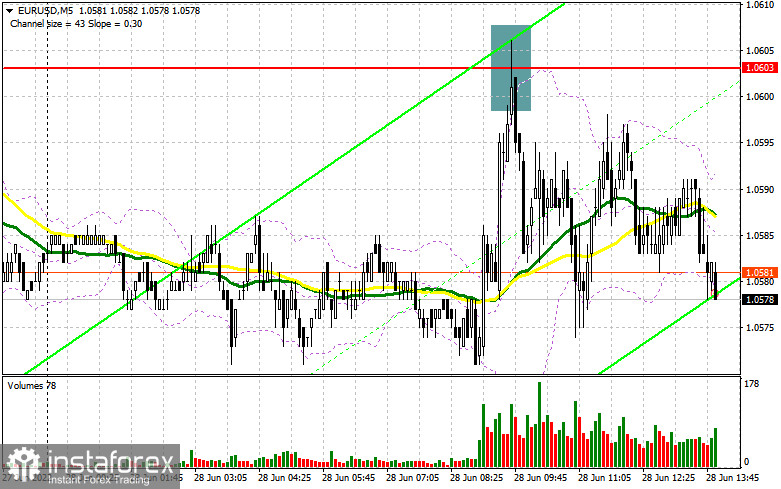

In my morning forecast, I paid attention to the 1.0603 level and recommended that decisions on entering the market be made from it. Let's look at the 5-minute chart and figure out what happened there. Another attempt to break above 1.0603 failed again. Despite the statements of the President of the European Central Bank, Christine Lagarde, her concern about inflation and the situation in the bond market, buyers of the euro have not managed to break above 1.0603. All this led to the formation of a false breakdown and a signal to open short positions. At the time of writing, the pair has gone down about 25 points. Against this background, the technical picture, as well as the strategy itself, remained unchanged. And what were the entry points for the pound?

To open long positions on EURUSD, you need:

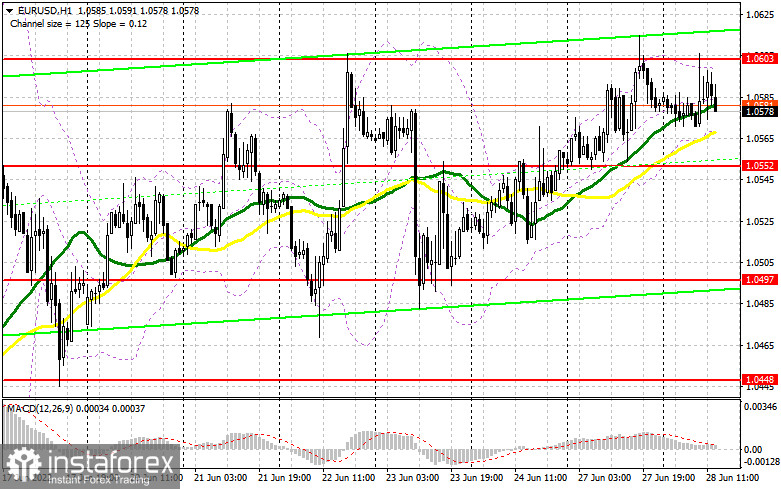

Until the moment when trading is conducted below 1.0603, we can expect a larger movement of the pair down. During the American session, data on the balance of foreign trade in goods in the United States and the consumer confidence index are released, which is likely to have a limited impact on the market. I expect further low volatility and trading in the upper part of the 1.0497 – 1.0603 side channel. In the case of strong reports, which will be quite surprising for the market, as well as a decline in the pair, the key task of the bulls will remain to protect the nearest level of 1.0552, which acts as the middle boundary of the side channel. Moving averages pass just above this range, so the formation of a false breakdown there forms a signal to open long positions in the hope of trying to regain the 1.0603 area – the upper limit. A breakout and a top-down test of 1.0603 in the afternoon will deal a very strong blow to the bears' stop orders, which will allow the pair to break out of the side channel with the possibility of updating 1.0640 and building a new uptrend to 1.0663 and 1.0687. A more distant target will be the 1.0714 area, where I recommend fixing the profits. If EUR/USD declines and there are no buyers at 1.0552, nothing terrible will happen – the pair will only move to the lower part of the side channel. In this case, I advise you not to rush into the market: the best option for opening long positions will be a false breakdown in the support area of 1.0497. I advise buying EUR/USD immediately for a rebound only from the level of 1.0448, or even lower – around 1.0388 with the aim of an upward correction of 30-35 points within a day.

To open short positions on EURUSD, you need:

The fact that the bears did not let the pair into the 1.0603 area, keeps them a fairly good chance of returning the market to their control. If the euro re-rises in the afternoon after weak US data, only the formation of a false breakdown at 1.0603 forms a signal to open short positions with the prospect of returning to the middle of the 1.0549 side channel. A breakdown and consolidation below this range, as well as a reverse test from the bottom up – all this will lead to an additional sell signal with the demolition of buyers' stop orders and a larger movement of the pair down to the 1.0497 area. A more serious struggle will unfold for this level, since issuing EUR/USD lower will be "suicide" for buyers. A breakthrough and a reverse test of 1.0497 from the bottom up will be evidence of a resumption of the bearish trend with the prospect of a rapid decline at 1.0448, where I recommend completely exiting sales. A more distant target will be the 1.0388 area. In case of an upward movement of EUR/USD during the European session, as well as the absence of bears at 1.0603, I advise you to postpone short positions to the next attractive level of 1.0640. The formation of a false breakdown there will be a new starting point for the downward correction of the pair. You can sell EUR/USD immediately on a rebound from the maximum of 1.0663, or even higher – around 1.0687 with the aim of a downward correction of 30-35 points.

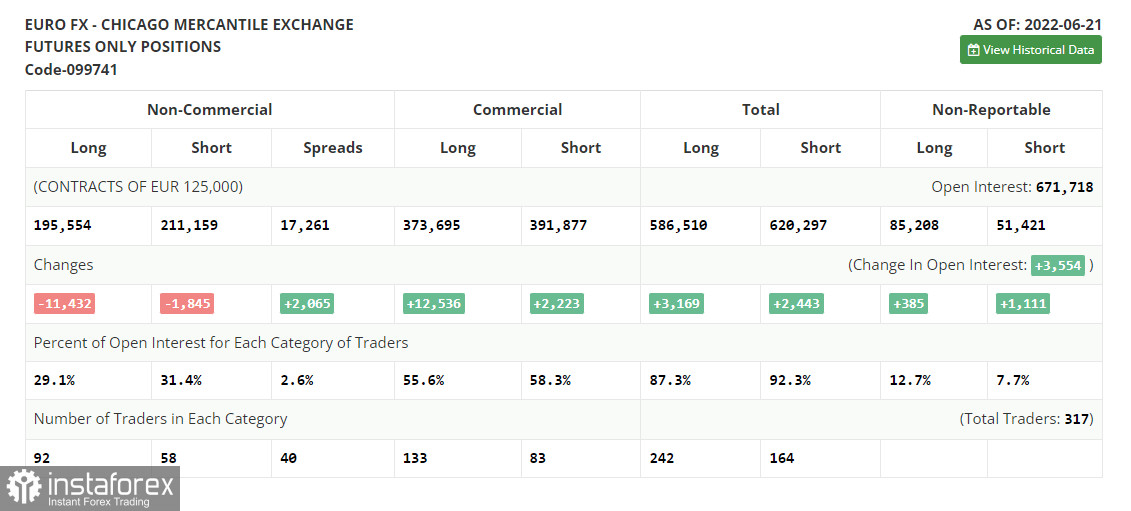

The COT report (Commitment of Traders) for June 21 recorded a reduction in both long and short positions, which led to the formation of a larger negative delta, indicating the preservation of bearish sentiment. Last week, Federal Reserve Chairman Jerome Powell spoke, who confirmed his firm position on further raising interest rates in the United States in the hope of fighting the highest inflation in the United States over the past 40 years. The European Central Bank also intends to start raising interest rates next month, which limits the upward potential of the dollar against the euro. Given how risky assets are oversold against the dollar, we can expect a further recovery of the euro after the start of the cycle of tightening monetary policy in the eurozone. The COT report indicates that long non-commercial positions decreased by 11,432 to the level of 195,554, while short non-commercial positions decreased by 1,845 to the level of 211,159. The low exchange rate of the euro makes it more attractive, but at any moment traders can return to buying the US dollar. The reason for this will be the persistence of high inflation and the need for a more aggressive policy on the part of Central Banks. At the end of the week, the total non-commercial net position remained negative and decreased from -6,018 to -15,605. The weekly closing price rose from 1.0481 to 1.0598.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.