Risk appetite will continue to fall given the sharp slowdown in global economic growth, high inflation, and sharp increases in interest rates. Meanwhile, demand for dollar will rise, at least until US inflation becomes manageable because only by that will the Fed maintain its current pace of monetary tightening and removal of excess liquidity.

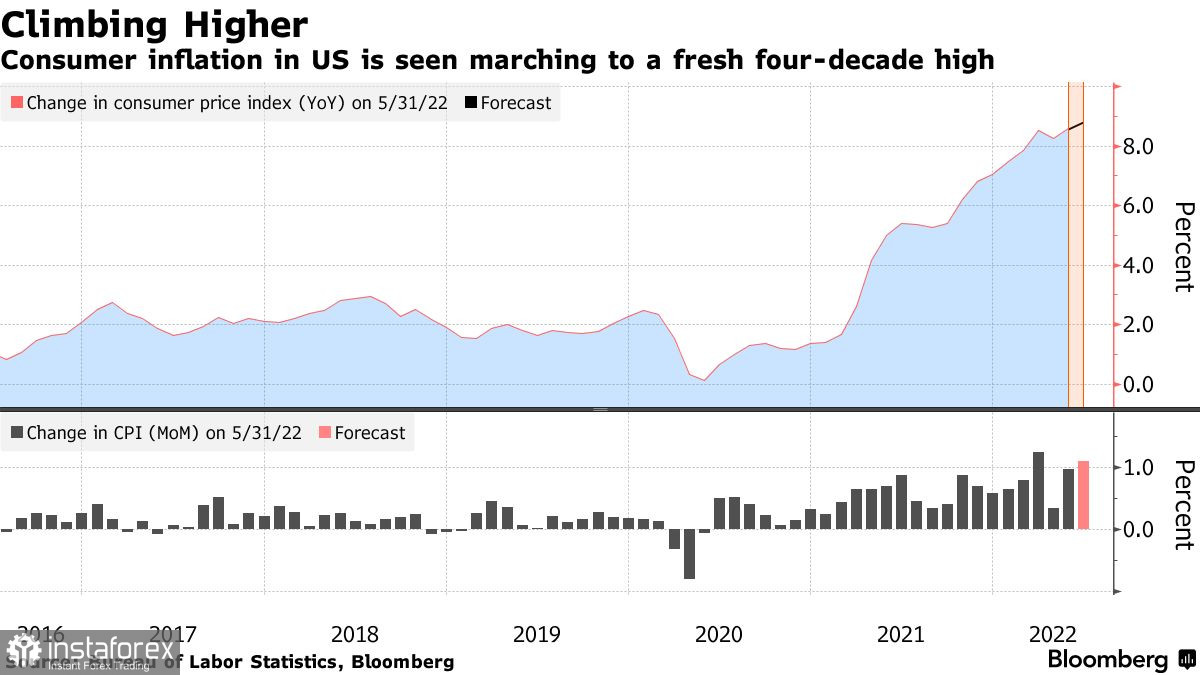

As noted above, data on US inflation will influence the Fed's decision on raising rates. So far, many expect to see another 0.75% rate hike at the end of this month because CPI is likely to show an increase of almost 9% year-over-year and a 1.1% rise month-over-month. Some economists, however, said that price pressures are stabilizing as commodity prices decline.

Another factor that stimulates inflation is the US labor market. Friday's data showed that the growth in the number of jobs remained at a fairly high level, while unemployment itself remained at lows. This kept wage growth strong, spurring retail sales and inflation. The continued rise in gasoline prices is also likely to push the June CPI to a new high.

All this indicates the further strengthening of the dollar, leaving traders no chance for a correction. And apparently, before the release of the US inflation report, the situation is unlikely to improve, so EUR/USD will fall below 1.0000, while GBP/USD will dip to yearly lows.

In EUR/USD, there is no more need to talk about purchases and attempts of traders to correct the situation. Only a return to 1.0050 will halt the developing bearish scenario. In that case, the pair will rise to 1.0110 and 1.0180, but it will not be enough to shift the market into bullish. With regards to a further decline, it is very important for buyers to become active around 1.0000, otherwise the pressure on the pair will increase. Falling below the said level will push euro down to 0.9950 and 0.9915.

Similarly, there is no more need to talk about correction in GBP/USD. Only a consolidation above 1.1920 will push the pound to 1.1980, where buyers will face much more difficulties. In the case of a larger upward movement, the pair could reach 1.2030. But if sellers push pound below 1.1870, the price will fall straight to 1.1820, and then to 1.1750.