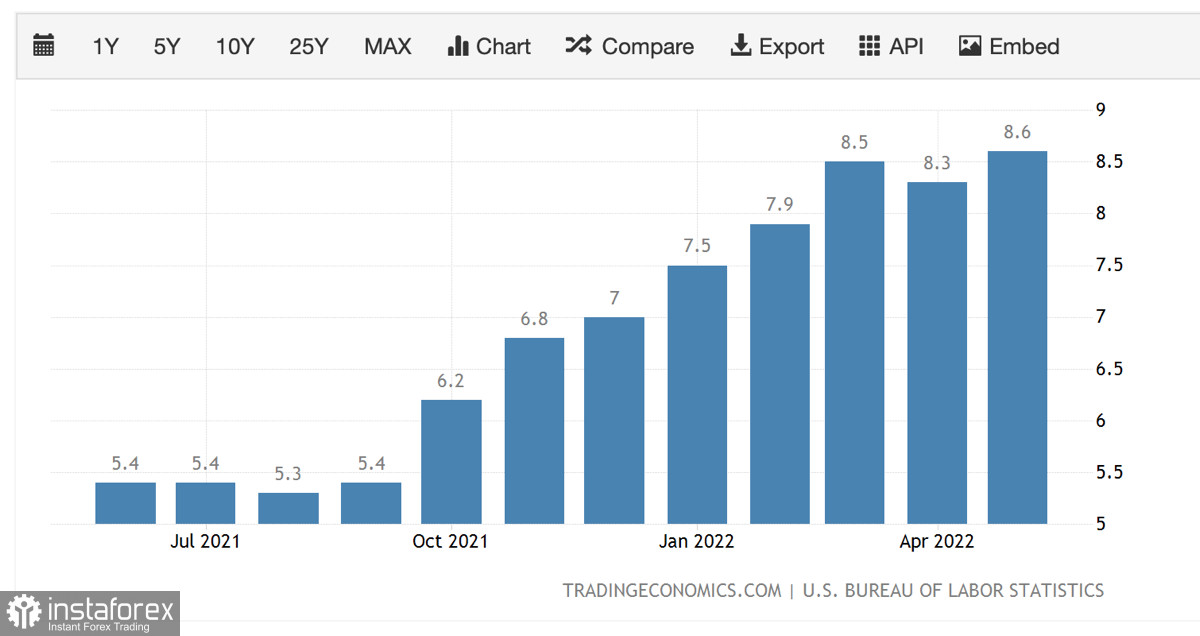

This week, several important events have unfolded that allow us to look into the future with cautious optimism. JPMorgan analysts say inflation may finally be peaking and expect it to "decelerate through the rest of the year," as inventories and other goods are rapidly increasing. The bank sees inflation cooling in the last six months of 2022. In addition, Fed Chairman Powell said the regulator would continue fighting persistent inflation to bring it to the 2% target. The official also reassured the market that the American economy is strong and can withstand further monetary tightening.

In light of these facts, crypto might resume growth at the end of 2022. With inflation peaking, markets have reached record lows and are now beginning to recover. As for the benchmark rate, the inflation rate in the next two months will show whether the crypto market may start to recover by the end of the fall of 2022.

At the same time, it is important to remember that the fundamental background is full of surprises. Powell says the Ukrainian conflict is the main driving force for rising inflation. Since the situation in Ukraine is unlikely to get better any time soon, markets will have to deal with the liquidity crisis until at least October 2022.

On the daily chart, bitcoin is consolidating around $20k. Investors are in no rush to return to the market. On the 4-hour chart, BTC/USD is still trying to break through the mark of $22k, in line with the shoulders of the Head and Shoulders pattern.

Technical indicators show weak bearish activity and emerging upward bullish impulses. The RSI and Stochastic have returned to the bullish zone, signaling an upward trend. The MACD is still moving in the green zone, indicating favorable conditions for the implementation of the H&S pattern. In general, the market is in the final stages of the bear market, and there is every reason to believe that the deepest fall is yet to come.