US stock index futures rose for the fifth consecutive trading session. Does it mean that a bullish rally has started? On the contrary, there may be a technical correction after the big sell-off two weeks earlier, when the Federal Reserve made it clear that it no longer intends to tolerate an inflation rate of 8.6%. Notably, despite the sharp upside bounce, Wall Street is poised to end the worst first half of the year for the stock market in decades. Dow Jones Industrial Average futures increased by 0.3% or 81 points. S&P 500 futures added 0.4% and Nasdaq 100 futures jumped by 0.5%.

At the end of last week, the Dow Jones index soared by more than 800 points or 2.7%. The S&P 500 rose by 3.1% and the Nasdaq Composite gained 3.3%. In just five trading days, the indices posted their first positive week since May. The Dow increased by 5.4%. The S&P 500 rose by 6.5% and the Nasdaq Composite climbed by 7.5%.

The S&P 500 has managed to end the bear market it has been maintaining since mid-June, although it is still 18% below its level seen at the beginning of the year. Investors are still wondering whether stocks have bottomed or are just recovering from the serious oversold levels seen a few weeks earlier. As a result of their portfolio revisions in Q2 2022, stocks are expected to continue to rise this week.

With rising inflation in the US and depressed investor sentiment along with gradually evaporating free liquidity and an interest rate hike by the Fed, all this is likely to cause the market to stay in a sideways channel for a while.

Last week, the University of Michigan released data showing they expected inflation to rise by 5.3% on a yearly basis at the end of June. This is lower than the preliminary index released in early June expected inflation to rise by 5.4%. Nevertheless, consumers also expressed the highest level of uncertainty about long-term inflation since 1991. Fed Chairman Jerome Powell said earlier this month that rising consumer inflation had forced the central bank to raise rates by 75 basis points. Meanwhile, overall consumer sentiment fell to a record low of 50 points. That's down 14.4% from May's 58.4 and down 41.5% from a year earlier.

Today, investors expect Durable Goods Orders and Pending Home Sales reports.

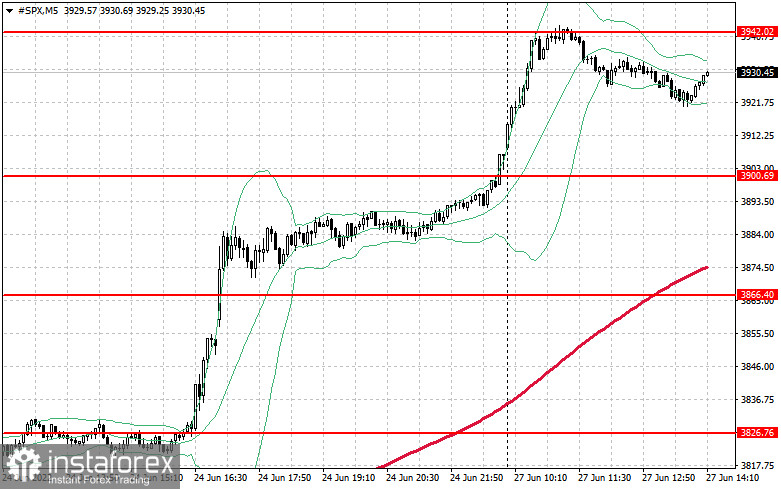

The technical picture of the S&P 500

The bullish rally continues. Today, buyers of risky assets will seek to take control over the resistance of $3,942, which was tested in the morning. A breakthrough of this level may push the asset to the area of $3,975, where large sellers are likely to return to the market. At least, there will be those, who wish to fix profits on long positions. The next target is located at a level of $4,013. In the case of pessimism and talks about high inflation and the need to fight against it, the trading instrument may reach the support of $3,900, but it will not harm the market much. On the contrary, bulls may allow the asset to test $3,866. A breakthrough of that level can lead to a new sell-off at $3,826 and $3,788.