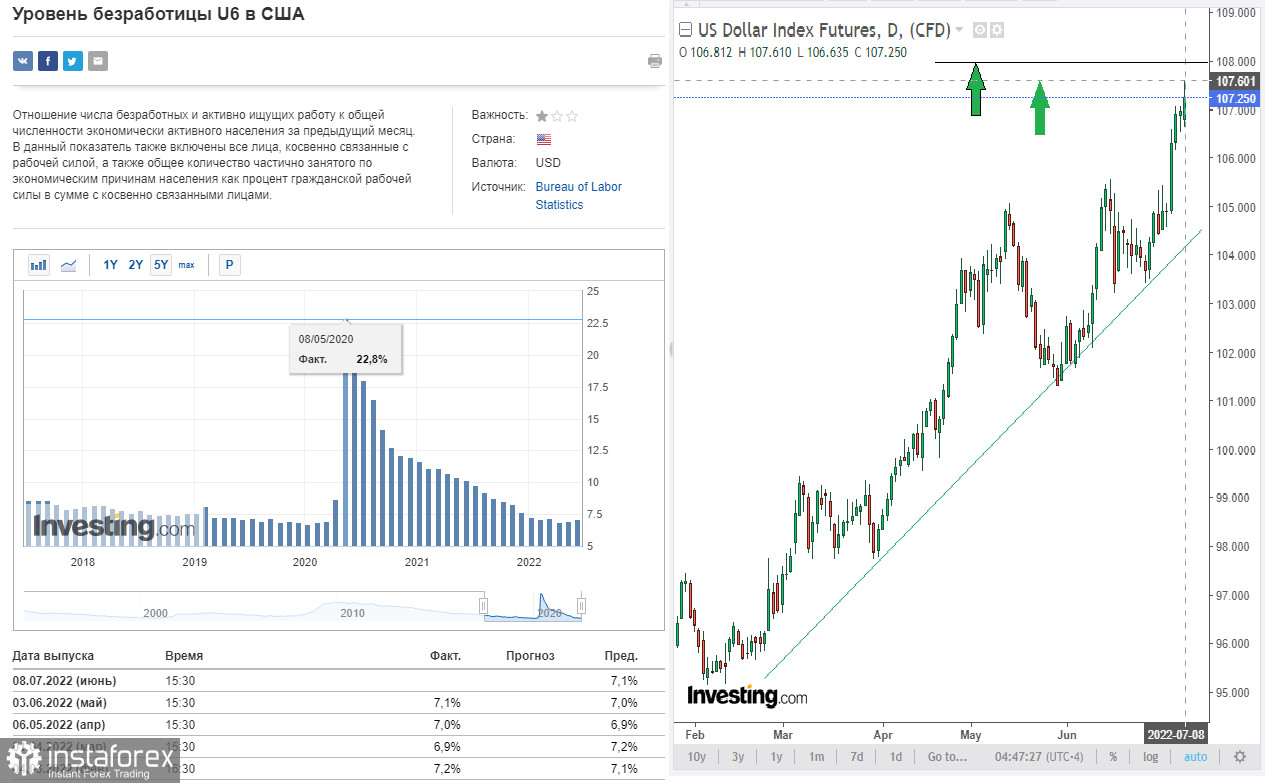

The dollar continued to strengthen ahead of the release of key data from the US labor market, while its DXY index rose. DXY futures were trading near 107.25, just below the new nearly 20-year high of 107.61 hit early in European trading on Friday. This week seems to be the most successful week for the DXY dollar index in the last few months, since at least April 2020.

Data from the labor market (along with data on GDP and inflation) are key for the Federal Reserve in determining the parameters of monetary policy, and if the report of the US Department of Labor does not disappoint market participants, the dollar index would have ended this week with an increase of more than 2.5%.

And this report suggests that the American labor market is still in good shape. It was expected that the American economy created 268,000 new jobs (outside the agricultural sector of the economy) in June, and unemployment remained at a pre-pandemic low of 3.6%, and for the fourth consecutive month. Recall that during the beginning of the pandemic, namely in April 2020, unemployment in the United States reached the level of 14.7%. Then the situation in the US labor market began to deteriorate sharply. In March 2020, the number of new (initial) applications for unemployment benefits rose to 282,000, then to 3,283,000 and 6,867,000 (in the week of March 19-27). According to economists, the American economy has lost more than 35 million jobs, which was not observed either during the global financial crisis or during the Great Depression of the 30s.

The coronavirus pandemic has caused the strongest damage to the US labor market in history. Unemployment in April jumped to 14.7% (against March's 4.4% and the forecast of 14%). This is the highest level since 1948. The highest unemployment rate of 24.9% was in 1933. US non-farm payrolls fell by 20.5 million in April, the equivalent of all new jobs created over the past ten years.

But already in May 2020, unemployment in the United States fell to 13.3%, and employers created 2.509 million jobs outside the agricultural sector of the American economy. Unemployment was forecast to rise to 19.8% in May, while the number of jobs fell by another 8.0 million. The data was so unexpected that many economists questioned its reliability and objectivity, given the slow pace of the opening of the economy and the fact that more than 12 million people filed new applications for unemployment benefits during the reporting period. The coronavirus pandemic has hit the American economy and the country's labor market hard, paralyzing activity in many segments of the economy and forcing many companies to announce massive layoffs.

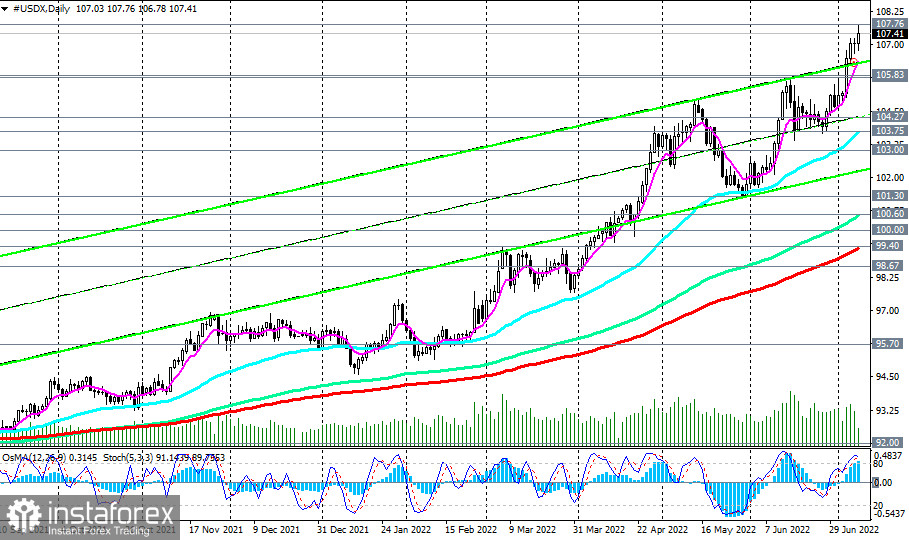

Nevertheless, in the future, the situation in the US labor market began to gradually improve, and since May 2021 (and from the local low of 89.60), the dollar index began to grow again, moving into a stable bullish trend. In addition to improving the situation in the US economy and the labor market, the Fed also played a big role in strengthening the dollar, which in March of this year began a cycle of raising interest rates, and before that it began to curtail quantitative stimulus measures for the economy, reducing the volume of purchases of government bonds.

And last Wednesday, after the release of the minutes from the June Fed meeting, the DXY dollar index (in the MT4 trading terminal the dollar index is reflected as CFD #USDX) broke through 107.00, and so DXY futures reached, as we noted above, a new almost 20- summer high of 107.61, while maintaining the potential for further growth. A breakthrough of Friday's local high at 107.61 and the next round mark at 108.00 would be a signal to increase long positions in DXY futures with the prospect of growth towards multi-year highs of 121.29 and 129.05, reached, respectively, in June 2001 and November 1985.

From a fundamental point of view, so far everything is going exactly according to this scenario (expectations of further strengthening of the dollar), and the main factor here is the Fed's monetary policy, as we noted earlier, the most stringent (at the moment) in comparison with other major world central banks .

According to the minutes of the June FOMC meeting released on Wednesday, the Fed will raise rates by 50 or 75 basis points in July: high inflation justifies "restrictive" interest rates, with the possibility of a "more restrictive stance" if inflation stays at high levels.

But there is an alternative scenario: the official report of the US Department of Labor will be disappointing. In this case, the dollar may sharply, for the time being, fall, and market participants' doubts about the effectiveness of the Fed's actions may grow.

Despite the fact that Fed Chairman Jerome Powell, recently (as part of a speech at the European Central Bank Forum in late June) reiterated that "the economy is strong" and can withstand further tightening of monetary policy, the US central bank still understands the growing inflationary risks, as well as the risks of deterioration of the situation in the labor market and in the country's economy. If the latest report from the US labor market turned out to be blatantly weak, then this may force the Fed leadership to "slow down" in their desire for a sharper increase in interest rates, and in the worst case, put this process on pause.

One can only guess about the reaction of the market to this, and it may turn out to be extremely negative for the dollar: new doubts about the success of the American economy may increase the outflow from American assets and, accordingly, the dollar.

John Williams, a member of the FOMC and the head of the Fed of New York, was set to make an assessment of this release afterwards.