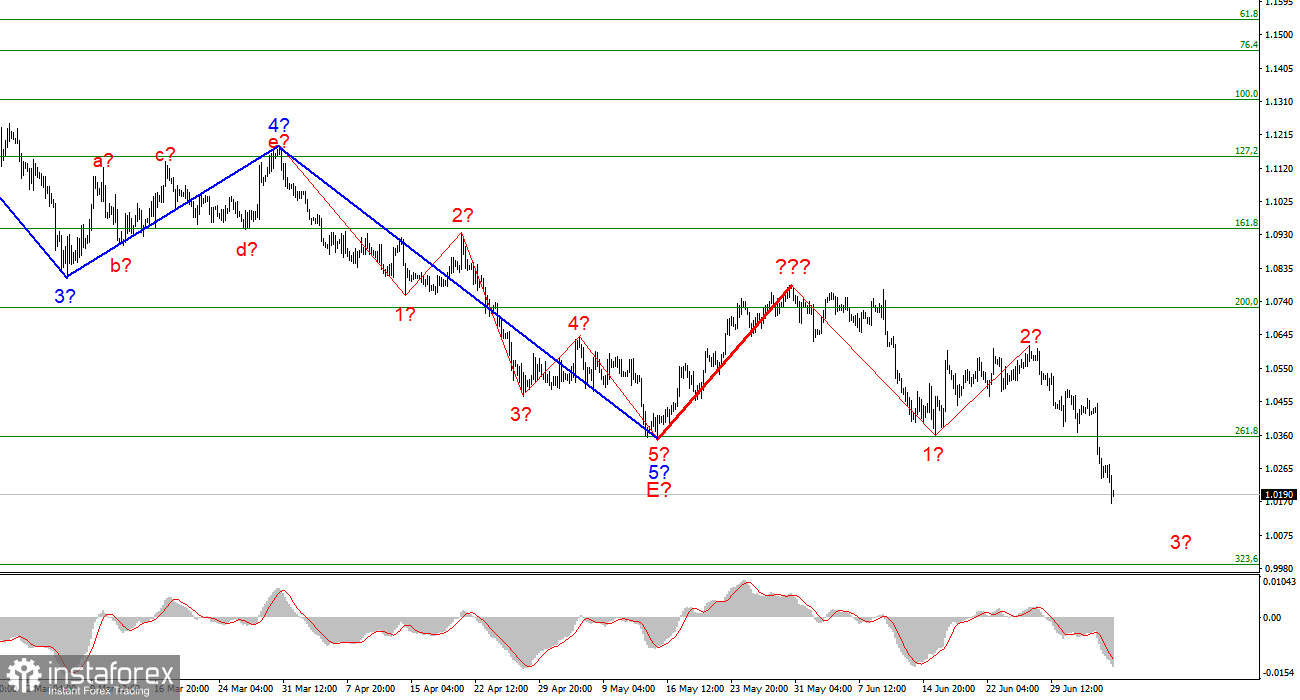

After the quotes dropped by about 200 basis points yesterday, marking the waves on the 4-hour chart for the euro/dollar instrument has become more difficult. The Fibonacci level of 261.8%, which was also the bottom point of waves E and b, was thus successfully breached. Now that it is already obvious that these waves are not E and b, the market mood is taking precedence over all other factors. A classic five-wave descending wave arrangement just a few days ago was outstanding and promising. Instead of constructing at least three correction waves, the market preferred to resume selling the instrument, indicating the instrument's secondary importance at this time. There are occasions when the market disregards a particular kind of analysis. Different forms of analysis can produce conflicting signals in some circumstances, one of which will be false. However, I want to point out that the market frequently disregards both the context of the news and various technical signals. The most important thing is to realize this has happened as soon as possible and act in line with the brand-new market reality. Now that a red line has identified one corrective wave, the device can construct a new five-wave falling series. I suggest focusing on the lowest wave order because the wave markup appears unreadable at a larger scale.

Comparing Tuesday's opening and closing values for the euro/dollar instrument, the decline was 155 basis points. It decreased by another 70 points on Wednesday. At first sight, it would appear that the euro's losses today are not significant, but I want to remind you that while the euro is not the most volatile currency, a shift of 70 points is significant for it and is typically preceded by some significant news. However, there was no such news context either yesterday or today. There have been several stories lately, but they don't seem to have the inherent power to change the instrument by over 300 points in less than two days. Let me remind you that only the European Union's business activity index was issued yesterday, and the euro dropped by 150 points as a result. Today saw the release of the industry business activity index and the retail sales index. Today's actions appear even more rational than they did yesterday. After all, only two reports were released today, and both were unreliable. Business activity decreased to 47.0 from the critical 50.0 level. Only 0.2% of retail sales increased each month. American statistics were released less than an hour ago and did not affect market sentiment during the day. As a result, despite the news context, demand for the euro currency was not decreasing today. There might be some underlying influence, but I don't believe it. We now have a new wave layout that entails creating five more waves built downward. And this, the May 31 new wave marking of the trend section, is quite significant since it portends a further instrument collapse.

General conclusions

Based on the analysis, I conclude that the downward trend segment is still being built. If this is the case, it is now viable to sell the instrument with objectives close to the predicted 0.9988 level, equivalent to 323.6 percent Fibonacci, for each "down" MACD signal, assuming that wave 3 will eventually form. The market is ready for increased sales of the instrument and the cancellation of the scenario with the creation of ascending structures, as shown by a successful effort to breach 261.8 percent.