Hi, dear traders! According to the H1 chart, GBP/USD fluctuated in the 1.2315-1.2416 range without testing any of them. Today, the pair is moving sideways without moving strongly in either direction. Today, UK retail sales data for May was released. Sales decreased by 4.7% YoY and 0.5% MoM. This data turned out to be highly disappointing, even though market players expected an even bigger drop. GBP/USD, however, did not fall to the retracement level of 523.6% (1.2146) afterwards. The retail sales data is not important at this point compared to monetary policies of the Fed and the BoE. As a result, traders ignored it.

The Bank of England could continue its monetary tightening cycle, while the Federal Reserve is certain to do so. In fact, the Fed is likely to outpace the British regulator, which could bring bearish traders back to the market. However, even without much activity by bears, GBP/USD cannot advance, indicating that it could continue to slide down in the future. To move upwards, the pair must settle above 1.2315 - it has already bounced off this level twice this week alone. Otherwise, the pair could fall under bearish pressure, with 1.2146 being the target for bears.

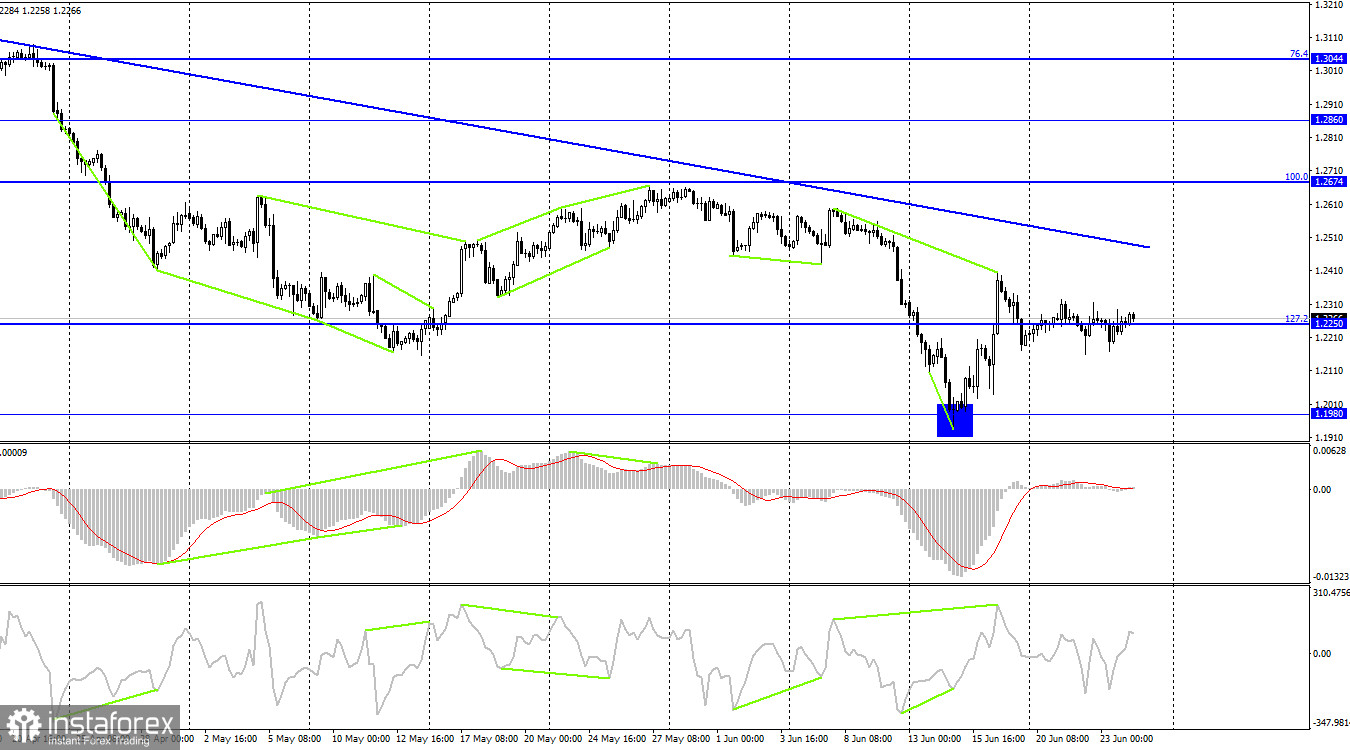

According to the H4 chart, GBP/USD reversed downwards and fell to the retracement level of 127.2% (1.2250) after the pair formed a bearish CCI divergence. If the pair settles below this level, it could then fall towards 1.1980. The descending trend line indicates that trader sentiment remains bearish. GBP/USD is unlikely to rise until it closes above the trend line.

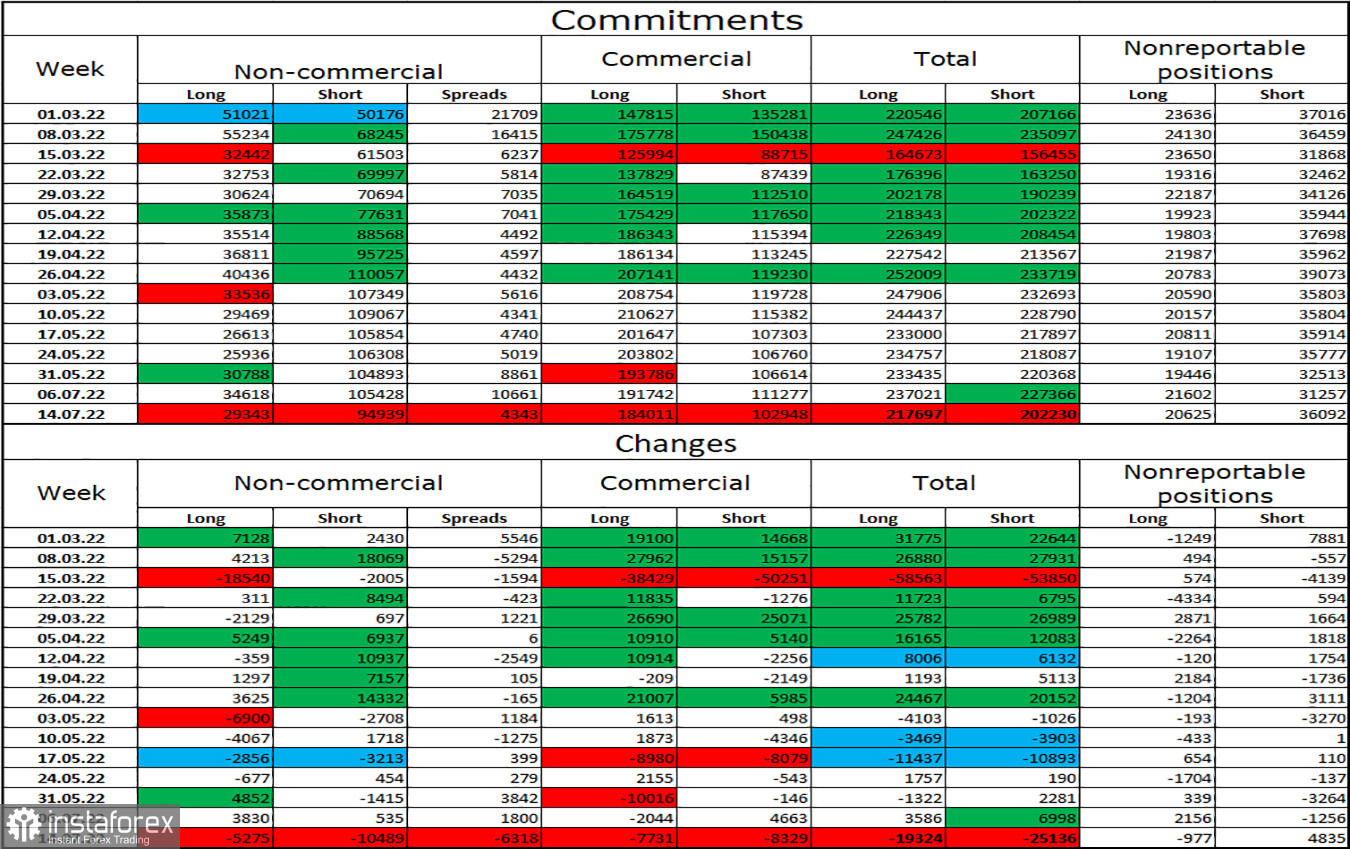

Commitments of Traders (COT) report:

Non-commercial traders became slightly more bullish last week. Traders closed 5,275 Long positions and 10,489 Short positions. Market players remain bearish on GBP/USD, and Long positions continue to greatly outnumber Short ones. Major players continue to decrease their exposure to GBP, and their sentiment has remained unchanged recently. GBP/USD could continue to fall in the next several weeks and months, despite the gap between Long and Short positions potentially indicating a trend reversal. At this point, the news and data releases are more important for market players.

US and UK economic calendar:UK – Retail sales data (06-00 UTC).US – UoM consumer sentiment (14-00 UTC).US – New home sales (14-00 UTC).

Traders ignored UK retail sales data, and the remaining data releases are unlikely to influence them as well.

Outlook for GBP/USD:Earlier traders were recommended to open new short positions if GBP/USD closed below the ascending trend channel on the H1 chart targeting 1.2146 and 1.1993. New short positions can be opened if the pair bounces off 1.2315 with the same targets. Long positions can be opened if GBP/USD settles above the trend line on the H4 chart, with 1.2674 being the target.