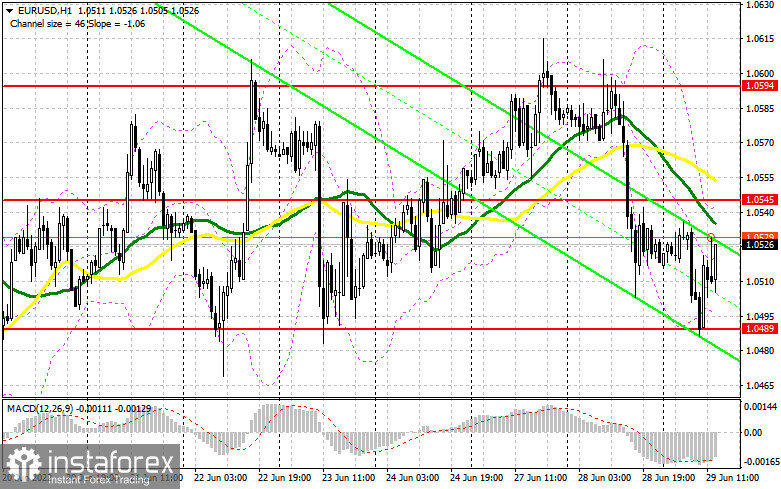

Earlier I asked you to pay attention to the level of 1.0497 to decide when to enter the market. Let's take a look at the 5-minute chart to clear up the market situation. A bulk of fundamental data of secondary importance allowed buyers to protect 1.0497. A false break of this level led to a buy signal, enabling traders to earn about 30 pips. The technical picture changed a bit for the second part of the day, but the strategy remained the same.

Conditions for opening long positions on EUR/USD:

Until the pair trades above 1.0489, it has every chance to surge. The recent announcements made by the ECB's representatives had a minor effect on the euro. During the American session, the US is going to publish its GDP data for the first quarter of the year. In addition, Jerome Powell and James Bullard will provide speeches. The politicians are likely to go on discussing inflation and interest rates, which may support the US dollar. In case of strong data, which is highly expected, and a decline in the pair, bulls should primarily protect the nearest level of 1.0489, which is acting as the lower limit of the range. A false break of this level will give a long signal with the target at 1.0545, which bulls lost yesterday amid the US trade. A break and a downward test of 1.0545 may seriously affect bears' stop orders, thus allowing the pair to touch the upper limit of the range of 1.0549 or rise even higher to 1.0640. The pair should consolidate above this level to form a new uptrend. In this case, it will have a chance to approach 1.0663 and 1.0687. The next target is located at 1.0714, where it is recommended to lock-in profits. If the euro/dollar pair declines and buyers fail to protect 1.0489, bulls may face obstacles. Under these conditions, it will be better to go long after a false breakout of the support level of 1.0448. It is also possible to buy the pair from 1.0388 or lower – from 1.0320, expecting a rise of 30-35 pips intraday.

Conditions for opening short positions on EUR/USD:

The fact that bears made an unsuccessful attempt to break the lower limit of the channel caused some problems. Yesterday, bulls, who failed to break the upper limit, found themselves in the same situation. All this points to the fact that bulls and bears have equal chances for success. If the euro rises in the second part of the day amid weak data from the US, only a false breakout of 1.0545, where there are bearish moving averages, will give a sell signal with the target at the lower limit of 1.0489. A breakout and settlement below this level as well as an upward test may lead to an additional sell signal, which may affect buyers' stop orders and cause a deeper drop to 1.0448. Buyers are likely to start fighting for this level since a decline below it may defeat them. A break and an upward test of 1.0448 will prove the revival of a bearish trend. In this case, the pair may slump to 1.0388, where it is recommended to close all sell orders. The next target is located at 1.0320. If the euro/dollar pair advances during the US trade and bears fail to protect 1.0545, traders should avoid selling until the price hits the upper limit of 1.0594. A false break of this level may launch a downward correction. It is also possible to go short from the high of 1.0640 or higher – from 1.0687, expecting a decline of 30-35 pips.

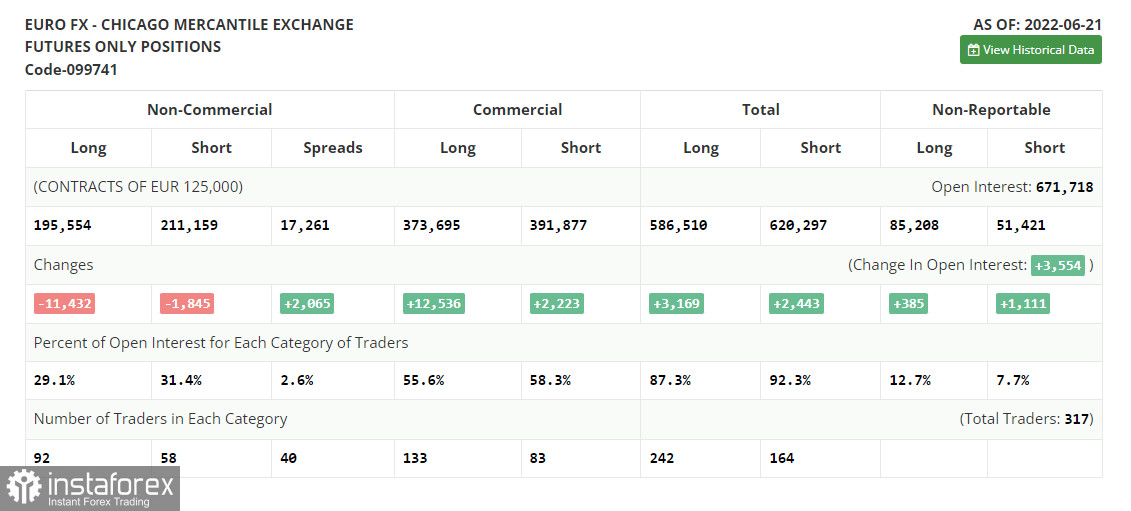

COT report

According to the COT report from June 21, the number of both long and short positions slumped, pointing to the bearish sentiment. In his recent speech, Jerome Powell confirmed the regulator's intention to raise the benchmark rate even more to combat the highest inflation in the last 40 years. The European Central Bank is also planning to start hiking the key interest rate as early as next month. This is likely to cap the greenback's upward potential against the euro. Since risk assets are significantly oversold, the euro may start recovering just after the beginning of monetary policy tightening. The COT report unveiled that the number of long-commercial positions dropped by 11,432 to 195,554, while the number of short non-commercial positions declined by 1,845 to 211,159. A low price of the euro is making it attractive for buyers. However, traders may switch to the US dollar at any moment amid high inflation and the necessity of a more aggressive policy of central banks. Last week's results showed that the total non-commercial net position remained negative and decreased from -6,018 to -15,605. The weekly closing price rose from 1.0481 to 1.0598.

Signals of indicators:

Moving Averages

Trading is performed slightly below 30- and 50-day moving averages, which points to bears' attempt to regain control over the market.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the euro/dollar pair decreases, the indicator's lower limit of 1.0490 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.