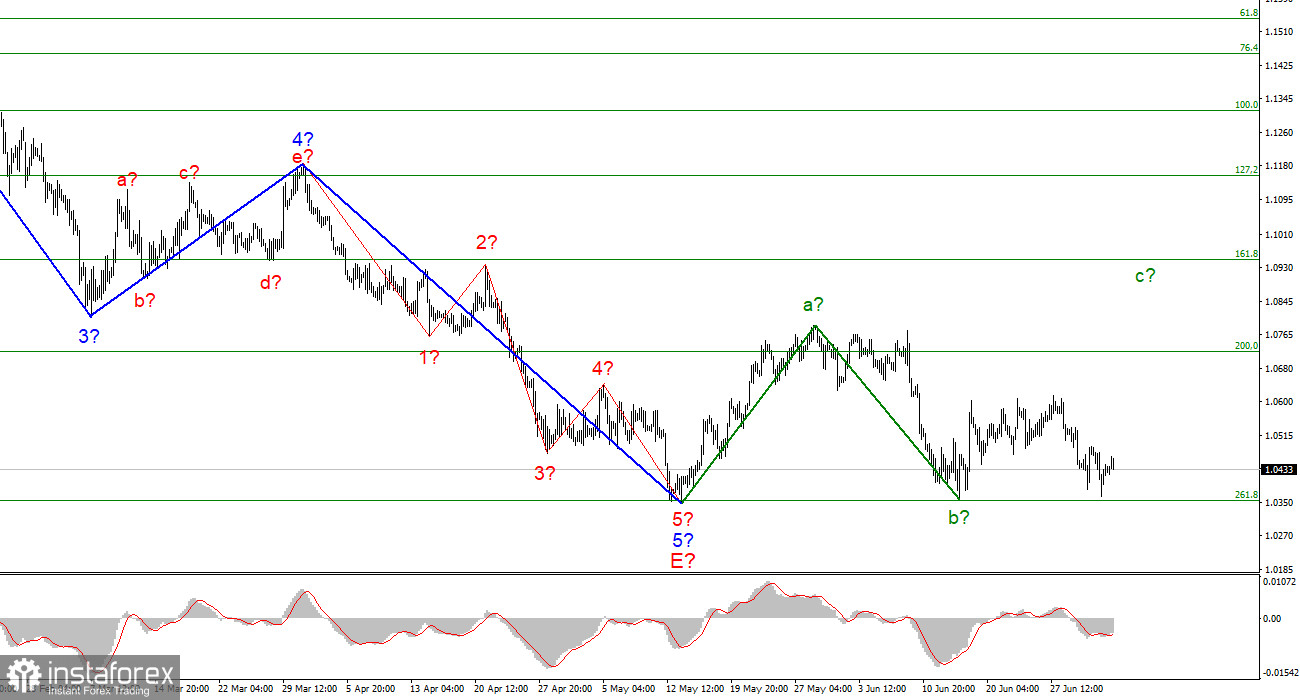

The wave marking on the euro/dollar instrument's 4-hour chart remains persuasive and doesn't need to be adjusted. I believe that the instrument has finished building a downward trend section and that if the wave marking for the present period is accurate, the instrument has started and is continuing to build a new upward trend section. A new portion of the trend is currently showing two waves. Both Wave A and Wave B have likely been finished. If this is the case, work on the climbing wave C is now in progress. The wave marking still holds because the instrument hasn't dropped below the trough of the downward trend section, but the instrument's reduction in quotes over the past two weeks is a very bad indicator. Adjustments will be required if an effort to breach the 261.8% Fibonacci level is successful. I observe that the trend's downward portion might complicate its internal wave structure and take on a somewhat longer shape. A highly positive wave marking can, however, be destroyed. However, the potential for creating an upward wave is still present.

US Independence Day causes the euro to stop.

On Monday, the euro/dollar instrument increased by ten basis points. Because a portion of the market in the United States is closed today in observance of Independence Day, there was very little trading activity today. I am currently unable to alter anything, not even the short-term wave markup. The current pivot point is 1.0355. A successful attempt to penetrate it will complicate the entire downward portion of the trend. Unsuccessful, but there are still prospects for the tool to develop better with targets towards the eighth figure.This week, there won't be many very significant economic plan events. I would draw attention to the Friday speeches by Christine Lagarde and the Nonfarm Payrolls report. Given that Lagarde gave four speeches last week, I can't say that I'm anxiously anticipating hers. We all know this has resulted in: a further decrease in demand for the euro due to Lagarde's speech, which as usual, prompted some concerns. The European regulator is still debating whether to raise interest rates once or twice this year, although inflation in the European Union is rising every month. Because neither one rate increase nor two rate increases will impact the rise in prices for essentially all products and services, the market believes this is completely unimportant. It is also understandable why the ECB would not want to let an economic downturn right after the end (or completion?) of a pandemic. However, the market pays close attention to the US to EU interest rates ratio. And at this point, the ratio demonstrates the superior investment climate in the United States. As a result, I think that overall, the news landscape continues to be in favor of the dollar rather than the euro. The market appears to be prepared for further euro sales without even waiting for the next Fed and ECB meetings. Unfortunately, this time could have been used to create the required wave.

General conclusions.

Based on the analysis, I conclude that the downward trend section's construction is finished. If so, you can purchase an instrument with objectives close to the predicted mark of 1.0947, equal to 161.8% Fibonacci, for each "up" MACD signal, assuming that wave C would eventually be constructed. If the attempt to breach the level of 261.8% is successful, it will signify that the market is prepared for increased instrument sales and the end of the growth scenario.

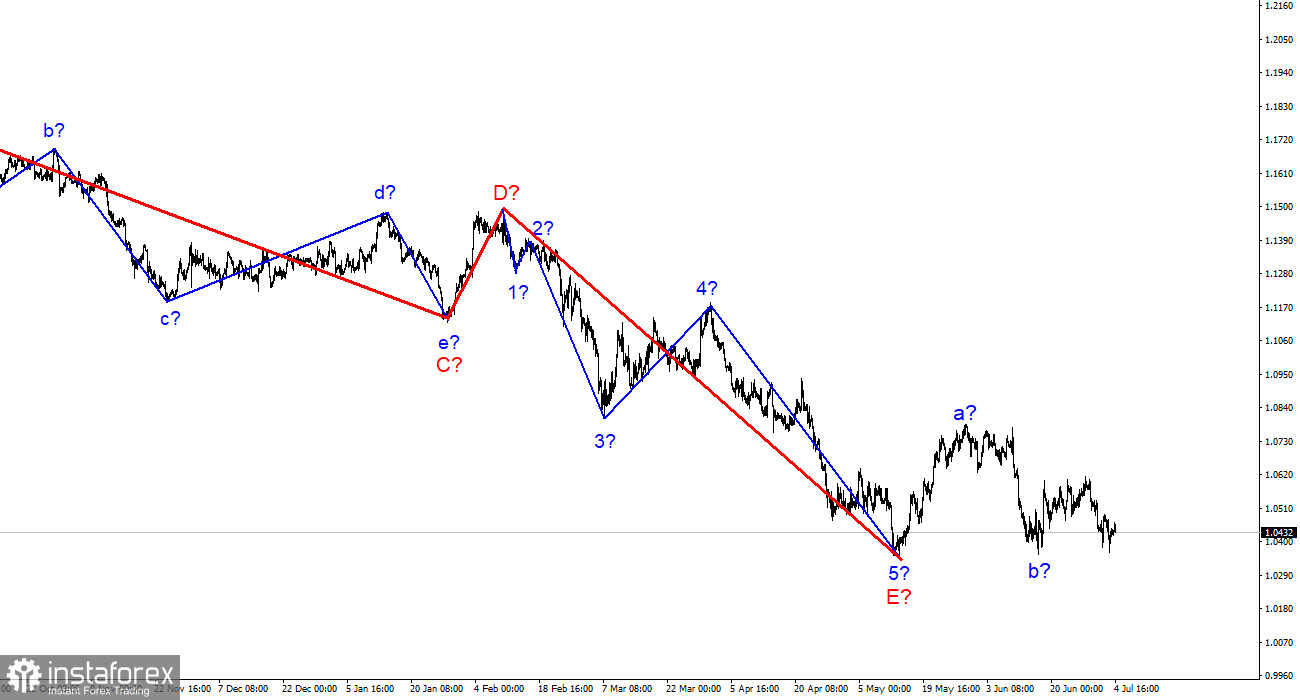

On a broader scale, it is visible that the intended wave E's building has been finished. As a result, the downturn as a whole now appears complete. If this is the case, the instrument may increase for several months with targets close to wave D's peak or to the 15th figure in the future.