The markets have accumulated quite a lot of conflicting information about the further actions of the Federal Reserve and the European Central Bank. Some are waiting for aggressive steps by the US central bank at the next meetings, after which a pause should be maintained in tightening policy. Next year, ideally, the central bank will again start easing monetary conditions. Meanwhile, one of the high-ranking members of the Fed said the day before that the central bank would need to cut rates even in 2023 in order to confidently suppress inflation.

New York Fed chief John Williams said he expects interest rates to be between 3% and 3.5%. The country's economy, in his opinion, will be able to avoid recession even with "significantly higher" rates.

Meanwhile, the incoming economic data does not signal this at all. Consumer confidence fell more than expected in June, adding to Wall Street's pessimism about a recession. The dollar went up, using its protective functions and expectations of a longer rate hike.

The euro's growth was interrupted after ECB President Christine Lagarde did not devote the markets to any details about the further development of the bank's policy. Players are left to think or use constantly changing forecasts for rates in the euro bloc. The latest data indicate that the ECB will immediately start raising rates aggressively, an increase of 50 bp in July is possible. There is a hawkish message, but the euro undermines uncertainty.

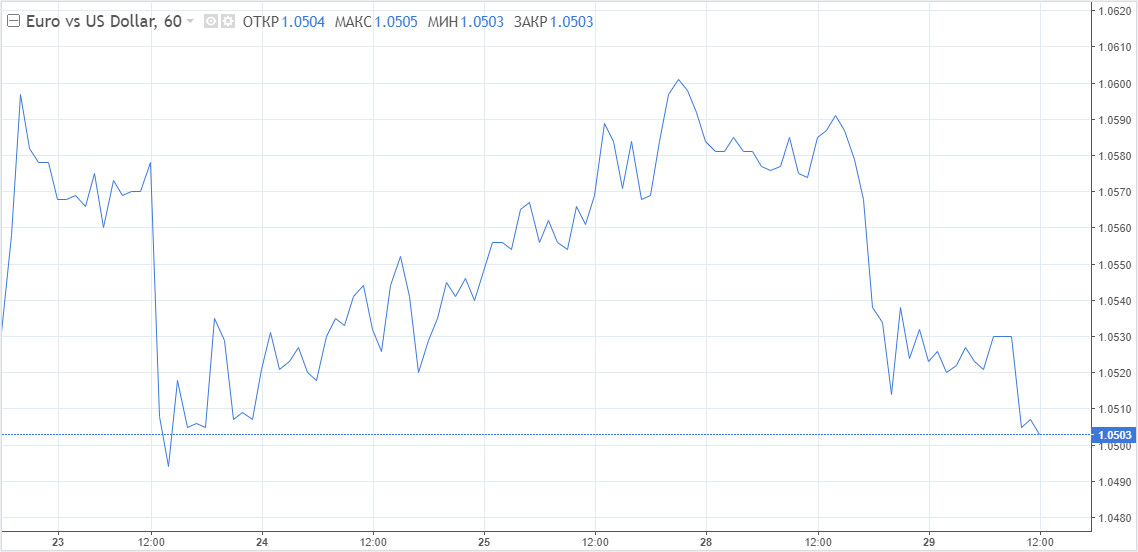

The euro was among the outsiders during Tuesday's US session. The rate fell against the dollar to last week's lows in the 1.0500 area. The annual ECB forum in Portugal ends today. The discussion panel will be attended by the heads of the ECB, the Fed and the Bank of England. Volatility will increase if the monetary authorities provide any details of further steps or provide unexpected information to the markets.

Short term forecast

The EUR/USD may continue sideways between 1.0500 and 1.0600. Earlier Tuesday, the quote was above 1.0600, but, as widely expected, did not hold the unbearable high for it. The euro needs to consolidate above these levels in order to continue rising.

The main resistance is noted at the level of 1.0550, then a test of 1.0500 is possible. Traders will keep a close eye on last week's low at 1.0467.

Fed and inflation: who wins

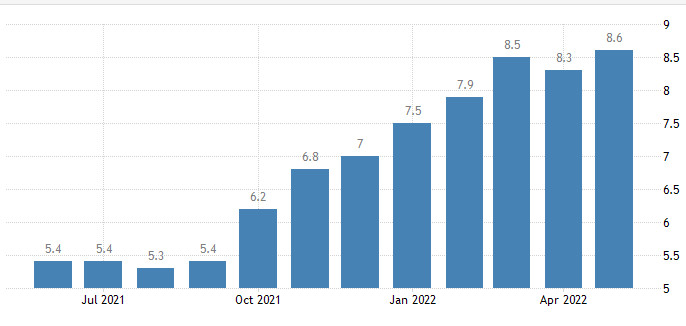

Inflation is taking deeper roots in the economy. As this price pressure penetrates the economy as a whole, one can see the growth of the average indicator. Now it is 6.53%, inflation has been growing continuously since mid-2021.

Another indicator that inflation is strengthening is the impact on wages. Unemployment is low: 3.6% in May versus 14% at the start of the pandemic. Businesses face stiff competition when looking for workers. And they overcome this by raising wages, which are paid in line with inflation.

Fed Chairman Jerome Powell, speaking last week in the Senate, once again put the fight against inflation in the first place. He acknowledged: "We are very far from our inflation target. We really need to restore price stability - bring inflation down to 2%."

Obviously, the central bank is trying to regulate policy based on the latest inflation indicators. Hot data just before the last meeting prompted a 75bp increase. Such a scenario now seems likely for July as well.

How far can the Fed go? The rate at 3.5% is rather a minimum, it can be much higher. In 2004-2006, the Fed's rate hike cycle peaked at 5.25%. This was with headline inflation of just 4.7% and core inflation of 2.4%. At the moment America is facing 8.6% and the baseline is 6%.

US Inflation Rate (Y/Y)

There are speculations that interest rates will have to approach the rate of inflation for real rates to be positive. Given the consensus expectation of a headline inflation of 6.5% by the end of the year, this suggests that interest rates should be much closer to the 2000s final rate of 5.25%.

The discrepancy between the final rate assumed by the market and the inflation rate is very large. Investors think the Fed will step back to protect stocks or avoid a recession, but this is not the case.

How will the ECB

The ECB could kick off its rate hike cycle with a bold move of 50 bp all at once. At the same time, an increase of 25 bp has already been dubbed a default. The central bank will have to dodge as much as possible. Unless a half-percent increase suddenly happens in July, it will definitely be needed in September. In any case, such a step cannot be avoided.

The deterioration of the situation and negative news in terms of inflationary expectations will force the central bank to act tougher. Up 50 bp at the July meeting will happen with a high degree of probability, the hawks are well aware that the moment has come. Any, even the most insignificant increase in the consumer price index in the eurozone this week will push for such a step. This will be a busy week for the ECB's policy as the central bank's annual forum is also being held.

Fragmentation is the most interesting topic for market players right now, as downside risks on the periphery could destabilize the eurozone and thus exacerbate the unenviable outlook for the euro.

The ECB is talking about some tools to ensure that the difference in bond yields between different countries remains stable, but so far without much detail.

Further discussion on this issue is expected this week. A compelling plan could boost the euro. At the same time, any negative messages will create downside risks.