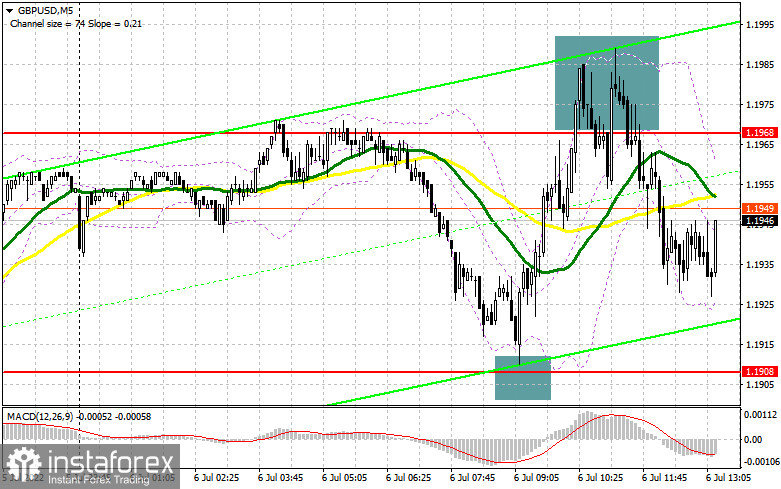

Earlier, I asked you to pay attention to the level of 1.1908 to decide when to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. A decline and a false break of this level led to a buy signal. As a result, the pound sterling advanced by 60 pips to 1.1968.Traders also opened sell orders after a false break of 1.1968. Weak data on the UK construction PMI forced traders to open more sell orders. By the moment I wrote the article, the pound sterling returned to 1.1908, allowing bears to earn another 50 pips. From the technical point of view, the situation remained the same.

Conditions for opening long positions on GBP/USD:

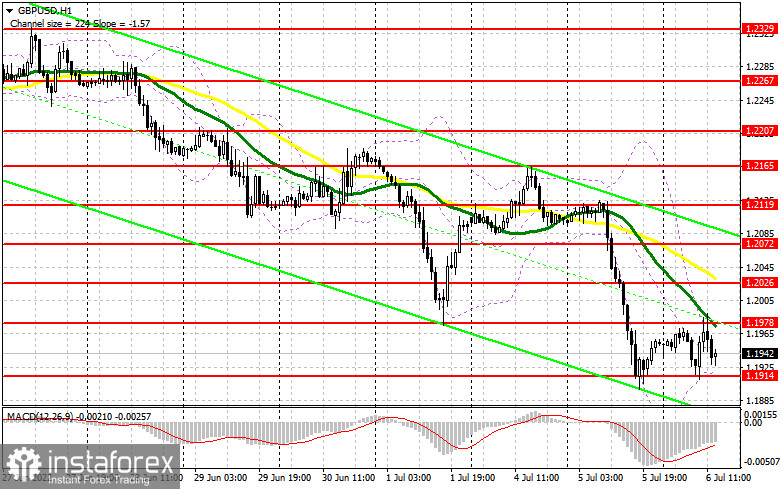

Bears are likely to break 1.1908, whereas strong data on the US economy may cause a rise in the volume of short positions. That is why I do not recommend to open long positions especially against such a bearish market. The US is going to publish data on the composite and services PMI. However, traders will be mainly focused on the FOMC meeting results and comments that will be provided by FOMC Member Williams. Only a false break of 1.1914 may lead to a long signal with the target at 1.1978, the level touched yesterday during the European session. The bearish trend will stop only if bulls regain control over the level of 1.1978. There, we can see moving averages that are capping the upward potential. A breakout and a downward test of this level will give a buy signal with the target at 1.2026. A breakout of this level may form another buy signal with the target at 1.2027, where it is recommended to lock in profits. If the pound/dollar pair declines and buyers fail to protect 1.1914, it is likely to slide to yearly lows. In this case, traders should avoid long positions until the price hits the next support level of 1.1859. It is possible to buy after a false break. Traders may go long from 1.1816 or lower – from 1.1742, expecting a correction of 30-35 pips.

Conditions for opening short positions on GBP/USD:

Today, bears have not renewed a yearly low yet. However, this will inevitably happen. Now, they should primarily protect a new resistance level of 1.1978, which the pair tested earlier today. However, this is not enough to continue the downtrend. In the best-case scenario, sell orders could be initiated after a false break of 1.1978. This, in turn, will cause a drop to yearly lows. Only a breakout and an upward test of 1.1914 as well as strong data from the US and hawkish FOMC meeting results will give a new sell signal, thus pushing the price to the low of 1.1859. In this case, the likelihood of reaching a new support level of 1.1816 will become higher. The next target is located at 1.1742, where it is recommended to lock in profits. If the pound/dollar pair increases during the US trade and sellers fail to protect 1.1978, bearish sentiment will become weaker. Under these conditions, sell orders should be avoided until the price hits 1.2026. It will be possible to sell the asset after a false breakout. Traders may also go short from the high of 1.2072 or higher – from 1.2121, expecting a decline of 30-35 pips.

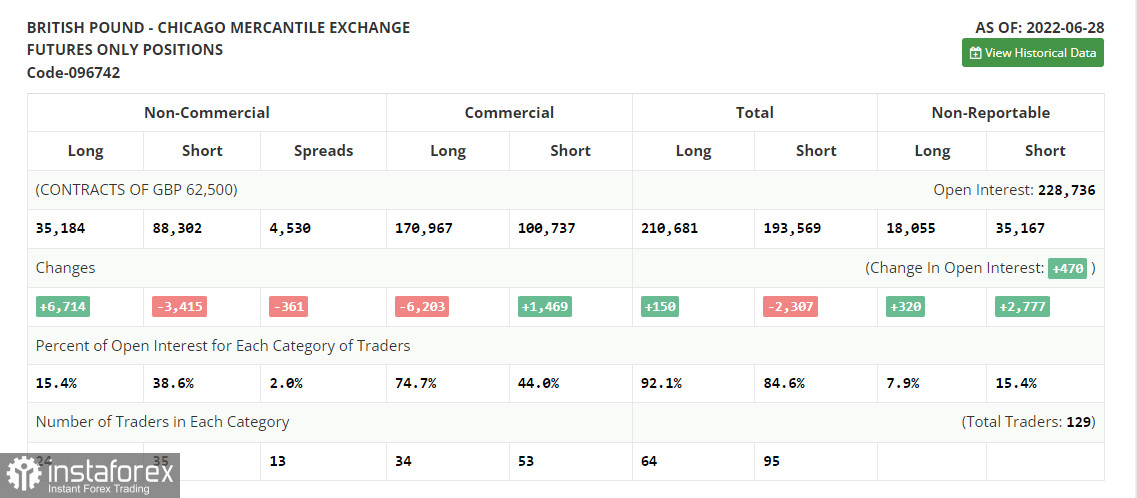

COT report

According to the COT report from June 28, the number of short positions declined, whereas the number of long positions jumped. This is pointing to an attempt to reach a new yearly low after the BoE's decision to increase the key interest rate and remain stuck to an aggressive monetary policy. A jump in inflation recorded in May is forcing the regulator to take aggressive measures. The cost of living crisis in the UK, which continues developing, is affecting the local economy especially during the period of the key interest rate hike. This fact is reducing the attractiveness of the British pound, which is actively declining to the low of 2020. The Fed's policy and the pace of the key interest rate hike are actively supporting the greenback. The COT report unveiled that the number of long non-commercial positions increased by 6,714 to 35,184, while the number of short non-commercial positions decreased by 3,415 to 88,302. However, this did not significantly affect the overall picture of the bear market, but led to a slight decrease in the negative value of the non-commercial net position from -63 247 to -53 118. The weekly closing price decreased to 1.2201 against 1.2295.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, which points to the continuation of the decline in the pound sterling.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the resistance level will be located at the upper limit of the indicator of 1.1978.

Description of indicators- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.