Currently, bitcoin is attempting to resume its decline. In theory, the movement of the last six months does not fit the definition of a "collapse," but the cryptocurrency has lost approximately 60% of its value in just six months. The euro or US stock indices are not available for such a movement. Therefore, we believe that the "bearish" trend is intact, as indicated by the clear downward trend line. All factors that harm risky currencies and US stock indices directly affect the cryptocurrency market. Remember that cryptocurrencies are the most speculative asset class, so they fall first. However, in addition to the terrifying foundation and geopolitics, additional factors may contribute to the decline of Bitcoin.

Yesterday, Fed Vice Chairman Lael Brainard stated that the most recent collapse of the cryptocurrency market demonstrates unequivocally that the sector requires stricter government oversight. Remember that this concept emerged in the United States the previous year and the year before. The purpose of stricter regulation of cryptocurrencies is to safeguard the interests of investors. It is difficult to comprehend precisely how investors will be better protected, given that, for instance, the stock market is currently experiencing a steep decline, but no one is calling for stricter regulation. And in the case of cryptocurrencies, everyone knows that the market can, almost without exception, move in various directions. However, if additional regulatory measures are implemented, the demand for bitcoin and its "siblings" will decrease even further. Consider that the primary benefit of cryptocurrencies is their anonymity and independence from central banks and governments.

Simultaneously, Bloomberg surveyed investors and discovered that more than half anticipate bitcoin's price to fall to $ 10,000 and that only 40% believe bitcoin will recover to $ 30,000 in the near future. NFTs exploded in popularity last year and were also met with extreme skepticism. Only nine percent of investors surveyed consider NFT a worthwhile investment opportunity. 91 percent of respondents believe that these are merely status symbols. Even among investors, that is, people who invest their money, specifically in bitcoin, skepticism and "bearish" sentiments are prevalent. In such a scenario, it is improbable that the world's first cryptocurrency will experience a rapid increase in value.

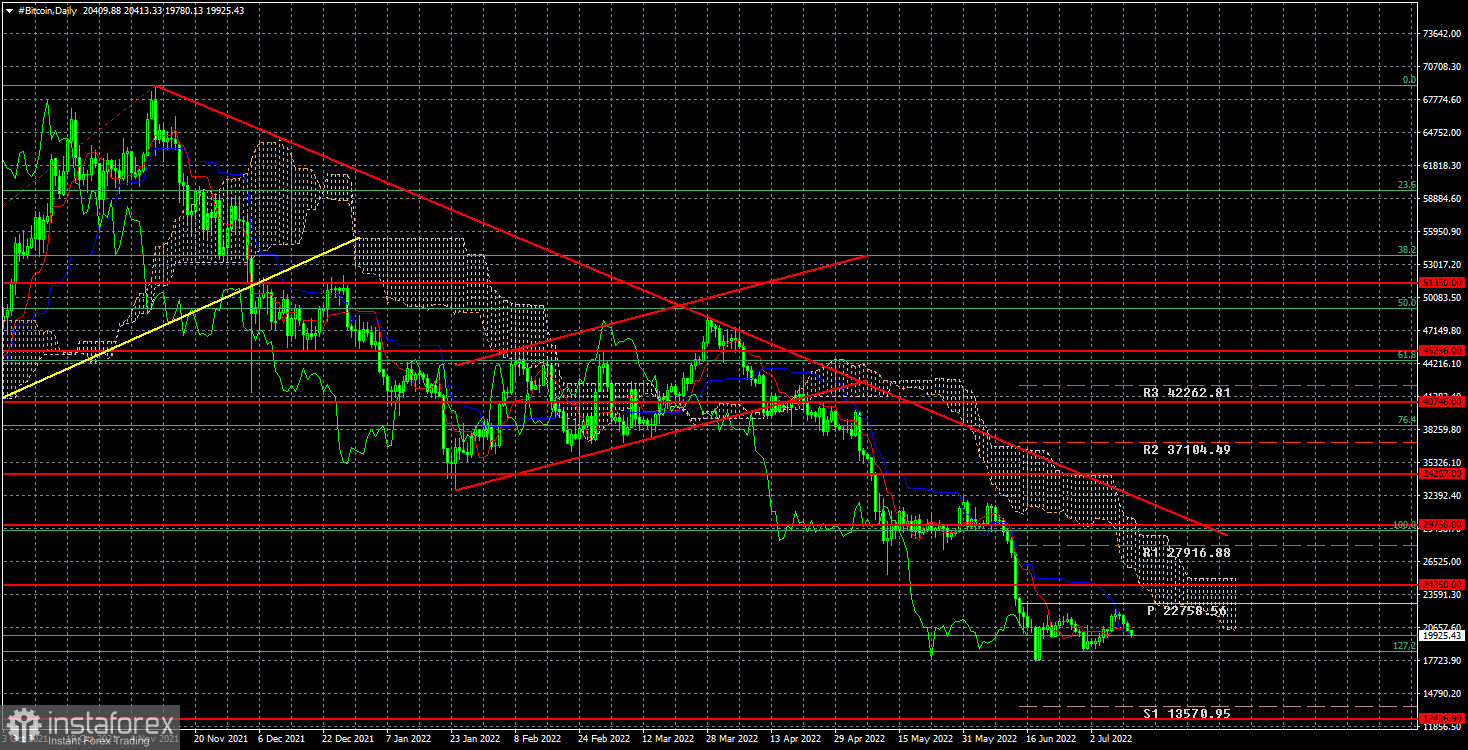

On a 24-hour timescale, "bitcoin" prices were fixed below the $ 24,350 threshold. Consequently, the target itself is now $ 12,426. "Bitcoin" has twice attempted to surpass $ 18,500 (127.2% Fibonacci) and is now attempting to do so for the third time. Bitcoin can now theoretically fall to any value, including zero. This is improbable, but we believe the rate of 5,000 to 10,000 dollars per coin will become a reality in 2022. The breaking of the $ 18,500 threshold will signal a new buying opportunity.