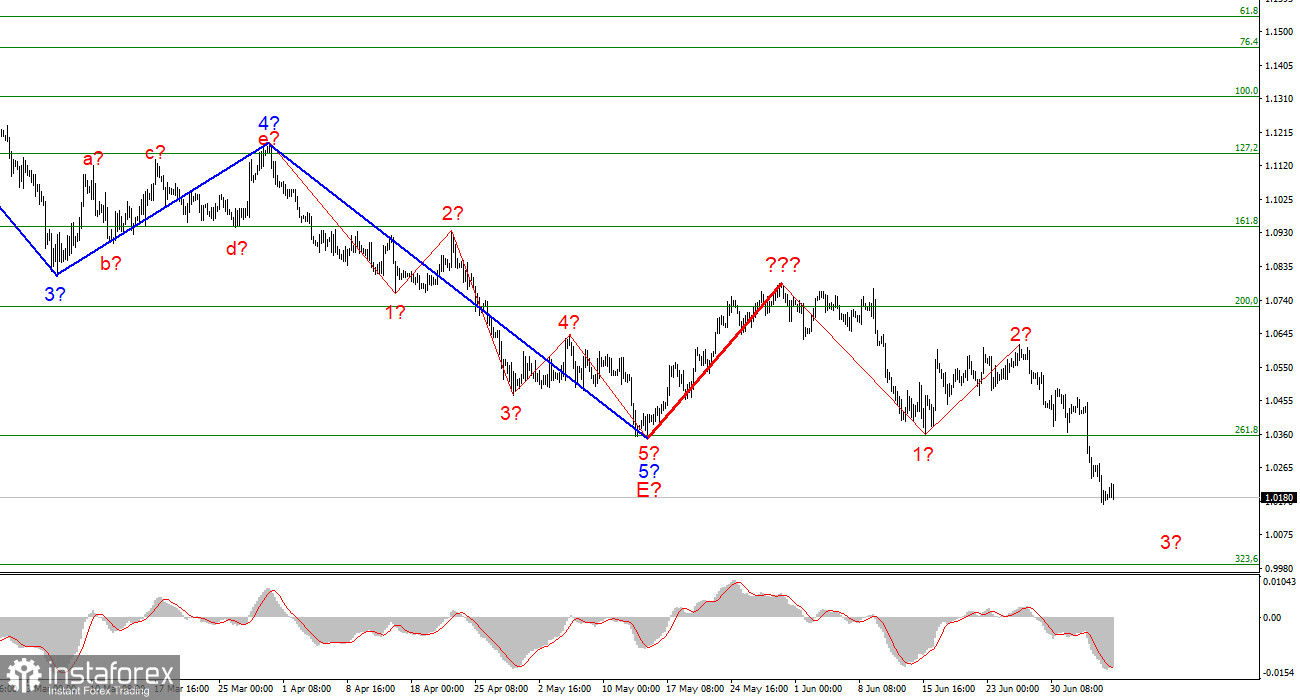

After this week's decline of nearly 300 basis points, the wave marking on the 4-hour chart for the euro/dollar instrument has become more complicated. Thus, the Fibonacci level of 261.8%, which was also the low of waves E and b, was successfully breached. Now that it is evident that these waves are not E and b, market sentiment has assumed the position of utmost importance. A few days ago, we had an excellent, promising wave structure consisting of a classic five-wave descent. Instead of constructing at least three correction waves, the market preferred to resume selling the instrument, indicating that wave analysis is currently of secondary importance. On occasion, the market completely disregards a particular type of analysis. There are instances in which distinct types of analysis produce contradictory results, one of which is incorrect. The most important thing is to recognize and act on the new market realities. Now that we have one red-lined correction wave, the instrument can construct a new five-wave descending series. I recommend paying attention to the lowest wave order now, as the wave markup appears illegible on a larger scale.

New day, new surprises.

Thursday saw the euro/dollar pair decline by only two basis points. Consequently, we can say that the European currency has avoided losses today. The construction of the descending wave continues, and practically no internal waves are visible within this wave. The instrument has sufficient decline potential to fall another 200 basis points. Today and tomorrow, the news backdrop for the US dollar will be quite significant, so we can anticipate a fascinating end to the week. In a few minutes, the ADP report will be released in the United States, which many consider comparable to Nonfarm Payrolls. The ADP report illustrates the extent to which the number of private-sector employees has changed. However, ADP and nonfarm reports rarely coincide, and there has been a recent trend: if the first report is positive, the second report must be negative. However, the market frequently pays no attention to the ADP report, preferring to wait for the payroll report, which is always released the following day. Thus, the labor market data released today is "acceptable." In addition to this report, no other significant events will occur today.

Consequently, I conclude that much will be decided regarding the euro currency tomorrow. However, what can be done if the tool refuses to build even the required correction structure and instead chooses to break the entire wave markup? I believe that the decline in demand for the euro will continue, as the market has demonstrated that it has no intention of purchasing euros under the current conditions. The new descending five-wave structure must be constructed in its entirety and without any modifications, complications, or clarifications. 95 figures can represent the objectives of this entire structure. It is hard to believe, but if the impulse structure is fully developed, the euro could fall another 700 points.

General observations.

Based on the analysis, I conclude that construction of the downward trend segment has resumed. Consequently, it is now possible to sell the instrument with targets near the estimated 0.9988 level, which corresponds to 323.6 percent Fibonacci, for each "down" MACD signal, anticipating the formation of wave 3. A successful attempt to surpass the level of 261,8 percent indicates the market's readiness for stronger instrument sales and the elimination of the scenario involving the construction of ascending structures.