The best cure for high prices is high prices. To what level does oil have to rise to get American and European producers back to production? The first reduced it because of the requirements of shareholders, the second - to reduce environmental pollution. When it came time to save the world economy, spare capacity was running out. It will be possible to count on an increase in supply only when Brent soars to $140-150 per barrel.

Problems with the production of oil are typical not only for Europe and the USA, but also for the Middle East, Africa and South America. Within OPEC, only Saudi Arabia and the UAE are believed to have the spare capacity needed to increase production. At the same time, France is confident that the Emirates are working to the limit, and +150,000 b/d is the maximum that Riyadh is capable of. Agree, minuscule compared to the expected 2 million bpd. It seems to be true, given that UAE Energy Minister Suhail al-Mazrouei said that the country's production is close to the ceiling of 3.168 million b/d. That is how much it makes up its quota in OPEC.

As for Africa and South America, according to Bloomberg calculations, due to political conflicts, oil production in Libya has halved since mid-April to about 600,000 b/d, and Ecuador warned of a complete cessation of oil production worth about 520 million b/d due to anti-government strikes. While the displacement of Russia from the markets continues, and there is no one to replace it, Brent has only one thing left – to grow.

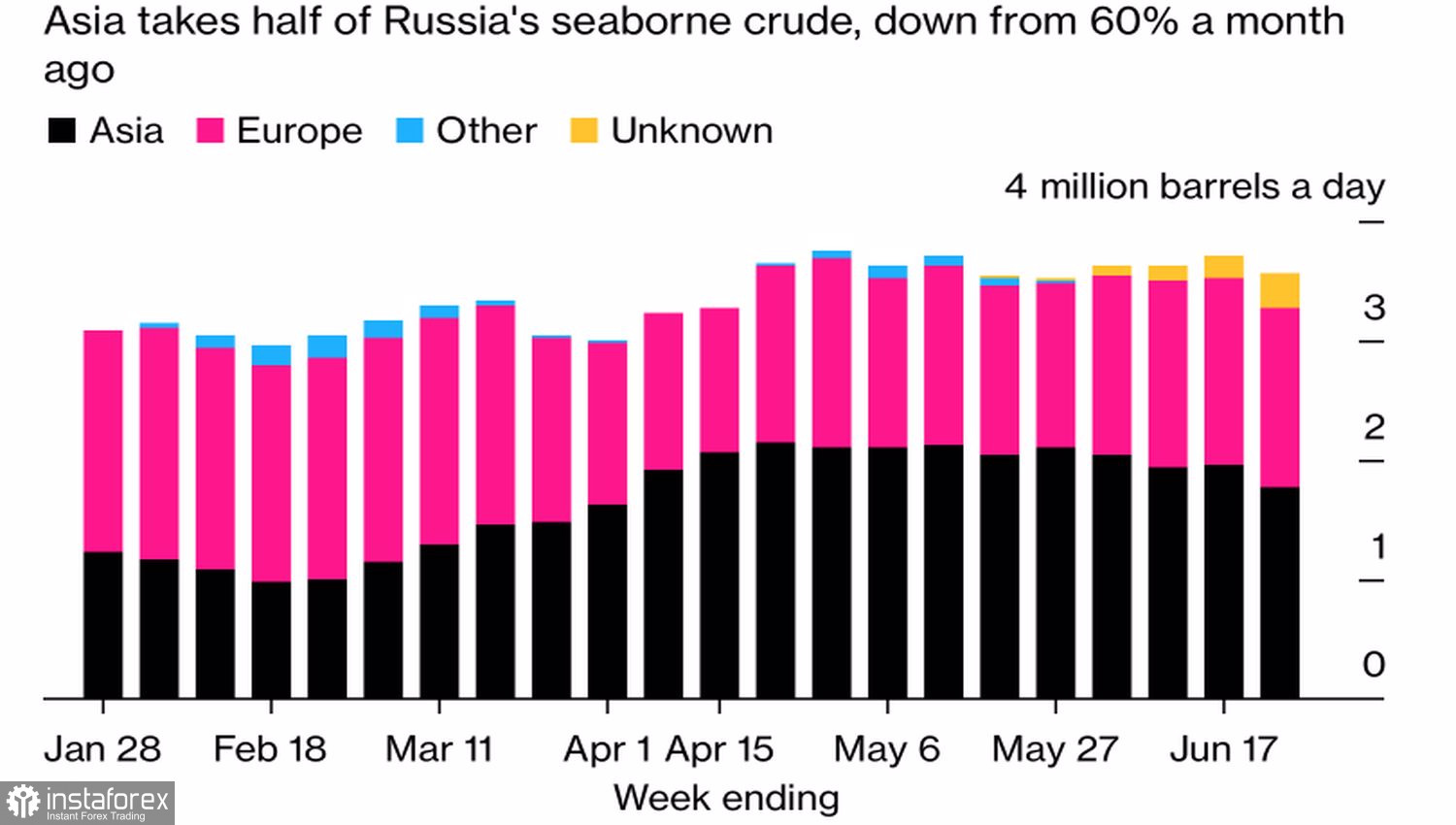

Sea freight from Russia actually fell by 20% in the week to June 24, dropping to the very bottom since the end of March. However, this is due to repair work and is unlikely to be related to sanctions. The indicator is able to recover in the near future.

Dynamics of sea transportation of oil from Russia

Meanwhile, the G7 seriously discussed the possibility of setting a price ceiling for oil from the Russian Federation in order to limit Moscow's income. The mechanism is that if someone needs insurance and transportation services, he must resell Russian oil at a deliberately low price. Potentially, this will have a positive impact on the global economy, as it will slow down inflation. Nevertheless, serious problems may arise with the implementation of the proposed measures.

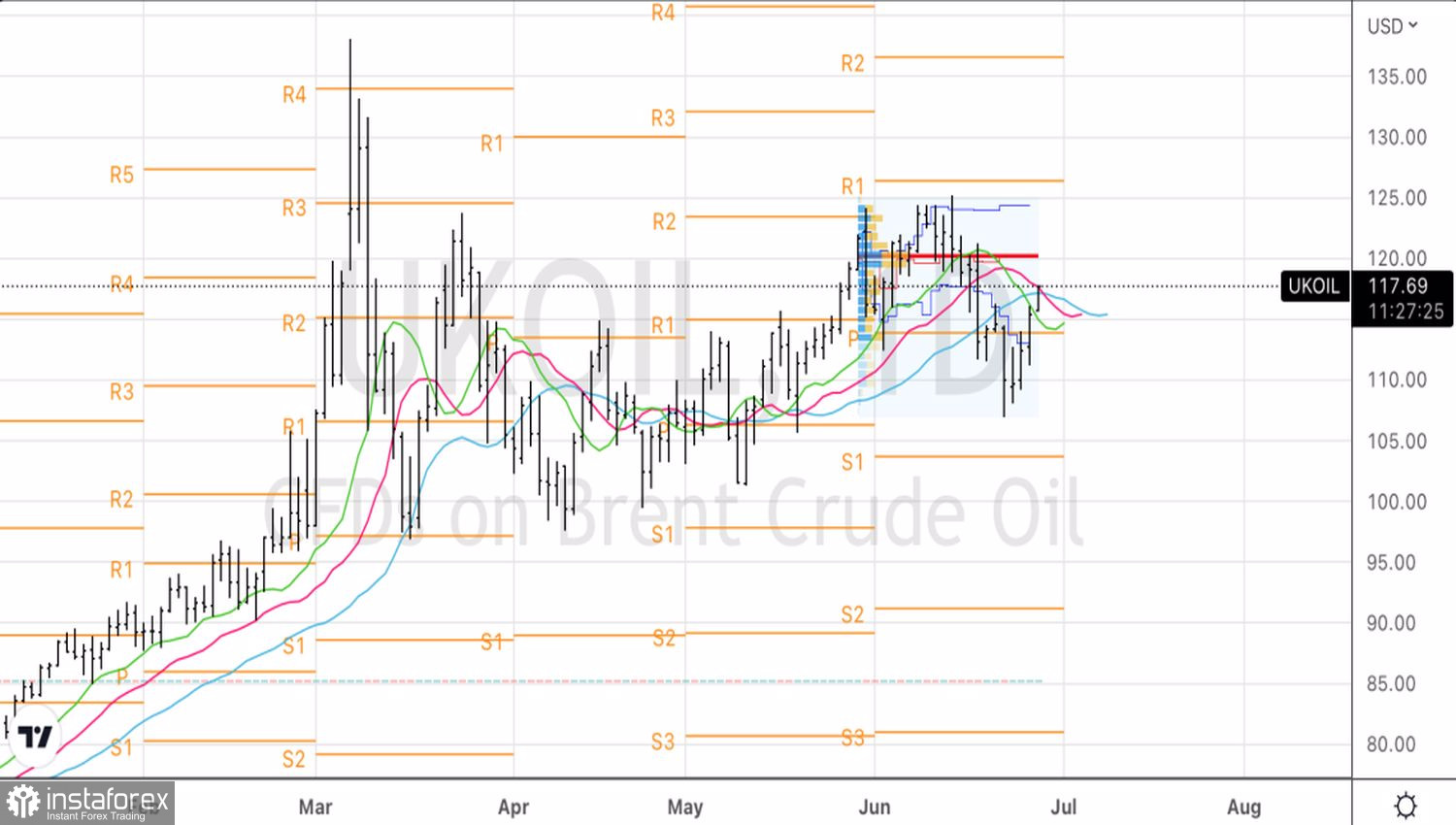

Brent, daily chart

Thus, supply problems are obvious, which reinforces the bullish structure of the oil market, known as backwardation. The difference between futures with nearby execution dates exceeds $4 per barrel, which signals a shortage of supply. Against this background, the achievement of zero marks in the number of infected in Shanghai and Beijing and China's decision to shorten the period of isolation of tourists staying in the country contribute to the growth of oil due to hopes for an increase in global demand.

Technically, the return of Brent quotes above the reference level at $114 per barrel gave us the opportunity to form longs. I recommend periodically increasing them with targets of $120 and $124.