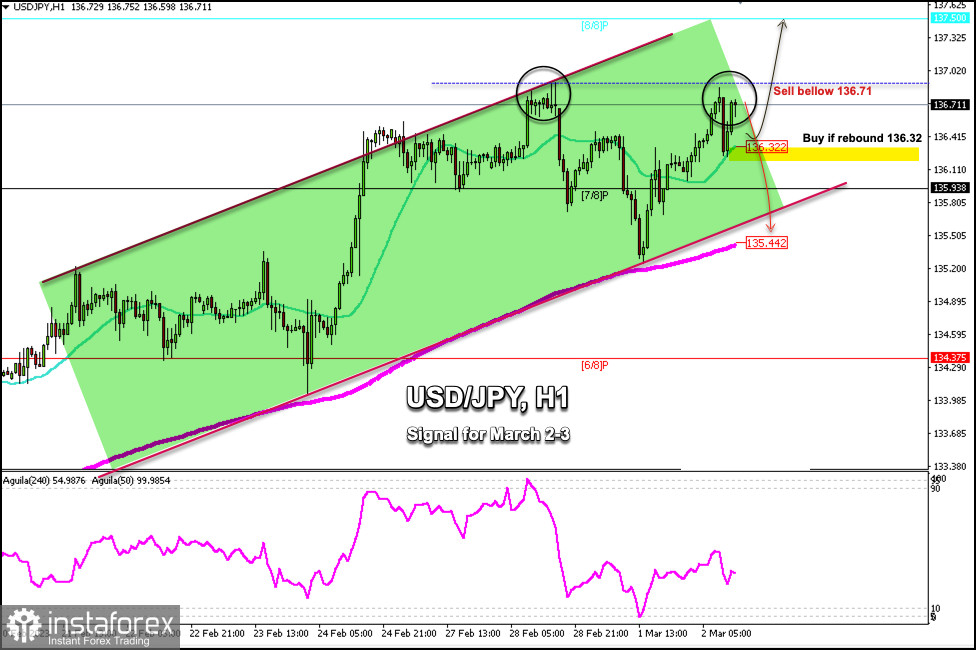

Early in the American session, the Japanese yen is trading around 136.71, above the 21 SMA, and above the 200 EMA. According to the 1-hour chart, we can see that the yen is stuck within an uptrend channel formed since February 21.

On February 28, the Japanese Yen reached 136.91 and made a strong technical connection from that level. USD/JPY is currently trading near this level. In case it fails to break this resistance, we could expect a technical correction so that the price could reach the area of 136.32 (21 SMA).

If bearish pressure prevails and USD/JPY falls below 136.30 (21 SMA), it will be a clear signal to sell with targets at the bottom of the uptrend channel that coincides with the 200 EMA around 135.44.

A sharp break above 137.00 and consolidation above this level could accelerate the bullish momentum and we could wait for the Japanese Yen to reach the 8/8 Murray zone located at 137.50.

Conversely, as long as the instrument trades below the February 28 high at 136.91, the Yen is expected to make a technical correction and it could reach the 135.44 area.

Any correction towards the 7/8 Murray zone or the 21 SMA could be seen as a buying opportunity as the eagle indicator is showing a positive signal.