The EUR/USD currency pair continued to ride on a "swing" during Thursday. A few days ago we started warning traders about the beginning of the "swing" and, as we see, we were right in this warning. On Wednesday evening, the European currency showed growth again, and the next day on Thursday, it fell again. And whatever you want to call this movement: "flat", "swing", "consolidation period". The euro currency is squeezed into a very limited price range and it is extremely difficult to trade it now. However, we are surprised by another fact. The euro is stuck in a side channel very close to its local lows, which, in turn, are located close to the 20-year low. Thus, the euro has once again shown that it is not even able to form a normal upward correction.

We have repeatedly said that most of the fundamental and geopolitical factors remain on the side of the US dollar. In principle, this judgment can be written now in every article, every day, because the situation does not change at all. The ECB cannot even raise the key rate at least once to assure the markets of their readiness to fight inflation. At the moment, the rhetoric of Lagarde and her colleagues looks like this: "we take high inflation very seriously, but we are not going to do anything and hope that it will begin to decline by itself." This is exactly the kind of rhetoric Lagarde openly voiced earlier this year. Under pressure from other central banks in the EU zone, Lagarde had to squeeze out words about one or two increases this year, but it should be remembered that even during the pandemic, many central banks (in particular, the Fed and the BA) kept their rates at ultra-low levels, but still positive, above zero. And in the EU, rates have been negative for a very long time. That is, you want to bring money to the bank for a deposit and have to pay for the fact that they will be in the bank.

Jerome Powell completely repeated his earlier rhetoric.

Meanwhile, Fed Chairman Jerome Powell has twice managed to address the US Congress. First before the Banking Committee, then before the Financial Services Committee. As we expected, in both cases his speech did not differ, and its essence did not differ from what Powell said immediately after the Fed meeting last week. Let's make a reservation right away: on Wednesday evening there was a drop in the US dollar, which should not have happened in principle since Powell's rhetoric remained "hawkish". Naturally, the market can react to any event as it pleases, and perhaps the reaction was just the opposite, illogical. We mean that it cannot be concluded about Powell's speech that it was "not hawkish enough." Or that the market was waiting for an even more aggressive attitude from the head of the Fed. Recall that the Fed has already raised the rate to 1.75%, and at the last meeting raised it by the maximum value over the past 18 years – 0.75%. Where should Powell be in an even more hawkish mood?

Yesterday and the day before yesterday, he did not say in plain text that in July the rate will also be increased by 0.75%. He also noted that the Fed will respond to statistical information to adjust monetary policy and not just thoughtlessly raise the key rate. But isn't it obvious that the regulator, which started tightening monetary policy to reduce inflation, will closely monitor inflation when making every decision on rates? What did the market want? For Powell to say clearly and openly: "we will raise the rate by another 0.75%"? Recall that at the beginning of the year we were talking about a maximum of five increases of 0.25-0.5% and already these expectations were considered "too hawkish". Now the Fed can raise the rate by 0.75% twice in a row and the market considers this an insufficiently aggressive approach? From our point of view, this is absurd. We believe that the fall of the dollar on Wednesday evening should not be associated with Powell's speech at all, since Jerome did not tell congressmen or the markets anything new at all.

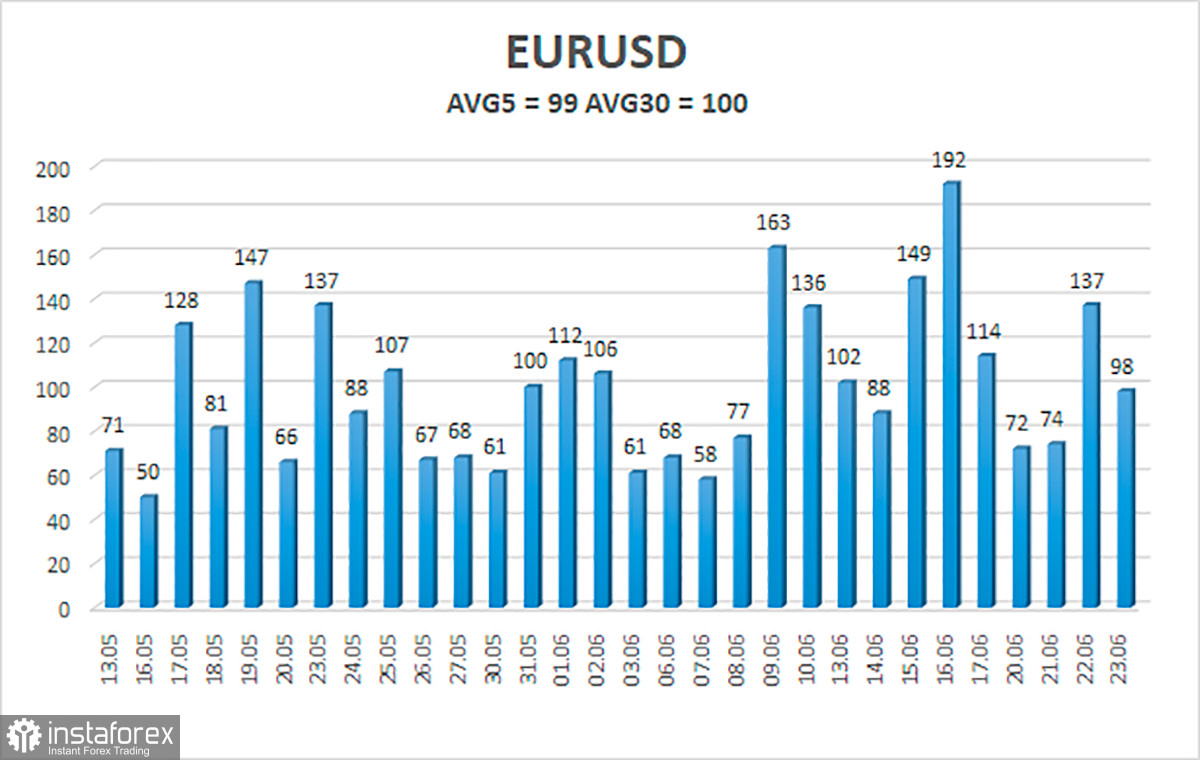

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 24 is 99 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0417 and 1.0615. A reversal of the Heiken Ashi indicator back up will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0437

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0559

R2 – 1.0620

R3 – 1.0681

Trading recommendations:

The EUR/USD pair continues to trade in different directions every day. Thus, now it is necessary to trade on the reversals of the Heiken Ashi indicator since there is no clear trend. There is a fairly high probability of a "swing".

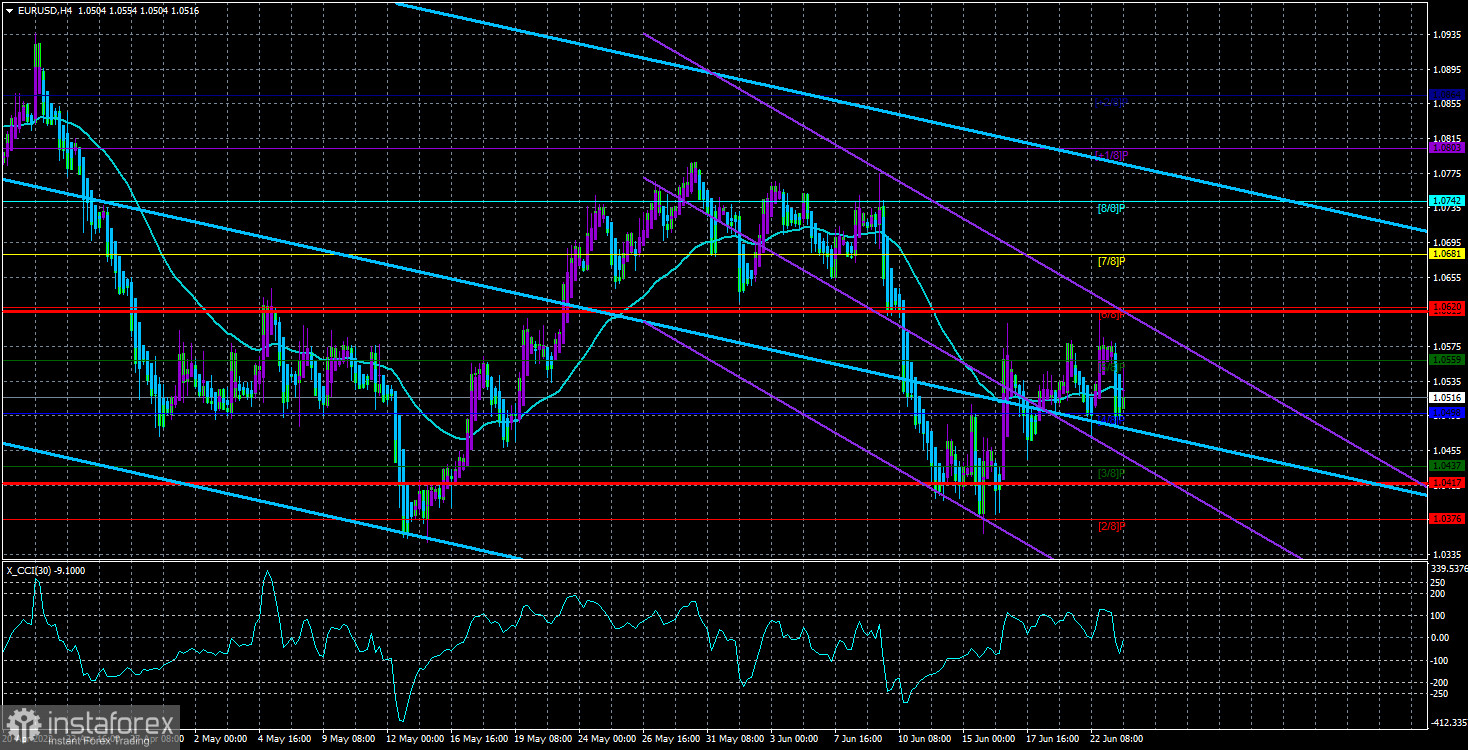

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.