The euro-dollar pair stopped at the threshold of parity. Therefore, the main intrigue of the upcoming week lies in a simple question: will the EUR/USD bears make the last dash to the 1.0000 target or will they fall into a drift, marking the price bottom at the bottom of the 1st figure. The current fundamental background contributes to the further strengthening of the greenback, however, the pace of the pair's decline will largely depend on the key macroeconomic releases of the coming week. Therefore, the option of a corrective rollback also cannot be ruled out, given the "prehistory" of US inflation reports.

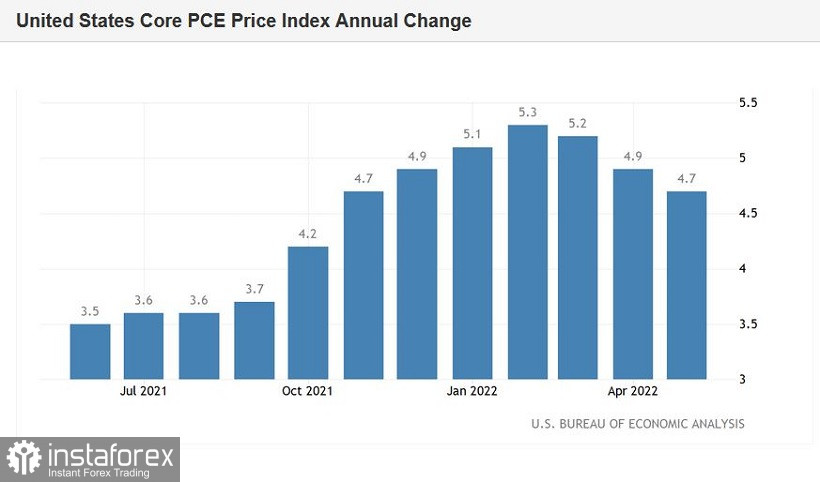

Thus, EUR/USD traders will focus on the release of data on the growth of the consumer price index in the US. This is the most important release, which can either neutralize the fears of dollar bulls about the pace of tightening of the Federal Reserve's monetary policy, or vice versa - confirm concerns about this. Here it is necessary to recall the last two inflationary reports, which left a very ambiguous impression. First of all, we are talking about the basic price index of personal consumption expenditures (PCE). On an annualized basis, this most important inflation indicator for the Fed has been falling for the third consecutive month. The March result turned out to be the peak, after which the indicator began to consistently go down. It is also worth recalling the June consumer confidence index, which is calculated by the University of Michigan. It collapsed to 50 points, while in May it was at 58.4 points.

At the same time, the salary indicator did not disappoint. According to the latest Nonfarm, the growth rate of the average hourly wage rose in June to 5.1% (against the forecast of a decline to 5.0%). This is a very good result, given the fact that over the past six months this indicator has fluctuated in the range of 4.9-5.3%.

Thus, on Wednesday the pendulum will swing in one direction or another. The consumer price index will either strengthen the hawkish mood, further strengthening the dollar's position, or "make confusion", allowing EUR/USD bulls to organize a correction.

According to preliminary forecasts, the total CPI will rise to 1.1% M/M and 8.8% Y/Y. Nearly 9% inflation would set another multi-year record: the last time the general consumer price index was at that level was in January 1982. As for the core index, excluding food and energy prices, the forecasts are no longer so unambiguous. If on a monthly basis the indicator should reach the same level as in June (0.6%), then on an annualized basis, growth is expected to slow down - the indicator should reach 5.8%. In this case, it will be possible to speak of an established trend towards a slowdown in the core CPI (declining dynamics for the third consecutive month).

It should be noted right away that regardless of the "color" of this inflationary release, the probability of a 75-point increase in the Fed's interest rate at the July meeting will not decrease. Here, rather, we are talking about further prospects for tightening monetary policy, or rather about the pace. It is also worth noting that even a disappointing report on the growth of the CPI will not reverse the downward trend for the EUR/USD pair: it can only provoke a large-scale correction. There are no prerequisites for a trend reversal at the moment - on the contrary, the fundamental picture is in favor of a safe dollar. The energy crisis in Europe is getting worse, the cost of gas is rising, as well as the cost of electricity. Plus, the coronavirus, which again reminded of itself in Italy, Germany, France and the UK. The results of the G20 summit also did not lower the degree of heat, on the contrary, Beijing and Washington exchanged rather harsh statements, where the phrase "cold war" appeared. The geopolitical situation remains tense, and this fact keeps the greenback afloat.

Among the main events of the week, one can also highlight: the speech of the head of the Fed of New York, John Williams (Monday), the release of the index of business sentiment in Germany from the ZEW institute (Tuesday), the release of the Fed's economic review by region ("Beige Book") - Wednesday, the US Producer Price Index, Fed member Christopher Waller's speech (Thursday), US Retail Sales Growth, University of Michigan Consumer Sentiment Index, Industrial Production (Friday).

But the key release of the week will still be the release of the US consumer price index. The June figures are capable of provoking increased volatility for the EUR/USD pair - they will either strengthen the downward trend or provoke an upward corrective rollback.

In my opinion, going long on the pair looks risky anyway. Taking into account the existing fundamental background, it is advisable to consider short positions when the next corrective rollback fades. Key downward targets - 1.0150, 1.0100, 1.0050.