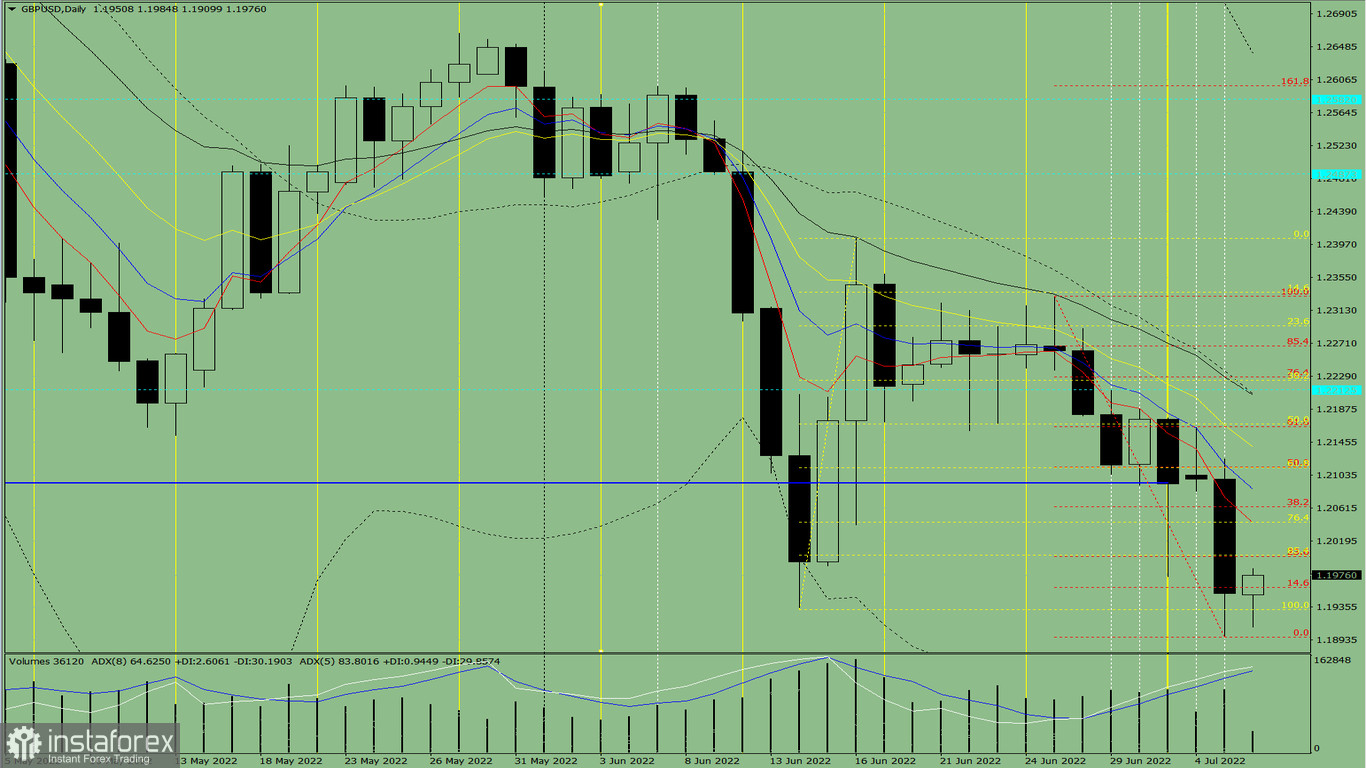

Trend analysis (Fig. 1).

The pound-dollar pair may start an upward pullback from the level of 1.1953 (close of yesterday's daily candle) to 1.2000, the 23.6% retracement level (red dotted line). In the case of testing this level, continued upward movement is possible with the target of 1.2063, the 38.2% retracement level (red dotted line). From this level, the price may move down.

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis – up;

- Fibonacci levels – up;

- Volumes – up;

- Candlestick analysis – up;

- Trend analysis – down;

- Weekly chart – down;

- Bollinger bands – down.

General conclusion:

Today, the price may start an upward pullback from the level of 1.1953 (close of yesterday's daily candle) to 1.2000, the 23.6% retracement level (red dotted line). In the case of testing this level, continued upward movement is possible with the target of 1.2063, the 38.2% retracement level (red dotted line). From this level, the price may move down.

Alternative scenario: from the level of 1.1953 (close of yesterday's daily candle), the price may start an upward pullback to 1.2000, the 23.6% retracement level (red dotted line). In the case of testing this level, a downward movement is possible with the target of 1.1897, the lower fractal (red dotted line). From this level, the price may move up.