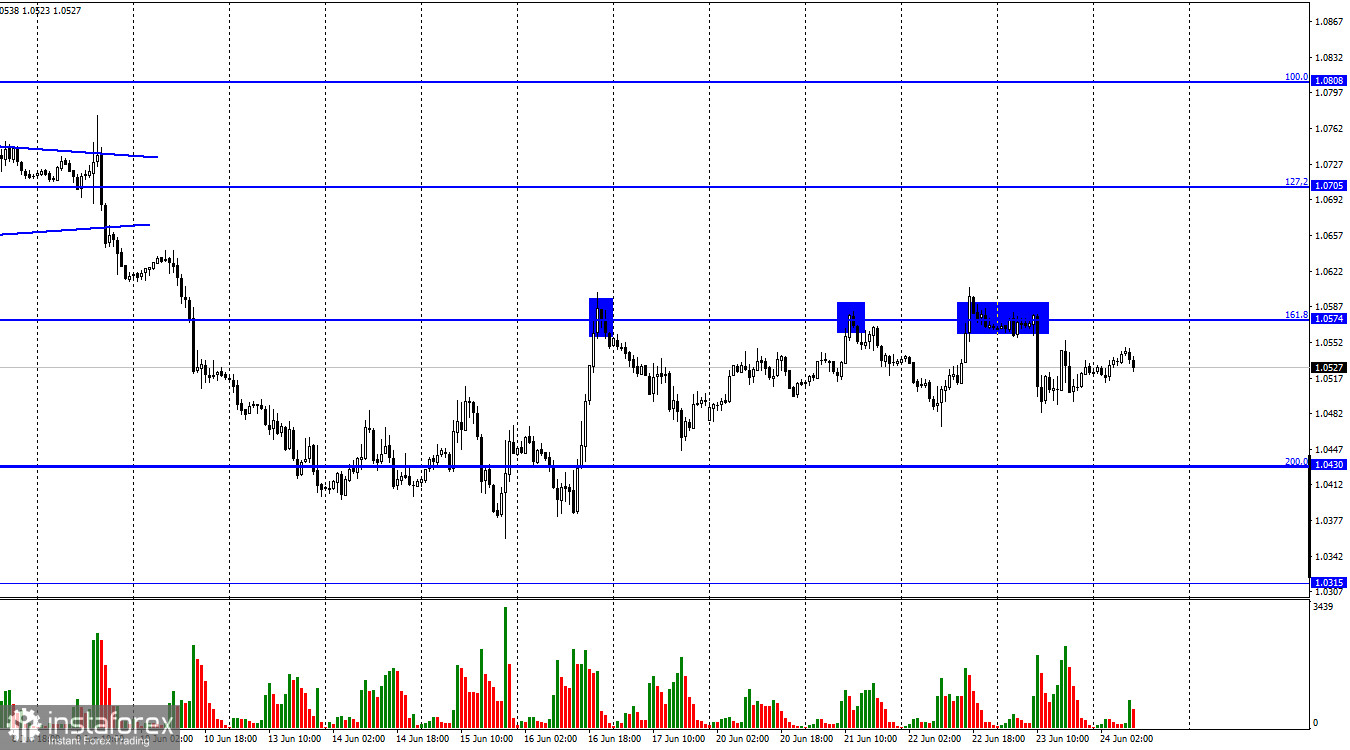

Hello, dear traders! On Thursday, EUR/USD bounced from the 161.8% retracement level of 1.0574. After a bear reversal, the pair went down to the 200.0% Fibonacci level. However, this mark is unlikely to be reached. Traders move from the 1.0574 level this week only, always failing to push the price through 1.0482. The price is now moving horizontally rather than in a trend. Even the 2-day testimony of Fed Chairman Powell in Congress has had no effect on trader sentiment. Small swings actually took place after his speech, but the general movement did not change like Powell's rhetoric. Last week, the US Federal Reserve raised the interest rate by 0.75%. The chairman said inflation would remain the regulator's primary goal and it would hike rates for as long as the CPI stabilizes.

Since the FOMC meeting, Powell's stance has not changed. Even if the United States enters a recession, the US central bank will still be an inflation hawk. Therefore, it is possible to expect 0.50-0.75% rate increases in July, September, and so on until the end of the year. The greenback will resume growth based solely on this factor sooner or later. The Federal Reserve rarely lifts interest rates, and now it has initiated the entire cycle, causing a reaction in the equity and stock markets. That is why the dollar will unlikely go untouched by such global economic changes. Yesterday, the United States saw the release of business activity data in the services and manufacturing sectors. The reposts logged a decrease in figures. Nevertheless, EUR/USD kept trading around 1.0574 despite disappointing results.

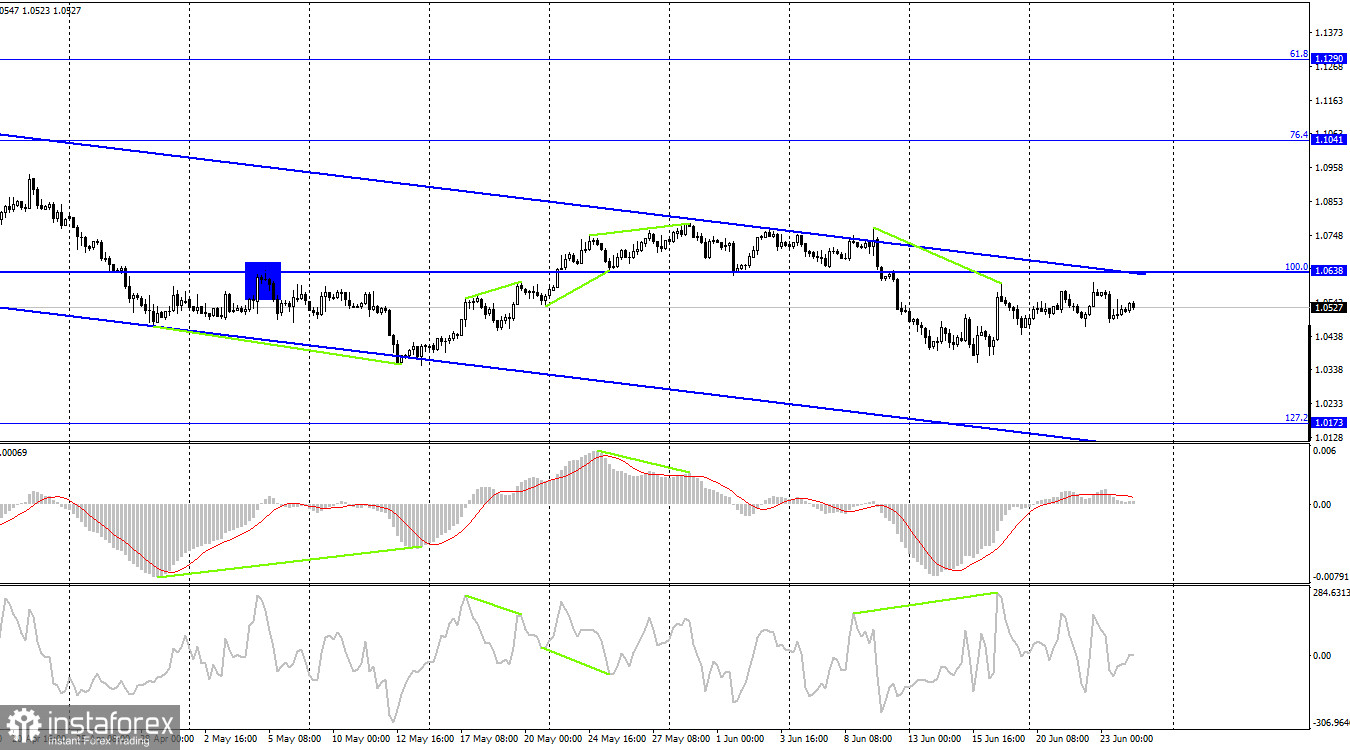

In the 4-hour time frame, a bearish reversal occurred after the bearish CCI divergence. Quotes might fall to the 127.2% Fibonacci level of 1.0173. If the price settles above the trend corridor, the euro could head towards the 76.4% Fibonacci level of 1.1041.

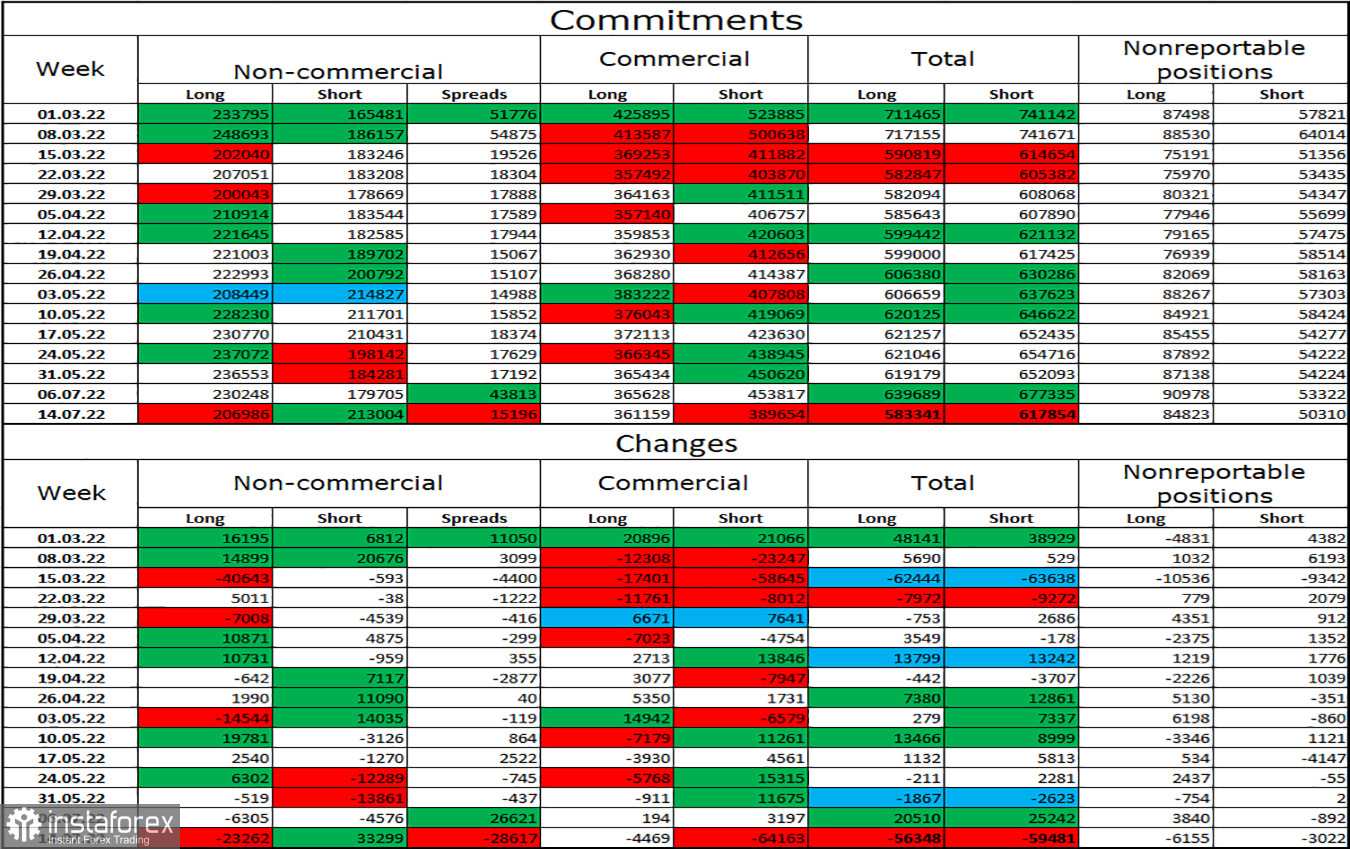

Commitments of Traders:

Last week, as many as 23,262 long positions were closed and 33,299 short ones were opened, showing that sentiment stopped being bullish. Speculators now hold 207K longs and 213K shorts. Although the gap between them is rather small, it is no longer beneficial for bulls. In recent months, the euro was mostly bullish among Non-commercial traders, but it was of little help to the currency. Over the past few weeks, there has been a greater likelihood of a rise in the euro, but the latest COT report revealed the possibility of a new sell-off. Neither the Fed's nor the ECB's rhetoric has had a positive effect on the euro.

Macroeconomic calendar:

United States: Michigan Consumer Sentiment; New Home Sales (14-00 UTC)

On June 24, no macro events are to unfold in the eurozone. The United States will see the release of two important reports. Overall, the fundamental background will have little effect on market sentiment today.

Outlook for EUR/USD:

Look for short entry points after a bounce from 1,0574 on the 1-hour chart, with the target at 1.0430. Some 60-70 pips of profit could be earned on such bounces daily. Longs could be considered after consolidation above the corridor on the 4-hour chart, with the target at 1.1041.