US stock futures fell along with European stocks on Monday. This came as traders await the key second-quarter earnings season. They want to see how companies cope with inflation.

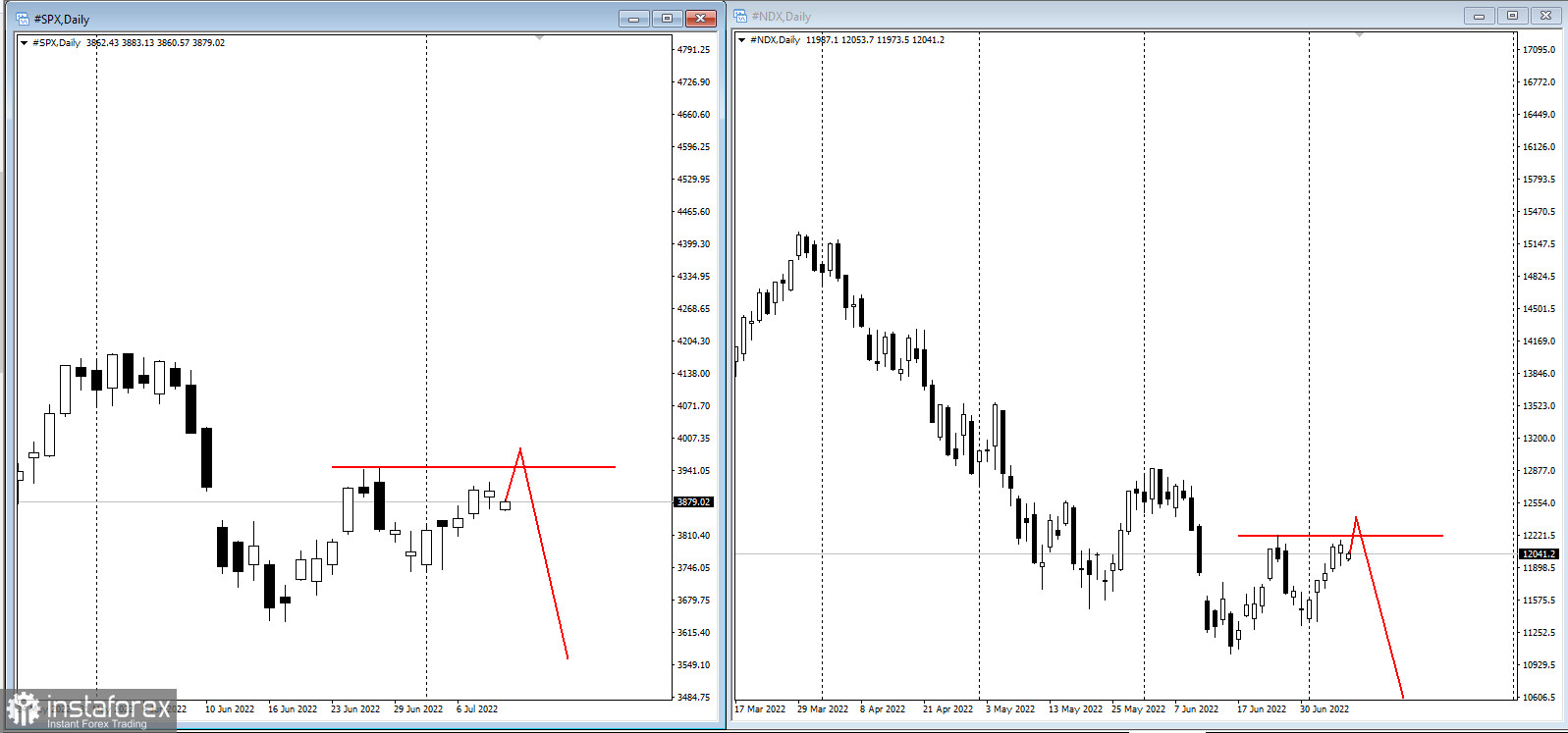

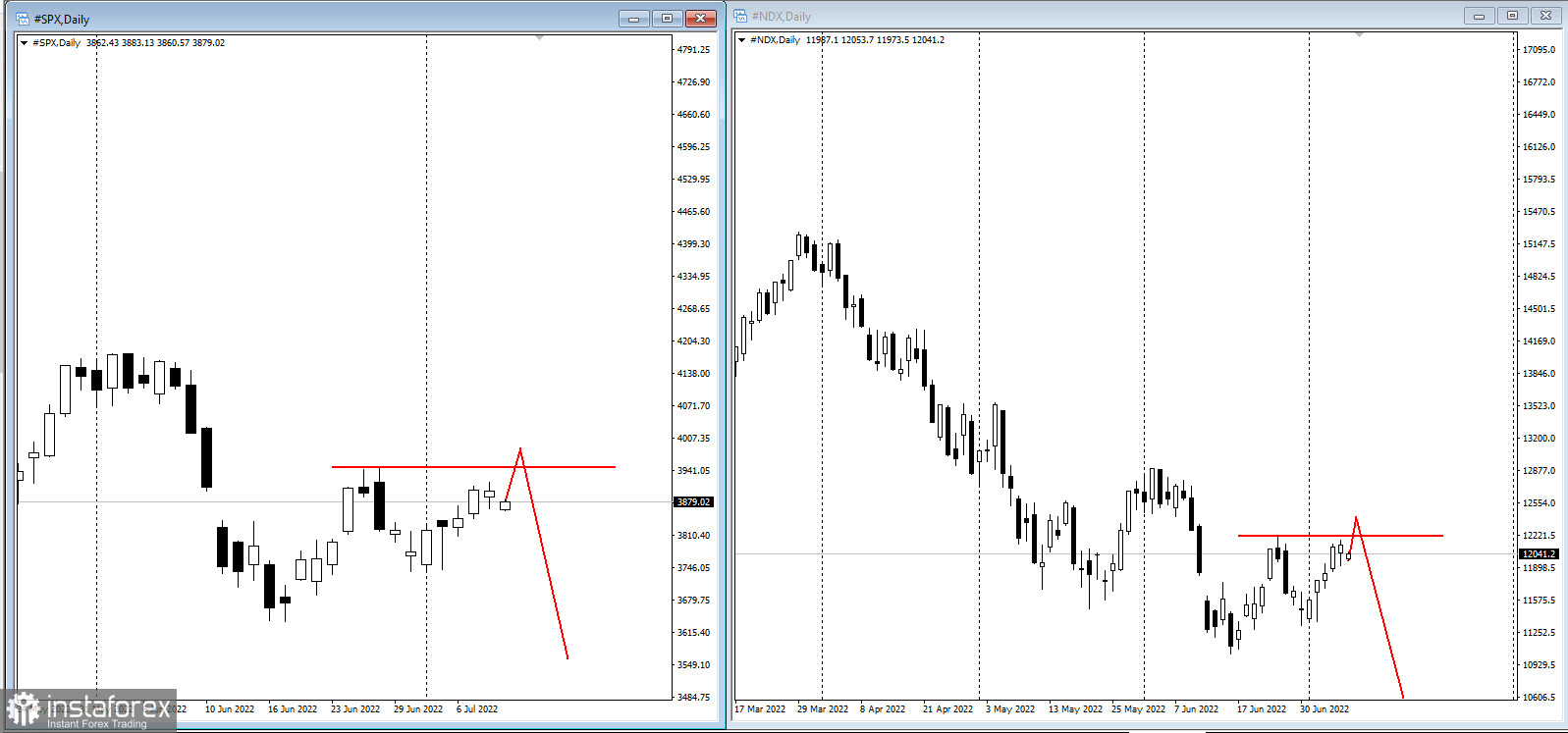

Contracts on the S&P 500 and Nasdaq 100 were lower on Monday. This suggests that last week's rally in US stocks has come to a halt. Shares of Twitter fell in premarket trading after Elon Musk announced that he would abandon his $44 billion offer to buy the social media company.

The Euro Stoxx50 index lost around 0.5%, with automakers and mining companies among the worst performing sectors, as fears of a renewed Covid in China also weighed on risk appetite.

Yields on US Treasuries and European bonds fell.

Price pressures, tighter monetary policy and a slowing global economy continue to put pressure on markets. The US inflation rate is expected to approach 9% by the end of the week, a new high in four decades. This is an indication for the Fed to continue hiking the rate in July. The company's profits will illuminate recession fears that led to an $18 trillion drop in global equities in the first half of the year.

"The real earnings hit will come in the second half as we're hearing from companies, especially retailers, saying they're already seeing weakness from consumers," Ellen Lee, portfolio manager at Causeway Capital Management LLC, saidShanghai reported it had found its first case of the more contagious BA.5 sub-strain of the Omicron strain on Sunday and warned of "very high" risks. This has raised concerns about new quarantine measures, given that China remains committed to eliminating the disease

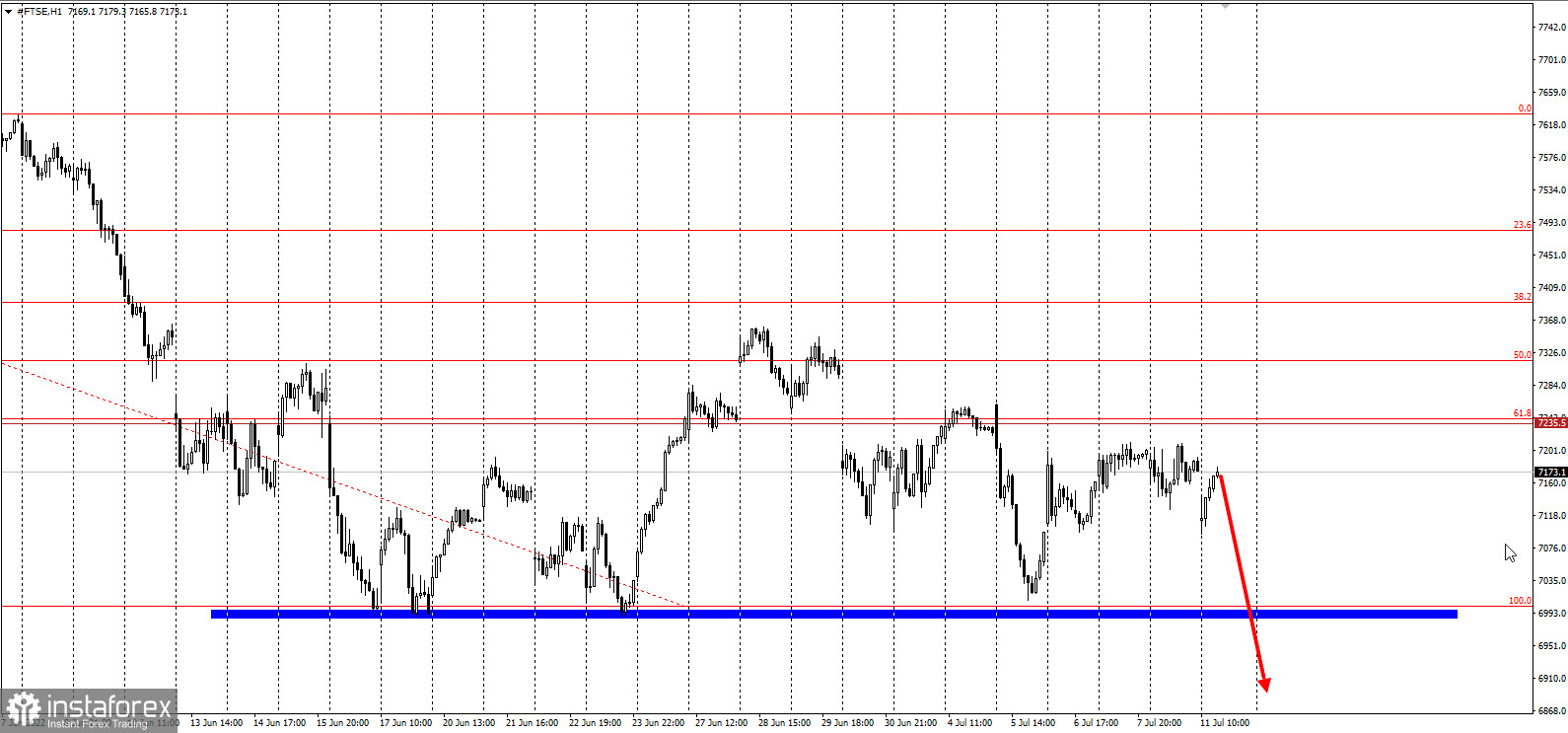

FTSE100 dropped as the fight for the UK prime minister's position heats up.

The flow of natural gas from Russia to Germany via a crucial undersea pipeline stopped on Monday for a 10-day scheduled maintenance period. European countries expect President Vladimir Putin to seize the opportunity to permanently cut off flows because of Western support of Ukraine.

What to watch this week:- Earnings reports from JPMorgan, Morgan Stanley, Citigroup, Wells Fargo

- New York Fed President John Williams speaks on the Libor rate, Monday

- Speeches by Bank of England governor Andrew Bailey, Monday and Tuesday

- South Korea and New Zealand rate decisions, Wednesday

- Federal Reserve Beige Book, Wednesday

- China trade, Wednesday

- US consumer price index, jobless claims, Thursday

- China GDP, key economic data, Friday

- G-20 finance ministers and central bank governors meet in Bali, Friday

- Speech by Atlanta Fed President Rafael Bostic, Friday