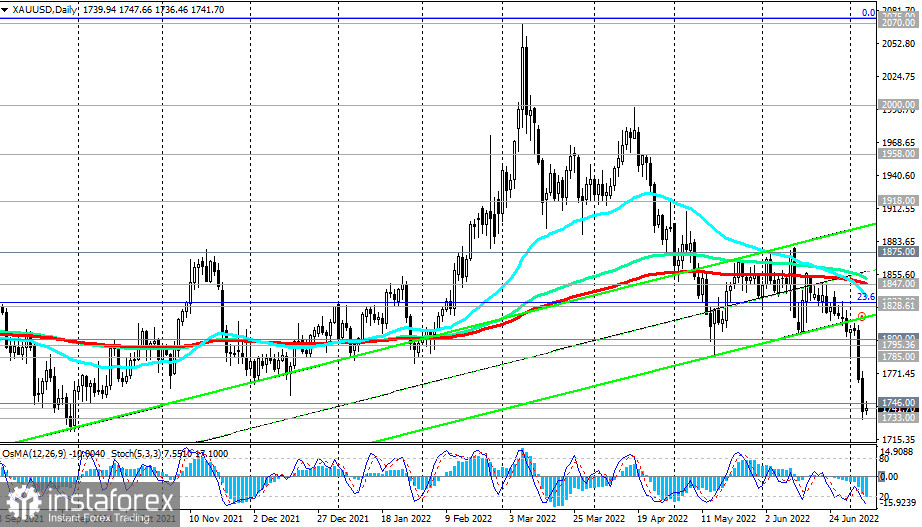

XAU/USD continues to decline for the 4th month in a row. As we suggested in our previous reviews dated 05/02/2022, 05/23/2022, and 06/02/2022, after the breakdown of the 1851.00 support level, the decline of XAU/USD will continue towards the recent balance line passing through the 1800.00 mark.

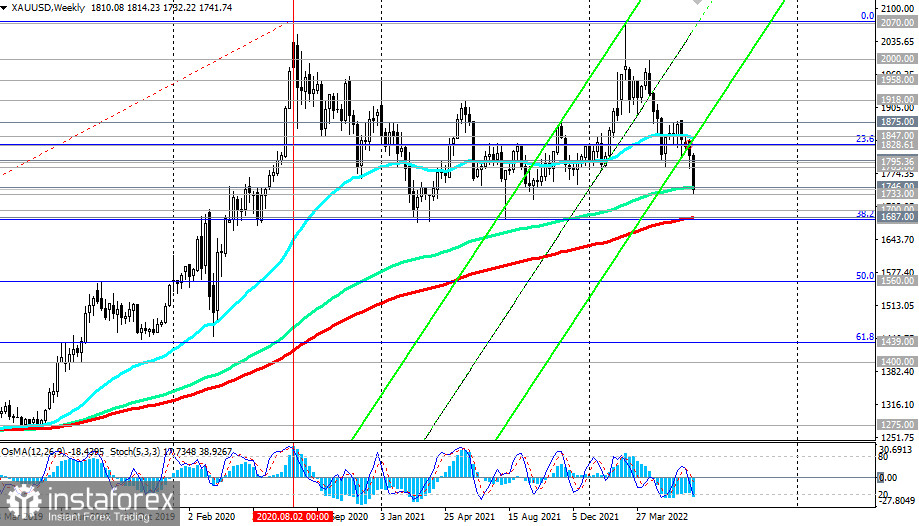

Then our alternative scenario worked, according to which a breakdown of the support levels of 1800.00, 1785.00 will push XAU/USD to further decline towards the key support levels of 1738.00, 1700.00. These scenarios turned out to be working, and the price is moving, as we assumed, towards the 1700.00 mark. But for this, it is necessary to overcome the strong long-term support level of 1746.00 (144 EMA on the weekly chart). The targets after its breakdown will be the key support levels of 1687.00 (200 EMA on the weekly chart), 1682.00 (38.2% Fibonacci retracement to the growth wave since December 2015, and the level of 1050.00).

In turn, a breakdown of the support level of 1668.00 (50 EMA on the monthly chart) will increase the risks of breaking the long-term bullish trend of XAU/USD.

In an alternative scenario, there will be a rebound from the support level of 1746.00, and an upward correction of XAU/USD will begin from the current levels with the prospect of growth to the "balance line" we have identified, passing through the level of 1800.00.

The price of gold may receive support from possible restrictions on Russian gold exports to the EU, US, UK, and Japan as part of the next round of sanctions against the Russian economy.

Statements by the Fed management about the growing negative impact on the economy from interest rate hikes, which could lead to a pause in the tightening cycle of the US central bank's monetary policy, could provoke a weakening dollar and an increase in gold quotes. It is known to be a traditional defensive asset, especially during periods of geopolitical and inflationary risks. This is the period we are currently experiencing.

Support levels: 1746.00, 1733.00, 1700.00, 1687.00, 1682.00, 1668.00

Resistance levels: 1785.00, 1795.00, 1800.00, 1828.00, 1832.00, 1847.00, 1875.00

Trading Tips

Sell Stop 1731.00. Stop-Loss 1751.00. Take-Profit 1700.00, 1687.00, 1682.00, 1668.00

Buy Stop 1751.00. Stop-Loss 1731.00. Take-Profit 1785.00, 1795.00, 1800.00, 1828.00, 1832.00, 1847.00