US stock index futures rose slightly on Thursday as traders continued to buy shares in the hope of upbeat data on the labor market and a further market recovery. Dow Jones Industrial Average futures rose by 98 points, or 0.32%. Futures for the S&P 500 and Nasdaq 100 added 0.23% and 0.32% respectively. Yesterday, the S&P 500 posted its first three-day winning streak since late May. The index is currently about 20% below its all-time high. Meanwhile, the Dow Jones gained over 69 points, or 0.2%. The Nasdaq Composite advanced by about 0.4%.

The minutes from the June meeting of the US Federal Reserve released yesterday showed that officials are determined to further tighten monetary policy. Markets have already priced in further interest rate hikes, so changes will occur only following some news, for example, about a shift in the Fed's stance. The regulator's intention to keep raising interest rates to fight high inflation while sacrificing economic growth rates is further evidence of the paths politicians are willing to take to achieve their goals.

However, many investors find it risky to buy stocks as fears of a recession continue to weigh on Wall Street. Moreover, an extremely volatile reporting season is ahead, but statistics will hardly be upbeat. Most likely, only in the autumn it will be possible to seriously reflect on when a real market reversal will take place, what the Fed will do, and what will happen in international politics, due to which the consumer price index rises according to officials of the US central bank.

Today's macroeconomic calendar includes statistics on US weekly jobless claims. Tomorrow, the Department of Labor will report data on job openings.

Premarket trading

GameStop turned out to be the top performer. Its stocks rose by 7.8% in premarket trading after the video game retailer announced a 4-for-1 stock split. Split-adjusted trading will begin on July 22.

Seagen shares gained 4.5% in premarket trading after the Wall Street Journal reported that Merck was in early talks to acquire the biotech company for more than $200 per share.

Shares of private space tourism company Virgin Galactic rose by 3.7% in premarket trading after it signed a contract with a subsidiary of Boeing to build two new 'mothership' aircraft which will be used as launch platforms for its future spaceplanes and launching of satellites.

Securities of Chinese electric car makers advanced after the news that the government would consider extending a tax break for electric vehicles. Shares of Li Auto added 1% in premarket trading, Nio and Xpeng increased by 1.5% and 3.3% respectively.

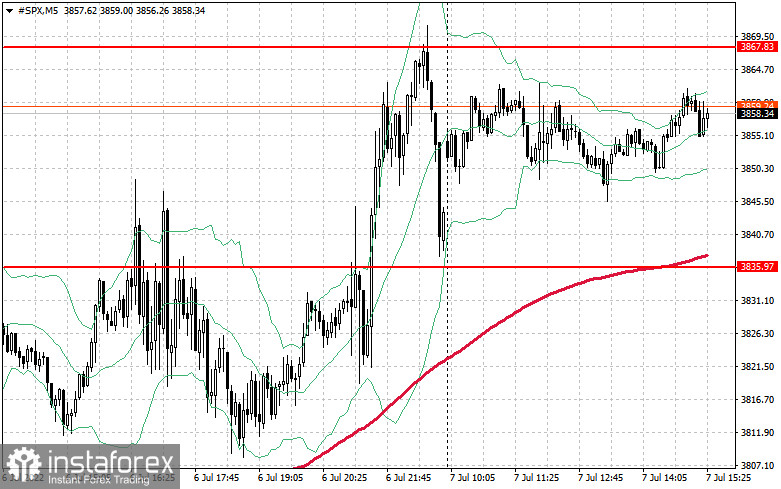

S&P 500 technical analysis

Yesterday, bulls managed to take control of the $3,835 mark, which is pretty good for developing a further bullish correction. However, only a breakout of $3,867 will allow the trading instrument to gain strong upside momentum and reach the area of $3,905, where major sellers will return to the market again. At least, some traders will lock in profits on long positions. The level of $3,942 can be seen as a more distant target. In case of pessimism, statements on high inflation and the need to fight it, as well as risk avoidance, the index will easily break below the nearest support of $3,835 and head for a more stable level of $3,788. If bulls' trading activity is subdued, a breakout of this area will lead to a new sell-off at $3,744 and $3,704.