Futures on US stock indices have stabilized slightly following yesterday's volatility. The major indices are trading almost unchanged, and yesterday's purchases, which were prompted by a rather pronounced correction at the start of the week, indicate the manifestation of bullish sentiment. The decline in bond yields also boosted the growth of stocks yesterday evening. Futures linked to the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 are trading unchanged.

In response to yesterday's results, the Dow fell 129 points, compensating for larger losses at the start of the session. The S&P 500 recovered from a brief loss of 2 percent to end the day up 0.2%. The technology-focused Nasdaq Composite increased 1.75 percent.

The fear that the economy will soon enter a recession, coupled with a sharp increase in interest rates, caused the yield on 10-year US Treasury bonds to fall below that of 2-year securities. This indicates that the so-called inversion of the yield curve, a sign of an impending recession, is no longer visible.

As raw material prices, which have been fueling the markets quite well as of late, continue to push inflation higher and higher, oil prices have fallen below $ 100 per barrel, confirming the possibility of a global economic growth slowdown. In light of this context, Tuesday's decline was led by shares of energy companies.

As it turns out, some Wall Street analysts have already rushed to assert that the recession may be mild. Credit Suisse believes that the United States can avoid a recession, but it has not been specified how. According to analysts from Credit Suisse, the market is beginning to anticipate next year, which could be a year of recovery following the first half of 2022.

The absence of a debt crisis will enable us to anticipate that the trend will begin to improve in the near future. A decline in the range of 30 percent is the average value for identifying recessionary indicators. Once the market declines closer to 50 percent, as it did in the early 2000s and 2008, it will be possible to discuss actual problems and the debt crisis.

The release of the minutes from the Federal Reserve System's June meeting may increase market volatility today. Markit PMI reports for the manufacturing sector are anticipated, as are similar data from the Institute for Supply Management.

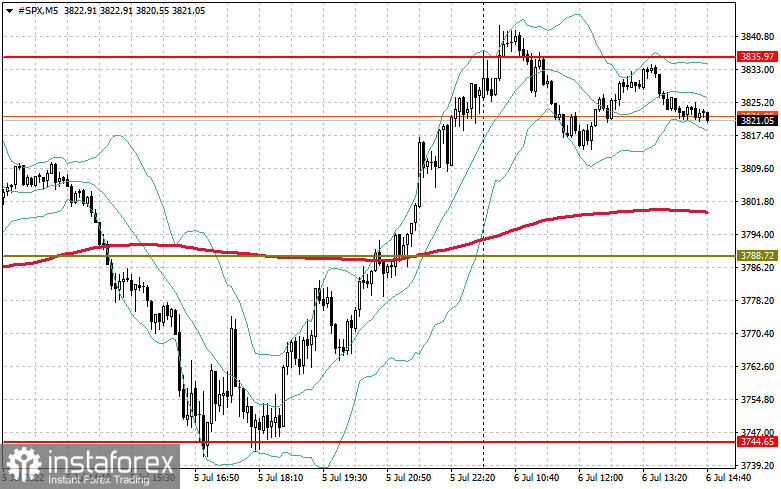

As for the S&P 500's technical picture,

Yesterday's recovery was quite remarkable. It makes no sense to alter the technical picture in light of this situation. Now, buyers must overcome the resistance level of $ 3,835. A break in this range will allow you to get out of a new protracted peak and will lead to an active movement of the trading instrument upwards to the area of $ 3,867, where large sellers will return to the market again. At least some traders will seek to lock in profits on long positions. The $ 3,905 level is a more distant objective. In the event of pessimism, regular discussion of high inflation and the need to combat it, as well as a sharp rejection of risks, as is presently the case in the foreign exchange market, the trading instrument will easily retrace to the closest support at $ 3,788. A breakdown of this range will result in a new sale between $ 3,744 and $ 3,704 if no bulls are present.