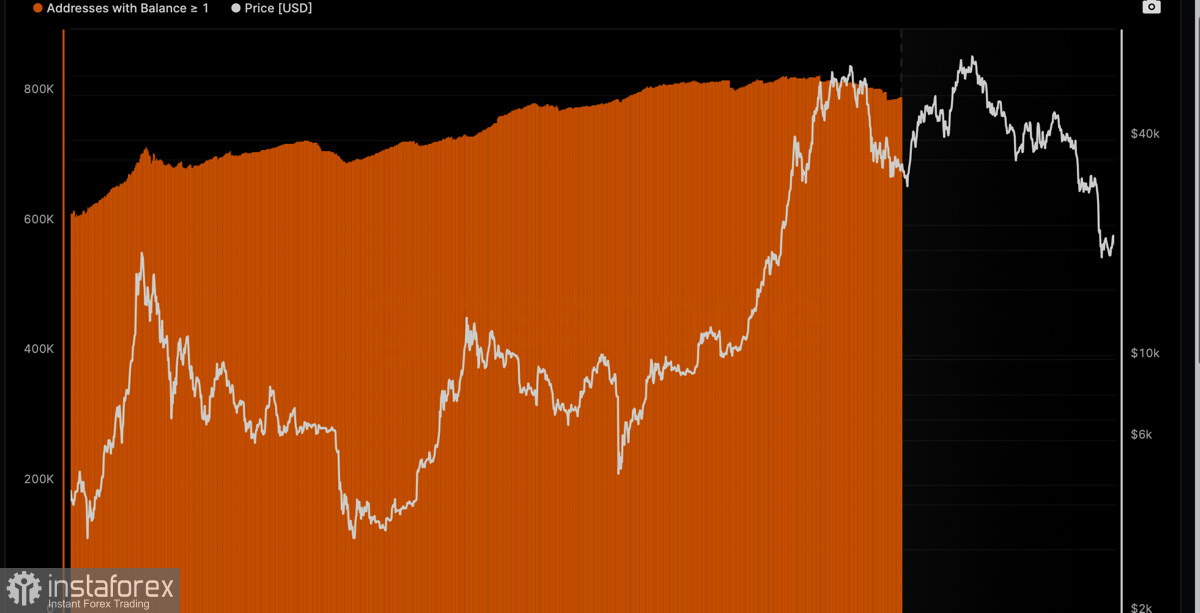

Over the past two weeks, Bitcoin has finally stabilized and began a period of consolidation. Subsequently, market sentiment began to improve, and the cryptocurrency began a smooth upward movement. The asset managed to break through the difficult level of $20.2k, where there was a strong resistance area. BTC trading volumes also showed an upward trend, and the unique address metric showed an increase in users.

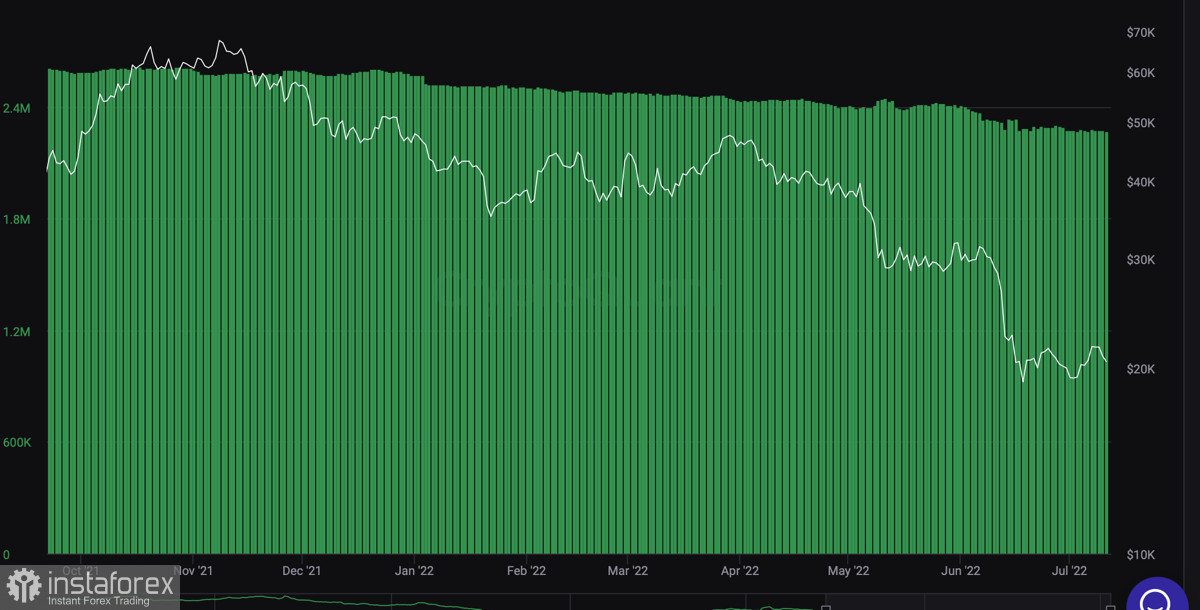

The local upward movement took place under the activation of almost all audiences of investors who are actively withdrawing BTC coins from crypto exchanges. Separately, it is worth highlighting players with wallet balances up to 1 Bitcoin, as well as large wallet owners with 10,000+ Bitcoin coins. Glassnode analysts believe that the current outflow of coins from exchanges can be called a record for the entire time of observation. This is partly due to the huge volumes of cryptocurrencies in free circulation after the mass sell-off in June, but it is also due to the growing appetite of the market.

The activation of buyers and the normalization of the market situation were the reasons for the growth of Bitcoin to the key resistance level of $22.3k. The coin failed to make a bullish breakdown of this area, but BTC tested $22.3k for the first time after falling in mid-June. The retest of the resistance zone occurred with a surge in trading volumes on one of the leading cryptocurrency exchanges. It was this breakthrough that provoked a local increase in interest in Bitcoin due to a significant increase in trading activity.

However, in the end, it turned out to be a manipulation designed to solve a large investor's problems. Despite this, we saw a small wave of liquidations provoked by manipulation. This case should show the market that the audience that can significantly influence market sentiment is gradually becoming more active. However, in the current case, the upward movement of BTC was dictated by a local outbreak of one address and had no long-term plans.

It is also important to note that over the past three months, investor interest in hardware wallets has increased significantly. This was stated by the CEO of Ledger, Pascal Gauthier, and noted that the current bear market differs from the previous ones in the increased attention of users to cold wallets. There is an ambiguous situation where, on the one hand, we see a significant outflow of BTC coins from crypto exchanges, but, on the other hand, these cryptocurrency volumes are transferred to hardware wallets, and in no way affect the price movement. In other words, the current accumulation is a recovery of stocks of long-term hodlers, not preparation for an upward movement.

This is logical given the continuing negative fundamental background around the crypto market. The main triggers for the cryptocurrency market at this stage are the Fed's tough policy and rising inflation. Leading world experts have already stated that the peak of the consumer price growth index has been passed, and the index will go down further. And most likely, this event will become the first important signal for the crypto market. Gradually, we are already seeing a series of green candles on the charts of stock indices. Therefore, we can assume that the global stabilization of the situation is already close.

However, as of July 11, it is not worth expecting a systematic upward movement of Bitcoin. The negative fundamental background remains, and the volume of BTC coins on exchanges remains at a high level, despite the active accumulation. In July, the asset will continue to plow the expanses of the $19k–$22.3k range, testing the upper and lower boundaries of the channel. Taking into account the high share of unpredictability in the market, we can expect a downward exit beyond this range since bears have accumulated more potential than bulls.