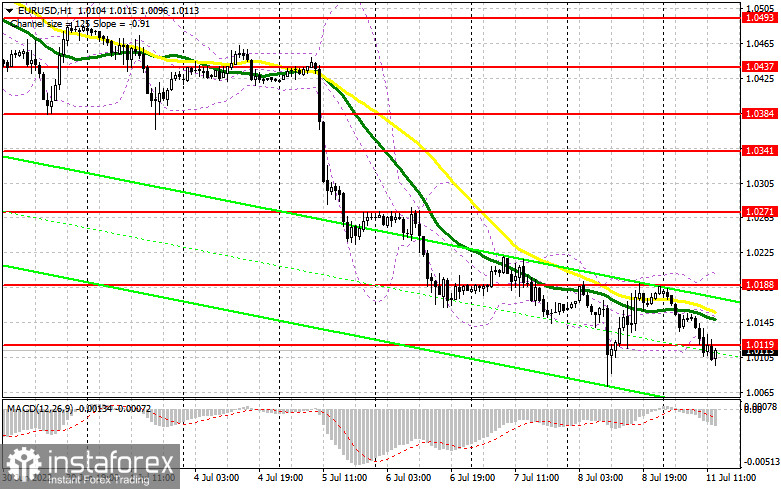

In the morning article, I highlighted the level of 1.0119 and recommended making decisions with this level in focus. Now let's look at the 5-minute chart and try to figure out what actually happened. A drop to 1.0119 was quite expected. However, it did not give a convenient entry point. Trading was constantly carried above and below this level. Apparently, a similar situation may occur in the afternoon due to low volatility and trading volume. The technical outlook has not changed so far.

What is needed to open long positions on EUR/USD

The bulls need to regain control by pushing the pair above 1.0119. If they fail, the euro is likely to drop to a low of 1.0052. For this reason, the main priority of EUR bulls is to defend 1.0052. In the afternoon, there will be no news or events that could lead to a surge in volatility. The Federal Reserve Labor Market Conditions Index and the speech of FOMC member John C. Williams are likely to be ignored by traders. In case of a further decline in EUR/USD, only a false breakout of 1.0052 will provide a good buy signal with the prospect of an upward correction to 1.0119. Only after a breakout and a downward test of this level, there could be a new buy signal. If so, it will erase some of the bears' stop-loss orders, pushing the pair back to the resistance level of 1.0188. Slightly below this level, the moving averages are passing in the bearish territory. The 1.0271 level will be a more distant target. However, there are no fundamental reasons for such a rise now. If EUR/USD decreases and bulls show no activity at 1.0052, which may push the euro to dollar parity, the bulls will lose steam. If so, it is better to stay away from the market. it is recommended to open long positions after a false breakout of the support level of 1.0000. You can buy EUR/USD immediately at a bounce from the 0.9958 level or even a low of 0.9915, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open short positions on EUR/USD

The bears are exerting pressure on the euro thanks to upbeat labor market data. They have already pushed the price to 1.0119. Now, they are aiming at a yearly low of 1.0052. If the euro rises during the American session after weak US data, only a false breakout of 1.0119 will generate an excellent sell signal with the prospect of a further fall to the nearest support level of 1.0052. The breakout and a decrease below this level are likely to occur in the short term. An upward test of this level will give an additional sell signal. It will also lead to a drop in the buyers' stop-loss orders. So, the price may reach a new yearly low of 1.0000. This is a psychologically important level that will be in focus during the first test. Traders are likely to lock in profits at this level. This is a good opportunity to buy the rebound for those who are trying to find the market bottom. Bulls and bears will tussle for this level. If the price dips lower, there could be parity. Besides, if the pair reaches the support level of 0.9958, it will be a rather negative factor. I recommend locking in profits at this level. A more distant target will be the 0.9915 level. If EUR/USD advances during the American session and bears show no energy at 1.0119, it will hardly undermine the bear market. In this case, it is better to cancel short positions until the test of 1.0188. A false breakout of this level will only strengthen the downtrend. It will also build the upper boundary of the medium-term downward channel. You can sell EUR/USD immediately at a bounce from a high of 1.0271 or a high of 1.0341, keeping in mind a downward intraday correction of 30-35 pips.

COT

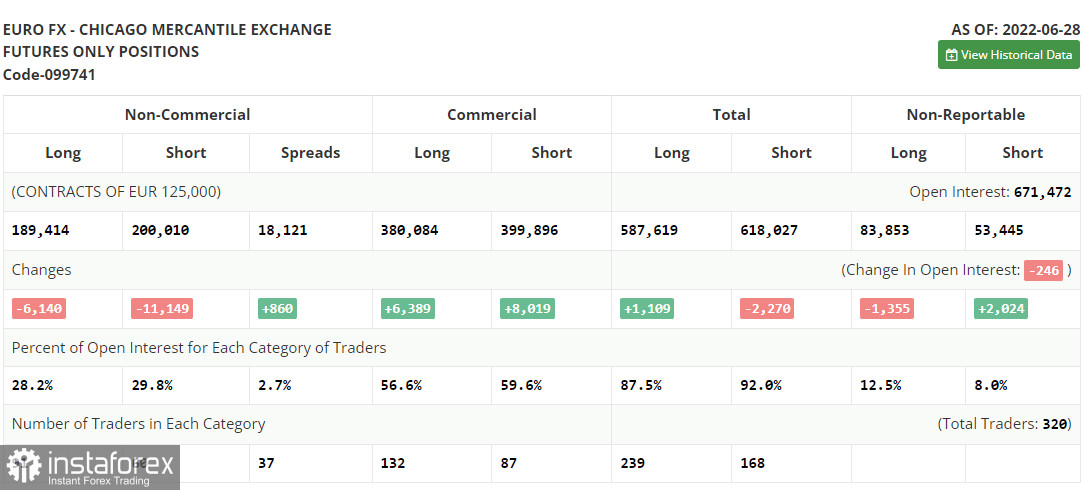

The COT report (Commitment of Traders) for June 28 again logged a drop in both long and short positions but it did lead to an increase in the negative delta. The number of short positions was lower than long ones. Last week, ECB President Christine Lagarde and Fed Chairman Jerome Powell made speeches. They stressed the need to tighten monetary policy to combat the highest inflation on record. This month, the ECB intends to start raising interest rates which should limit the upward potential of the US dollar against the euro. Eurozone inflation data released last week showed the regulator that they should urgently hike the key rate. However, given the headwinds in the global economy, demand for safe-haven assets is buoyant. Analysts are betting on the parity in the EUR/USD pair. The COT report revealed that the number of long non-commercial positions decreased by 6,140, to the level of 189,414, while the number of short non-commercial positions tumbled by 11,149 to the level of 200,010. The US dollar approaches new highs amid the low exchange rate of the euro, the need for further aggressive tightening by major central banks, and the recession in many developed countries. At the end of the week, the total non-commercial net position remained negative and amounted to -10,596 against -15,605. The weekly closing price dropped to 1.0584 against 1.0598.

Signals of technical indicators

Moving averages

EUR/USD is trading below 30- and 50-period moving averages. It means that the euro continues to decline.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the upper limit of 1.0188 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.