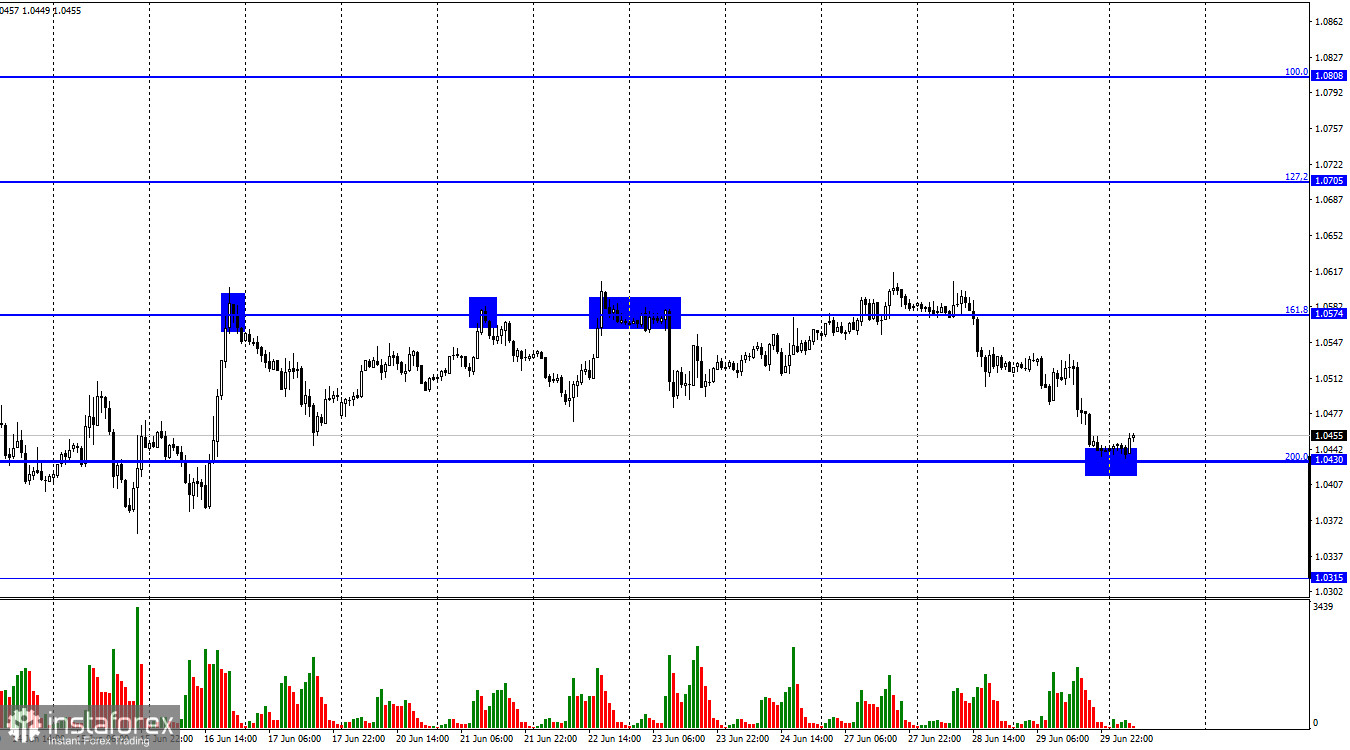

Hello, dear traders! On Wednesday, the EUR/USD pair continued declining and reached the 200.0% correction level at 1.0430. If the pair rebounds from this level, it will favor the euro and result in its growth towards the 161.8% Fibonacci level at 1.0574. The pair's consolidation below the level of 1.0430 will make its further decline towards the next level of 1.0315 more likely. Bull traders were trying to reach the level of 1.0430 during the last two weeks. Moreover, they even managed to close above it several times. However, the reason why the pair reversed in favor of the US dollar each time was probably a stronger and more significant level 10-20 pips higher. I think that the bulls did not manage to fulfill their plans, and the euro fell by 150 pips almost in a day. If it does not hold around 1.0430 for a long time, it might continue falling to the 2022 lows.

Yesterday, it was a busy day. The US GDP report was released and Lagarde and Powell delivered their speeches. These events were crucial for traders as they provided ground to trade more actively. However, the question is whether the USD had a reason to rally or did traders abandon their attempts to break through the 1.0574 level? I believe the second option is more correct. US GDP in the first quarter was even worse than in the last quarter. It fell by 1.6% compared to the previous quarter. Therefore, the US dollar could not rise with the US economy declining. Jerome Powell's speech did not contain any new aspects as the Fed Chairman expressed his major ideas once again. Christine Lagarde focused on inflation and said that the global economy was unlikely to go back to low inflationary pressures. The ECB President believes that the situation has changed dramatically over the past few years. Therefore, if inflation can be lowered over time, it will still be higher than it was before the coronavirus pandemic.

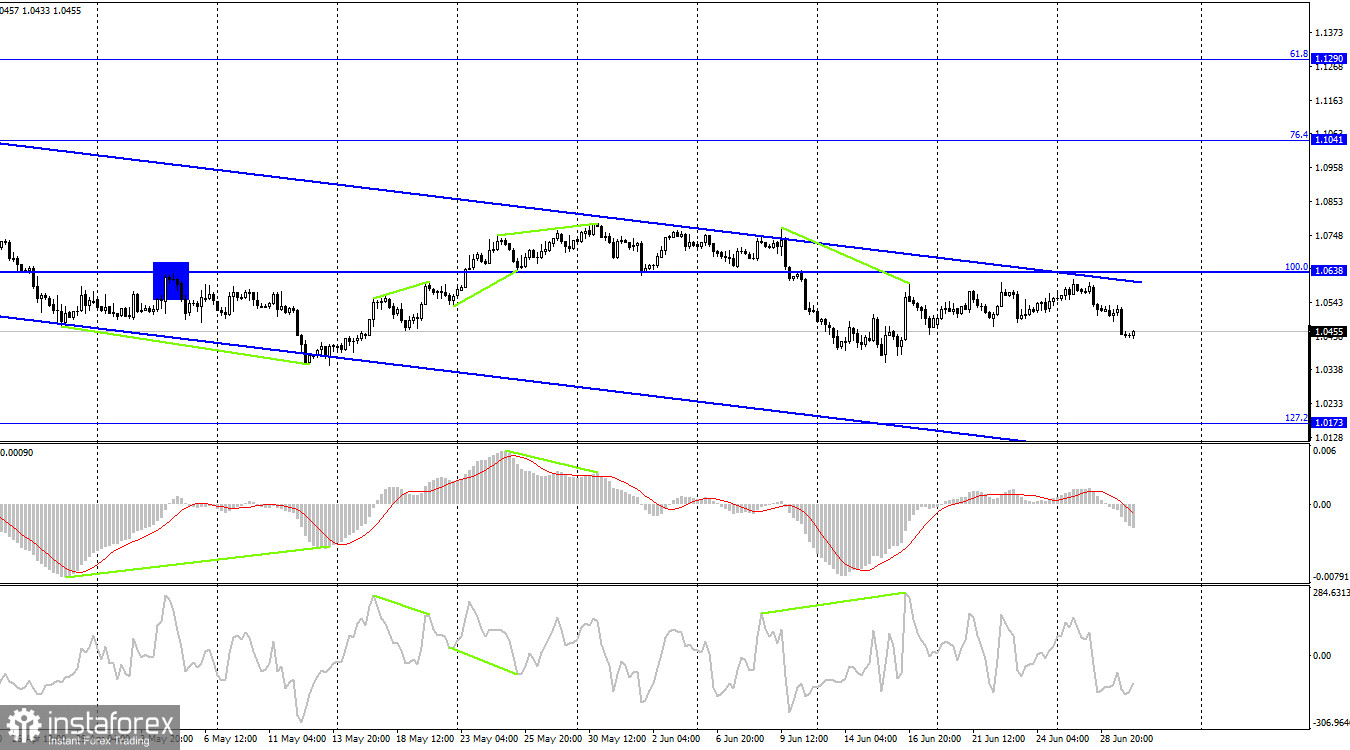

On the 4H chart, the pair reversed in favor of the US dollar and started declining towards the 127.2% correction level at 1.0173. If the pair consolidates above the channel, traders can expect the euro to continue growing towards the 76.4% Fibonacci level at 1.1041. No indicators show any divergences today.

COT report:

Speculators closed 1,432 long and 1,845 short contracts last week. This means that the bearish sentiment of major players has increased. The total number of long contracts held by speculators totals 195,000, while the number of short contracts is 211,000. The difference between these figures is not significant. However, bulls do not have an advantage. As for the euro, sentiment of non-commercial traders has been mostly bullish during recent months. Nevertheless, this fact did not favor the euro at all. The prospects for the euro's growth have been gradually rising over the last few weeks. However, the latest COT report shows that the euro's new sell-off is likely. There was no positive news from the Fed or the ECB.

US and EU economic news calendar:

EU - Unemployment Rate (12-00 UTC).

US - Initial Jobless Claims (15-30 UTC).

EU - ECB President Lagarde will give a speech (16-30 UTC).

On June 30, the EU and US economic calendars contain several important entries. Christine Lagarde will deliver a speech again. The other two reports are not significant. I believe that the news background will not affect or only slightly affect traders' sentiment today.

EUR/USD outlook and recommendations for traders:

I recommended selling the pair at the rebound from the 161.8% level at 1.0574 on the hourly chart with the target of 1.0430. This target has been reached. New sales are possible at closing below 1.0430 with a target of 1.0315. I recommend buying the euro if the pair consolidates above the channel on the 4H chart with the target of 1.1041.