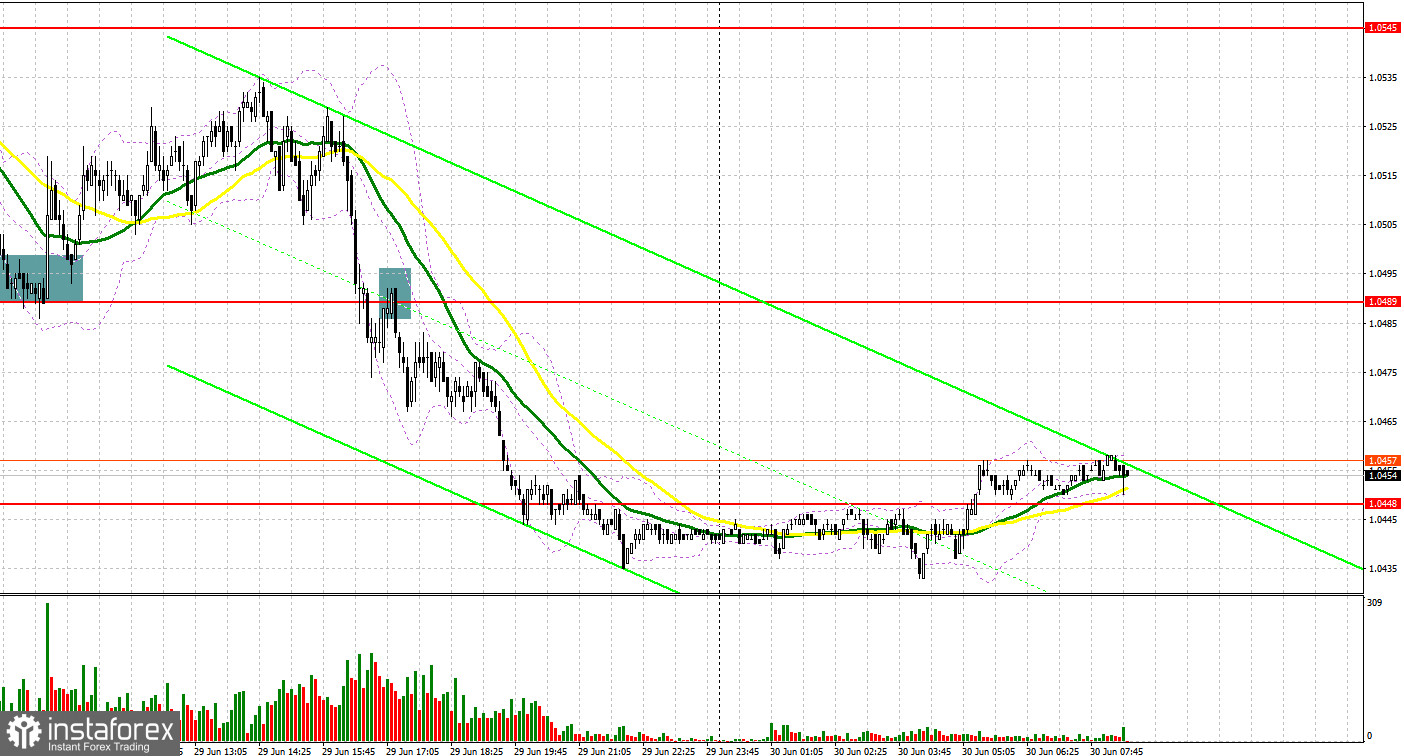

Yesterday, traders received several signals to enter the market. Let's focus on the 5-minute chart to find out what happened. Earlier, I asked you to pay attention to the level of 1.0497 to decide when to enter the market. A bulk of information of secondary importance allowed buyers to protect the level of 1.0497. A false breakout of this level led to a buy signal, which caused a 45-pip rise. In the second part of the day, bears broke 1.0489. An upward test of this level led to a sell signal. Against the backdrop, the pair lost more than 45 pips.

Conditions for opening long positions on EUR/USD:

Yesterday, in the first part of the day, data from the eurozone allowed the euro to keep its positions. However, during the US trade, demand for the US dollar increased, thus causing a slump in the euro/dollar pair. Today, Germany is going to disclose many reports, including retail sales, unemployment change data, and unemployment rate. If the data exceeds the forecast, the euro may recover. Otherwise, the price may test a new support level of 1.0434. The eurozone will also report its unemployment rate. However, it is not a very important indicator. Against the backdrop, it will be better to open long positions after a false break of the nearest support level of 1.0434. In this case, the target is located at 1.0481. At this level, we see moving averages that are capping the upward potential of the pair. Only a breakout and downward test of 1.0481 may affect bears' stop orders, enabling the pair to climb to 1.0525. The market sentiment will change for the bearish one, if the price exceeds 1.0525 to hit 1.0568 and 1.0604, where it is recommended to lock in profits. If the euro/dollar pair drops and buyers fail to protect 1.0434 in case of extremely weak data from Germany, buyers may face serious problems. Under the current conditions, it will be better to go long after a false break of the support level of 1.0388. It is also possible to buy the asset from the new yearly low of 1.0321 or lower – from 1.0255, expecting a jump of 30-35 pips.

Conditions for opening short positions on EUR/USD:

Bears have reached all their goals. However, today is a very important day and big sellers are unlikely to enlarge short positions to push the pair to new yearly lows. I suppose that pressure on the euro will be limited. That is why traders should be very cautious when opening short orders. Weak data from Germany and the eurozone may exert significant pressure on the pair, making it slide below the support level of 1.0434. However, the MACD divergence may cap the downward potential. If the euro rises in the first part of the day and Germany and the eurozone disclose strong data, only a false breakout of 1.0481 will give a sell signal with the target at 1.0434. A breakout and settlement below this level as well as an upward test will lead to an additional sell signal that may affect buyers' stop orders and cause a deeper decline to 1.0388. A breakout and an upward test of 1.0388 will prove the bearish sentiment and allow the pair to drop to 1.0321, where traders should close all short orders. The next target is located at 1.0255. If the euro/dollar pair increases in the first part of the day and bears fail to protect 1.0481, buyers will regain control over the market. In this case, traders should avoid short orders until the price hits 1.0525. A false breakout of this level may spur a downward correction. It is possible to sell the euro/dollar pair from the high of 1.0568 or higher – from 1.0604, expecting a decrease of 30-35 pips.

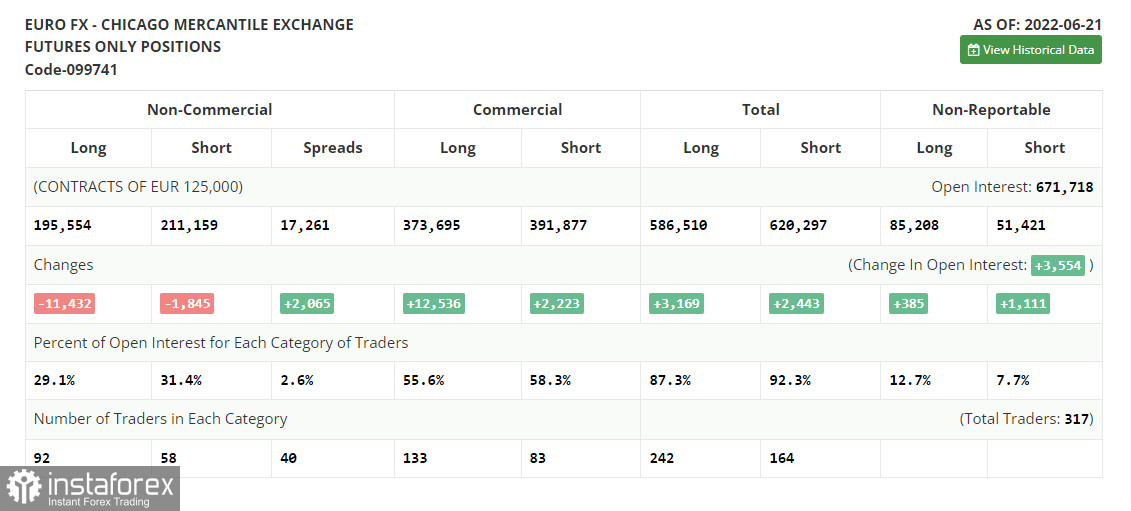

COT report

According to the COT report from June 21, the number of both long and short positions slumped, pointing to the bearish sentiment. In his recent speech, Jerome Powell confirmed the regulator's intention to raise the benchmark rate even more to combat the highest inflation in the last 40 years. The European Central Bank is also planning to start hiking the key interest rate as early as next month. This is likely to cap the greenback's upward potential against the euro. Since risk assets are significantly oversold, the euro may start recovering just after the beginning of monetary policy tightening. The COT report unveiled that the number of long-commercial positions dropped by 11,432 to 195,554, while the number of short non-commercial positions declined by 1,845 to 211,159. A low price of the euro is making it attractive for buyers. However, traders may switch to the US dollar at any moment amid high inflation and the necessity of a more aggressive policy of central banks. Last week's results showed that the total non-commercial net position remained negative and decreased from -6,018 to -15,605. The weekly closing price rose from 1.0481 to 1.0598.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, which points to bears' attempt to regain control over the market.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the euro/dollar pair decreases, the indicator's lower limit of 1.0400 will act as support. If the pair increases, the resistance level will be located at the upper limit of the indicator – near 1.0500.

Description of indicators- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.