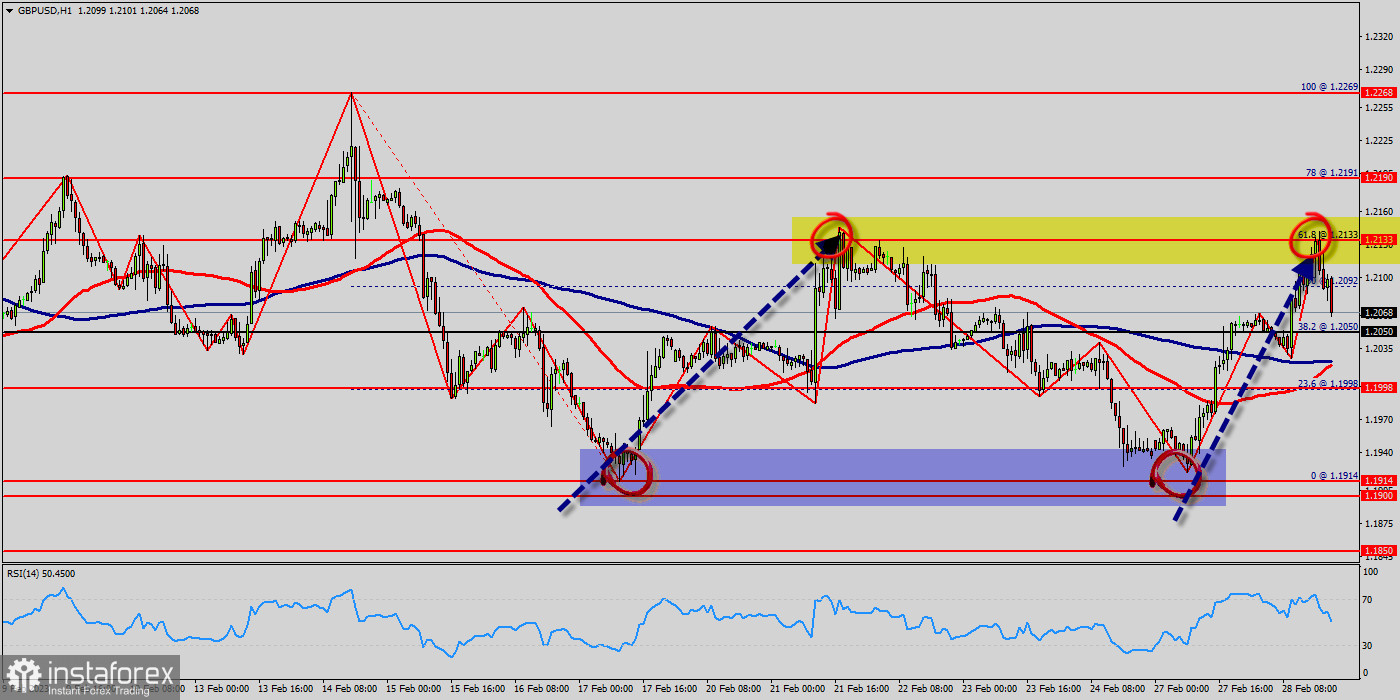

The GBP/USD pair has broken support at the level of 1.2133 which acts as a resistance now. According to the previous events, the GBP/USD pair is still moving between the levels of 1.2133 and 1.1994.

Therefore, we expect a range of 132 pips in coming days. The trend is still above the 100 EMA, but the bearish outlook remains the same as long as the 100 EMA is headed to the downside.

Hence, the price spot of 1.2133 remains a significant resistance zone.

Consequently, there is a possibility that the GBP/USD pair will move downside. The structure of a fall does not look corrective.

In order to indicate a bearish opportunity below 1.2133, sell below 1.2133 with the first target at 1.1998.

Besides, the weekly support 1 is seen at the level of 1.1998. However, traders should watch for any sign of a bullish rejection that occurs around 1.2133.

The level of 1.2133 coincides with 61.8% of Fibonacci, which is expected to act as a major resistance today. Since the trend is below the 61.8% Fibonacci level, the market is still in a downtrend. Overall, we still prefer the bearish scenario.

Nevertheless, stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at the level of 1.2190.