Over the past week, the EUR/USD currency pair has demonstrated its incapacity to produce a real upward correction. The demand for the euro continued to diminish despite its structural and macroeconomic foundations being sound, which caused the euro/dollar pair to fall again. For the third time in the previous two months, the quotes fell to the Murray level of "2/8" - 1.0376 on Friday. The last two attempts to pass this level failed, but remember that the more times a pair tries to pass a crucial level, the greater the likelihood that it will eventually succeed. We may claim that the euro has enjoyed a break during the past two months. But the euro can no longer maintain a steady trading range around its 20-year lows without adjusting. The current slump in the global economy should continue, or a new upward trend should start. Furthermore, it is still exceedingly difficult to anticipate an upward trend given that the economic and geopolitical backdrops have not changed in recent weeks.

Therefore, it is likely that the euro currency will continue to decline. According to us, the most significant differences between the monetary policies of the ECB and the Fed and the market's reluctance to purchase anything other than US dollars continue to be the two leading causes of the euro's decline. Furthermore, this condition may last for a very long period, which is awful for the euro currency. The only growth the pair can still rely on is technical, but the past two months have succinctly demonstrated how modest even this growth would be. Although we anticipated the emergence of a new global boom at the beginning of the year, the overall situation for the European currency is still worse than ever. But in today's environment, everything changes so quickly that it is hard to trade for an extended period.

This week, what can we expect?

There will be a holiday in the United States to begin this week. The major attractions will be closed on July 4, in observance of Independence Day. On this day, too, there are no noteworthy occurrences in the European Union. The index of business activity in the services sector for June (final estimate), which the EU will release on Tuesday, is anticipated to fall to 52.8 from 56.1 a month earlier. The US, the EU, and the UK are currently declining corporate activity, as was evident from the numbers released last week. The possibility of a recession is looming in the companies mentioned above, just as inflation is increasing globally. Thus, it is unlikely that macroeconomic indicators will give the dollar a further edge. Additionally, since this will be the second assessment, traders are fully prepared to lower the indicator.

The European Union will release a report on retail sales on Wednesday. At the moment, this is not the most significant signal. Of course, if the actual value differs significantly from the forecast, there may be a local reaction. These are the only events scheduled for this week in the European Union. The dates of Christine Lagarde's speech could, of course, appear on the calendar; however, these dates are not always known in advance. And Lagarde herself is theoretically able to make any significant declarations. But let's not forget that the ECB president spoke four times last week and used the same line of argumentation each time. Lagarde can once more formally back the euro. Since the regulator hasn't tightened monetary policy in the past, the ECB has the best chance right now to raise the rate. However, the ECB is reluctant to tighten it because it fears a recession, which would have more catastrophic repercussions for Europeans and the European economy, given that unemployment in Europe is twice as high as in the US. Therefore, it is expected that the rate in the EU will increase twice this year, which won't significantly impact the position of the euro overall.

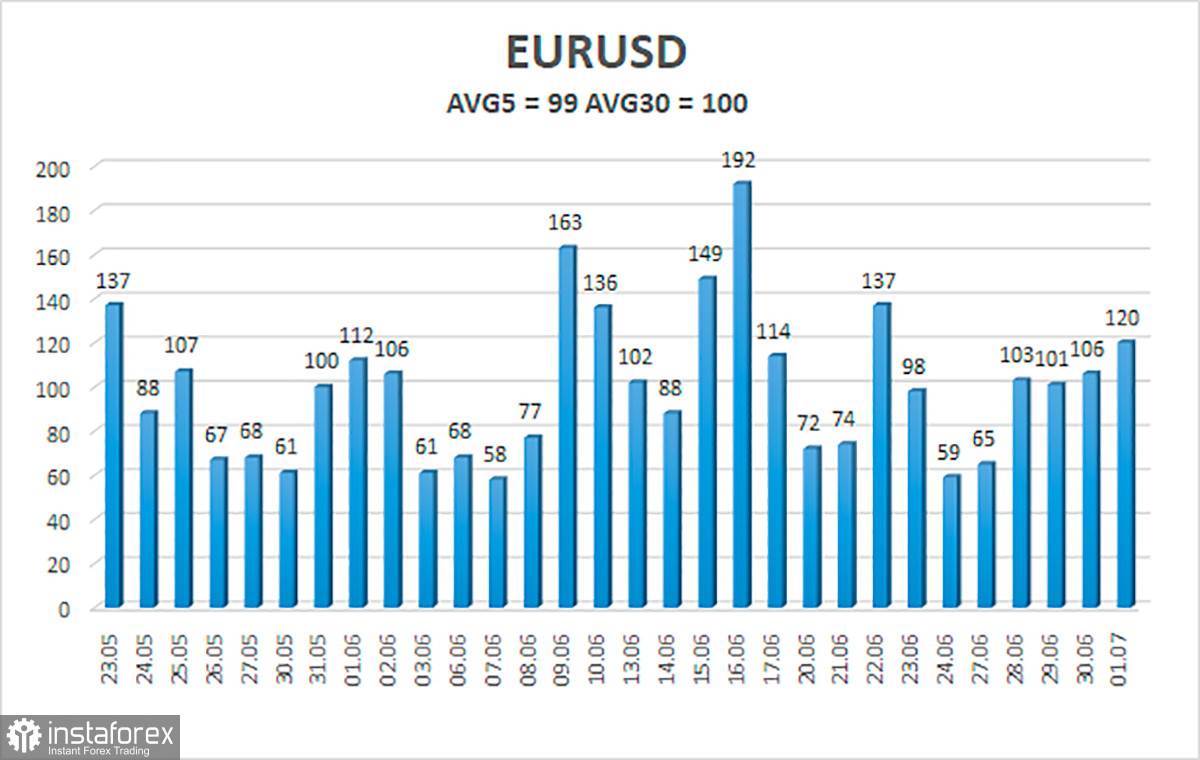

As of July 4, the euro/dollar currency pair's average volatility over the previous five trading days was 99 points, which is considered "high." As a result, we anticipate that the pair will fluctuate today between 1.0328 and 1.0526. A round of corrective action will begin when the Heiken Ashi indicator reverses direction upward.

Nearest support levels:

S1 - 1.0376

S2 - 1.0315

S3 - 1.0254

Nearest resistance levels:

R1 - 1.0437

R2 - 1.0498

R3 - 1.0559

Trading recommendations:

The EUR/USD pair appears to have resumed its downward trend, but given that it is now very close to the firm support level of 1.0376, it may start a fresh round of upward correction. As a result, we should now consider taking short positions with 1.0254 and 1.0328 as our targets as long as the Heiken Ashi indicator points downward. When fixed above the moving average, purchases of the pair with goals of 1.0526 and 1.0559 will become relevant.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.