Analysis of Monday's deals:

30M chart of the GBP/USD pair

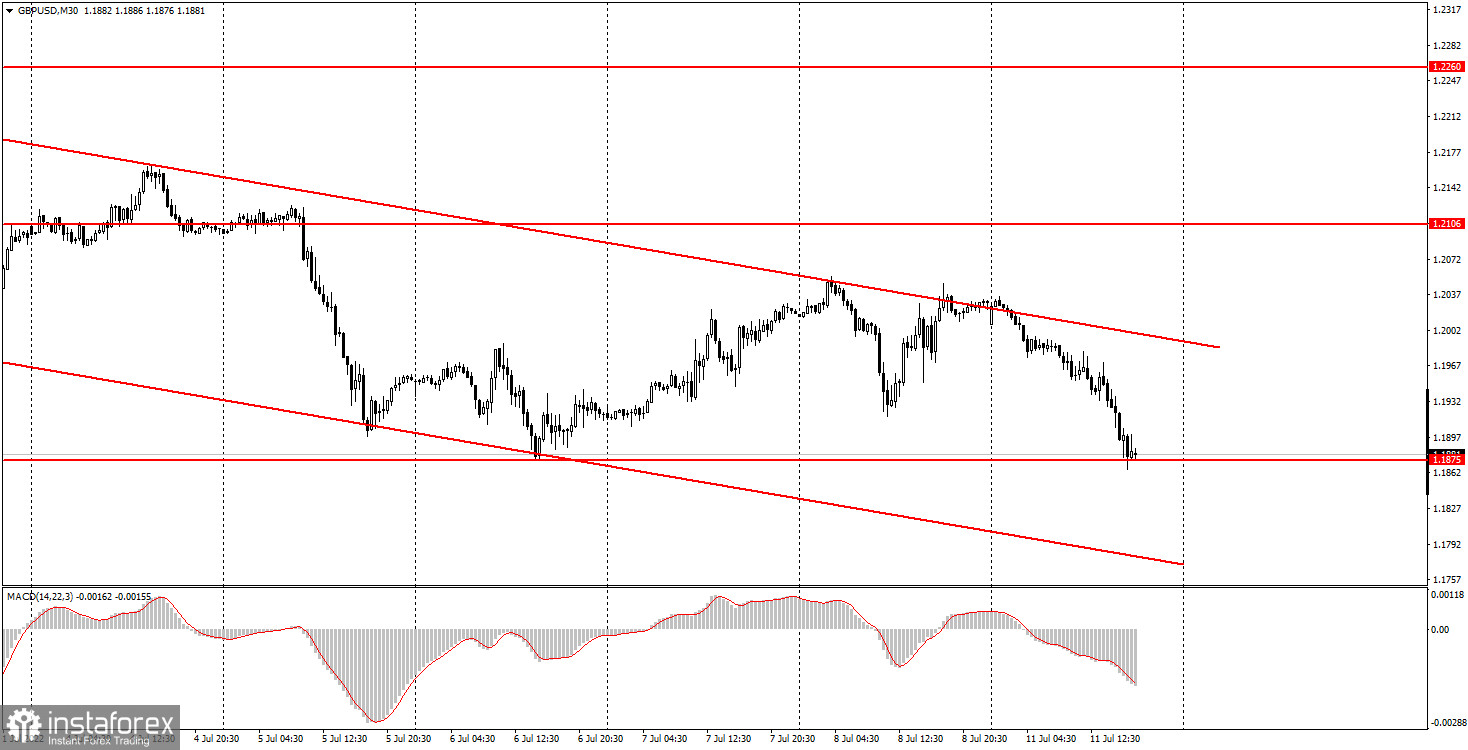

The GBP/USD pair also resumed its downward movement within the descending channel on Monday, which has long been signaling a downward trend. By the end of the day, the pair fell to the level of 1.1875, which is the last local low, and at the same time a 2-year low. At the moment, the price has not been able to overcome it, but this does not mean that the downward march is over. The British currency fell by 130 points despite the fact that there were no macroeconomic reports and no fundamental events during the day. The pound has been falling all day, including even at night, when the currency market is usually flat. Consequently, the British currency may continue to fall throughout the current week. The fears are only that the pair cannot constantly move in only one direction. And the euro and the pound are now in big trouble even just to correct. Therefore, we recommend focusing on the descending channel and considering long positions only after the price settles above it. And in the euro's case, you can also focus on leaving the channel, since both pairs have been moving in the same way for several months.

5M chart of the GBP/USD pair

Monday's move was almost perfect on the 5-minute timeframe. Firstly, the price moved only in one direction all day and there were practically no corrections. Secondly, an unambiguous sell signal was formed at the very beginning of the European trading session, which had to be worked out. Thirdly, the movement was trendy and volatile, which is also very good. As a result, novice traders had to open a short position. Further, by the middle of the US session, the price dropped to the area of 1.1875-1.1898, where it got stuck without even forming a new buy signal. By evening, the pair still remained in this range, where short positions should have been closed. It turns out that only one signal was formed, only one trade was opened, and it made a profit of 80 points. An almost perfect trading day.

How to trade on Tuesday:

The pair failed to leave the descending channel on the 30-minute TF and, having rebounded from its upper border, resumed its downward movement. Our fears about the exit of the price through the upper border of the channel did not come true. Now we only have to overcome the level of 1.1875 and the pound will rush further down. Macroeconomic and fundamental backgrounds do not support the pound, and besides, even on those days when they are absent, the British currency also falls. On the 5-minute TF on Tuesday, it is recommended to trade at the levels 1.1875-1.1898, 1.1989, 1.2048, 1.2106. When the price passes after opening a deal in the right direction for 20 points, Stop Loss should be set to breakeven. No macro releases are scheduled in the UK and US on Tuesday, but Bank of England Governor Andrew Bailey will make a speech in the evening. But in any case, the speech will be in the evening, so there will be nothing for traders to react to during the day. Both major pairs still continue to trade volatilely, so there will most likely be movements on Tuesday as well.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.