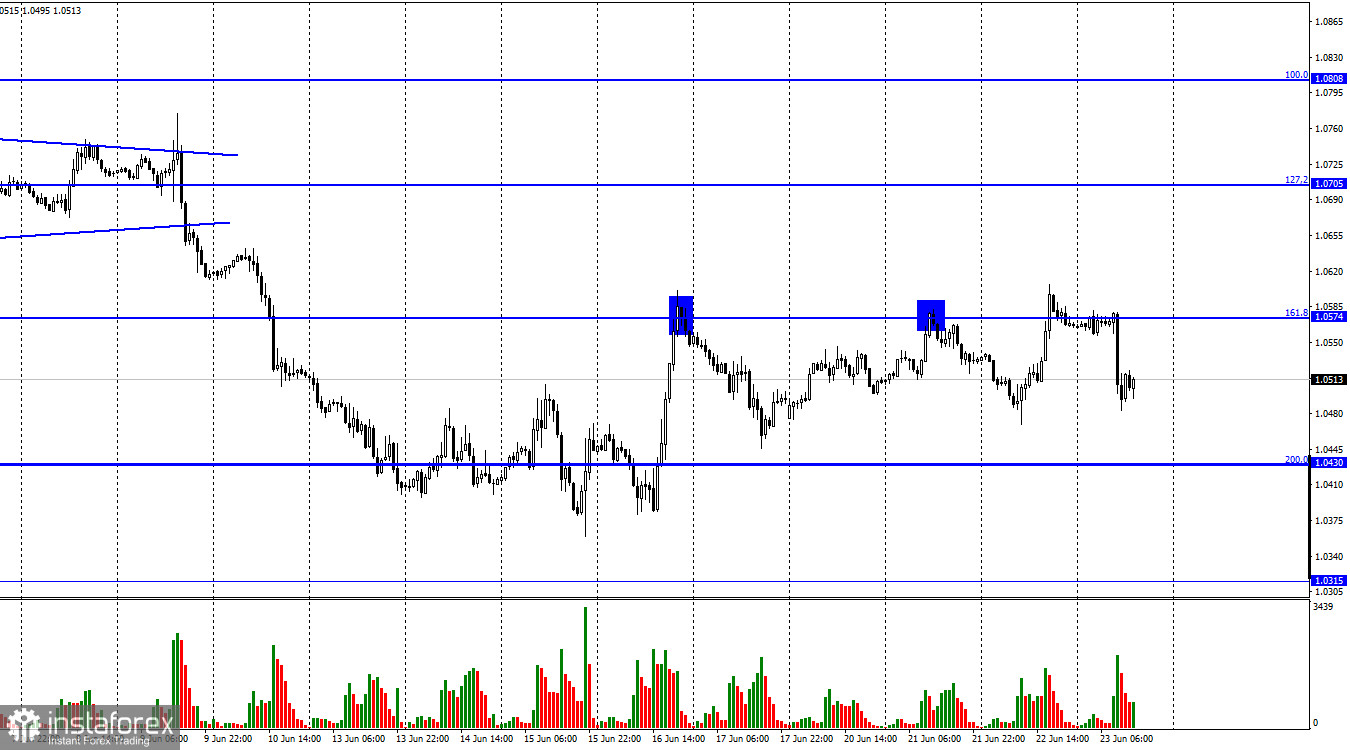

Hello, dear traders! On Wednesday, the EUR/USD pair rose to the 161.8% correction level at 1.0574, rebounded from it for the third time, and reversed in favor of the US dollar. Today, the pair started falling towards the 200.0% correction level at 1.0430. Therefore, the EUR/USD pair has been trading according to the same scenario for the last 4-5 days. First, it rises towards the level of 1,0574, then it falls by 100 pips and returns to 1,0574. Some traders may probably consider this trade a flat movement. Bull traders are still very weak to close above the level of 1.0574. Thus, a significant rise is unlikely. Bear traders are still analyzing the situation or just waiting for the right moment to sell off the euro. Therefore, the euro continues to lose ground and is at risk of dramatic decline.

This morning, PMI indexes have been published in the EU. The ISM Services Index was 52.8, while the ISM Manufacturing Index amounted to 52. Traders were expecting the figures of 55.8 and 54.0 respectively. Therefore, both indices came close to the boundary, that is the level of 50.0, below which the industry is considered to be in recession. Moreover, taking into account recession in some areas, a recession in the EU economy is possible, although the ECB has not started to raise the interest rate yet. Notably, ECB President Christine Lagarde said that the first hike was due next month. Besides, another increase could take place in September. The ECB has only announced its intentions to follow the policy of other central banks, which have already raised rates. However, business activity in the EU has fallen dramatically. Moreover, GDP saw modest growth in the last two quarters. Therefore, it is most likely to decline below 0%. Conclusion: even the EU economy and EU statistics cannot support the euro.

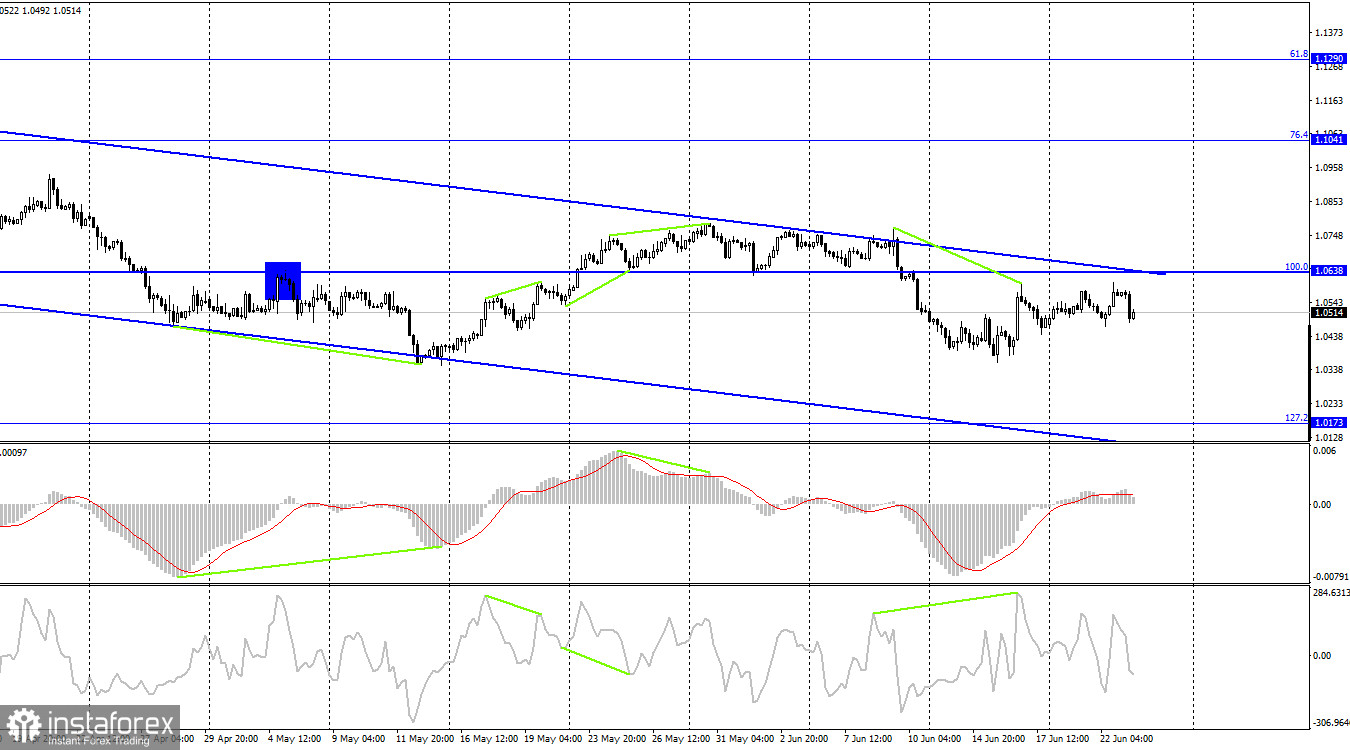

On the 4H chart, the pair reversed in favor of the US dollar after the CCI indicator formed a bearish divergence. The pair started falling and the decline may continue towards the 127.2% Fibonacci level at 1.0173. The pair's consolidation above the descending trend channel will favor the euro. Then it is possible 4 to expect the euro's significant rise towards the 76.4% Fibonacci level at 1.1041.

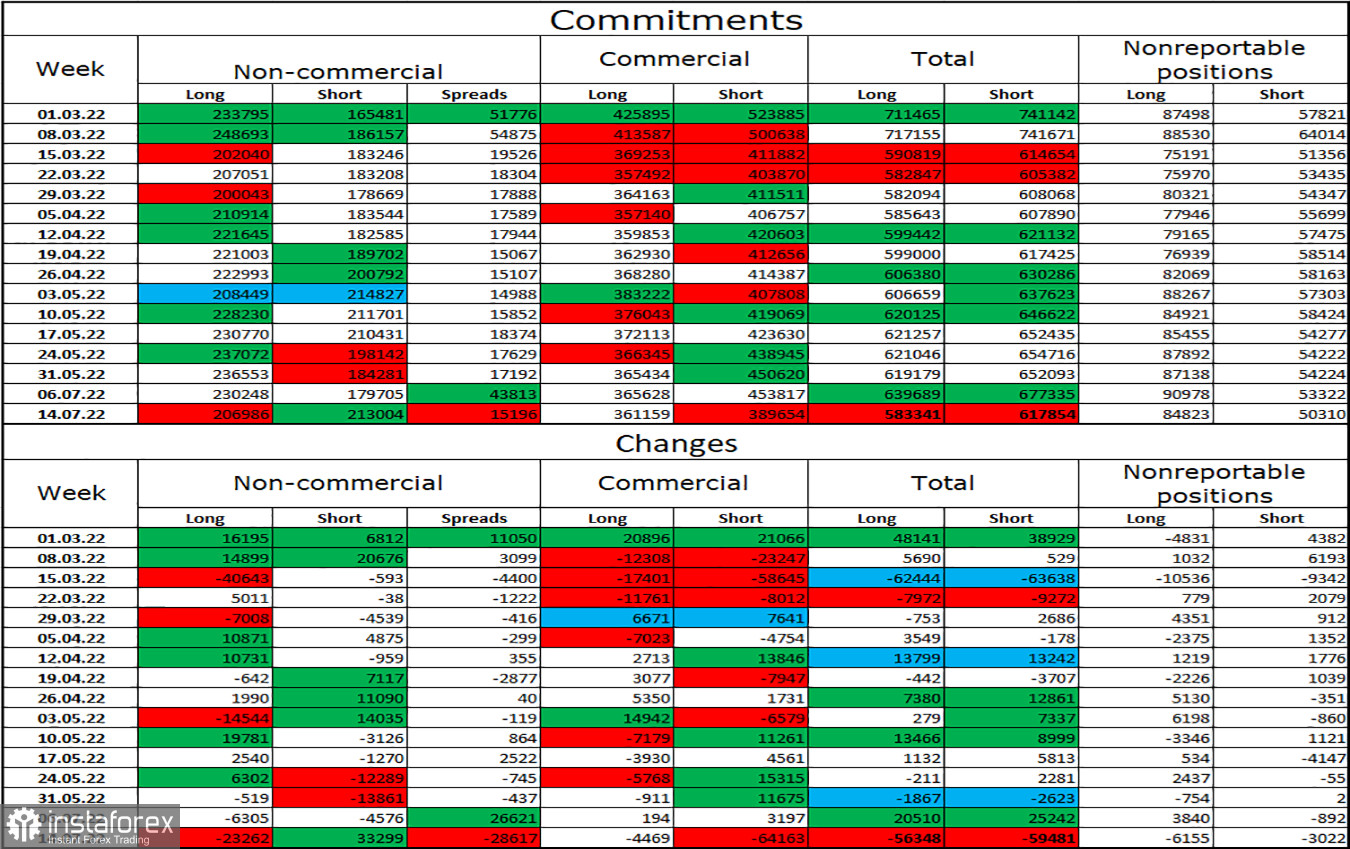

COT report:

Speculators closed 23,262 long contracts and opened 33,299 short contracts during last reporting week. This means that bullish sentiment of major players has weakened and is no longer bullish. The total number of olong contracts held by speculators is now 207,000, while the number of short contracts is 213,000. The difference between these figures is not significant. However, bulls do not have an advantage. As for the euro, sentiment of non-commercial traders has been mostly bullish during recent months. This fact did not favor the euro at all. The prospects for the euro's growth have been gradually rising over the last few weeks. However, the latest COT report shows that the euro's new sell-off is likely. There was no positive news from the Fed or the ECB. Though there were some encouraging signs, they were ignored by the negative news for the euro.

US and EU economic news calendar:

EU - ISM Services and Manufacturing Indexes (08-00 UTC).

US - ISM Services and Manufacturing Indexes (13-45 UTC).

US - Jerome Powell's speech in US Congress (14-00 UTC).

On June 23, the EU and US economic news calendars have some entries. EU PMI indices could lead to the euro's decline this morning. Then US indices were released and Powell delivered his second speech in Congress.

EUR/USD outlook and recommendations for traders:

I recommended selling the pair at the rebound from the 161.8% level at 1.0574 on the hourly chart with a target of 1.0430. I recommend buying the euro if the pair consolidates above the channel on the 4H chart with a target of 1.1041.