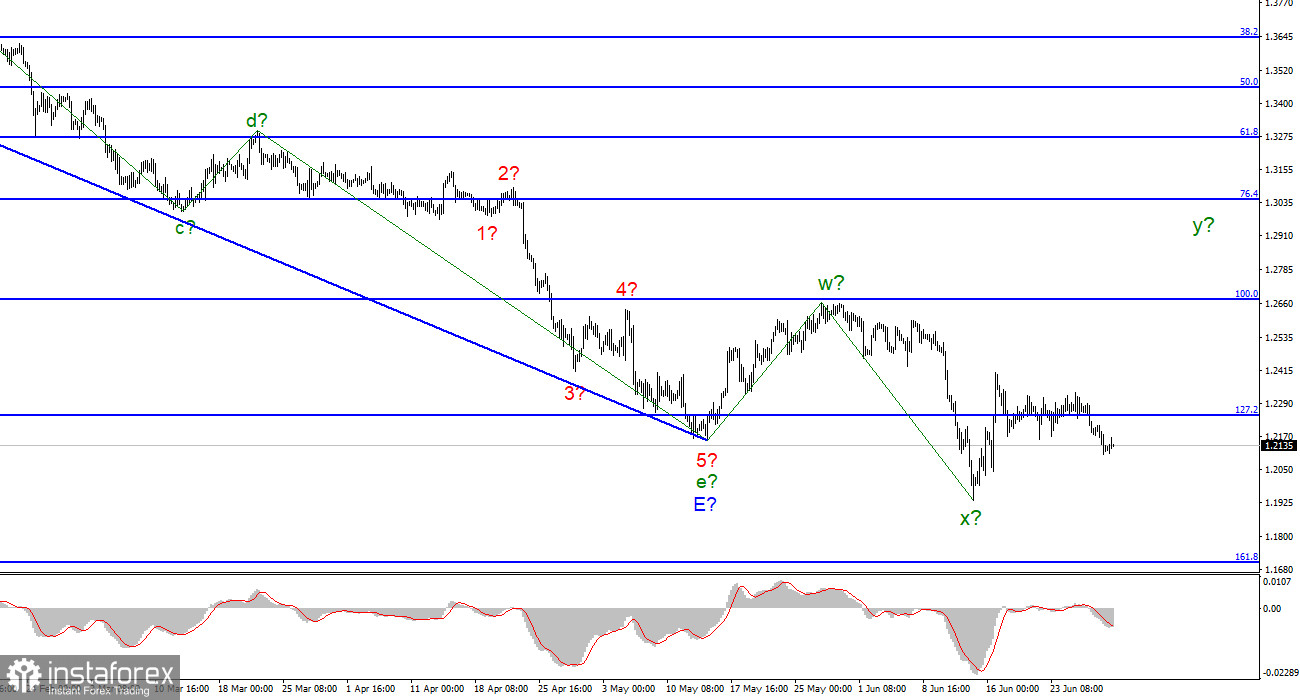

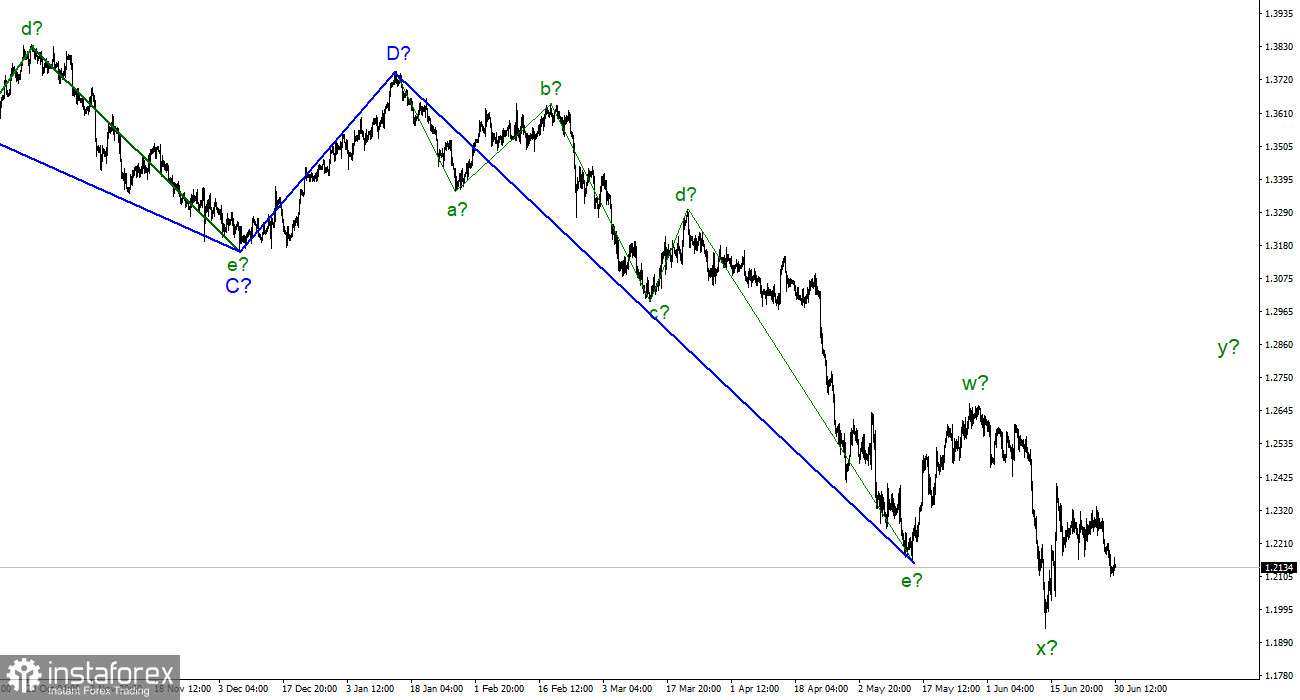

According to the pound/dollar instrument, the wave marking now requires additions and adjustments, but it may still take a more or less digestible form. At the moment, the last downward wave has gone beyond the low of the expected downward trend segment, which I consider completed. Thus, the classical correction structure a-b-c will no longer work. Nevertheless, wave analysis allows the construction of various correction structures, so a more complex three-wave formation w-x-y can be constructed. Anyway, the pound and the euro continue to show a very high degree of correlation, and both instruments should build approximately the same trend areas. Ascending. At the same time, according to the euro currency, it can be a classic a-b-c, and according to the pound, a rarer w-x-y. But in both cases, the instruments should now build an ascending wave, which should go beyond the peak of the previous ascending one. However, at the moment, both instruments show more of their desire to resume the decline, rather than build an upward wave. Although the news background for the euro and the pound this week was not bad, demand for both currencies is still declining.

Bailey spoke, but the market did not pay attention

The exchange rate of the pound/dollar instrument during June 30 did without a new decline, but over the past few days, it has lost enough to now doubt with might and main the ability to continue building an upward wave. The fact that this week the news background for the British was not bad, but at the same time the currency declined, from my point of view, says a lot. If the market is set up to sell the pound again, then no news background will help.

For example, yesterday Andrew Bailey said that inflation in the UK remains at too high a level and the longer it continues, the higher the likelihood of the Bank of England applying a tougher approach to rates. Accordingly, the British regulator admits that it will have to raise the interest rate at a higher rate if it wants not just to create the appearance of fighting inflation, but really to fight it. However, the market ignored this conclusion as well. What else does the market need to buy a pound, and not sell it?

A report on British GDP in the first quarter was also released today. Market expectations were met, and economic growth was 0.8% every quarter. This is lower than in the fourth quarter of last year, but it is still an increase. Let me remind you that yesterday the US GDP became known, which decreased by 1.6% in the first quarter. And the demand is still rising for the US dollar, not for the pound. Thus, I think that only a miracle can save the euro and the pound in the current situation. The market is setting up for sales again, and if this is the case, then updating the latest low is just a matter of time. If the downward section of the trend becomes more complicated, then it will most likely become very complicated. Then the pound may decline by another 400-600 basis points within a certain time.

General conclusions

The wave pattern of the pound/dollar instrument has become more evident. I still expect the construction of an upward wave within the corrective upward structure. If the current wave marking is correct, then the instrument's increase will resume with targets located above the calculated mark of 1.2671, which corresponds to 100.0% Fibonacci. I recommend buying on each MACD signal "up". If the wave marking is incorrect, then the MACD indicator will point down and you should not buy the instrument.

On an older scale, the entire downward trend section looks fully equipped but may take on a more extended form. If the current correctional structure still takes an even more non-standard form, then adjustments will have to be made.