Oil prices continue to decline as Covid-19 infections surged in China. The IEA warns that the worst of the energy crisis could be ahead.

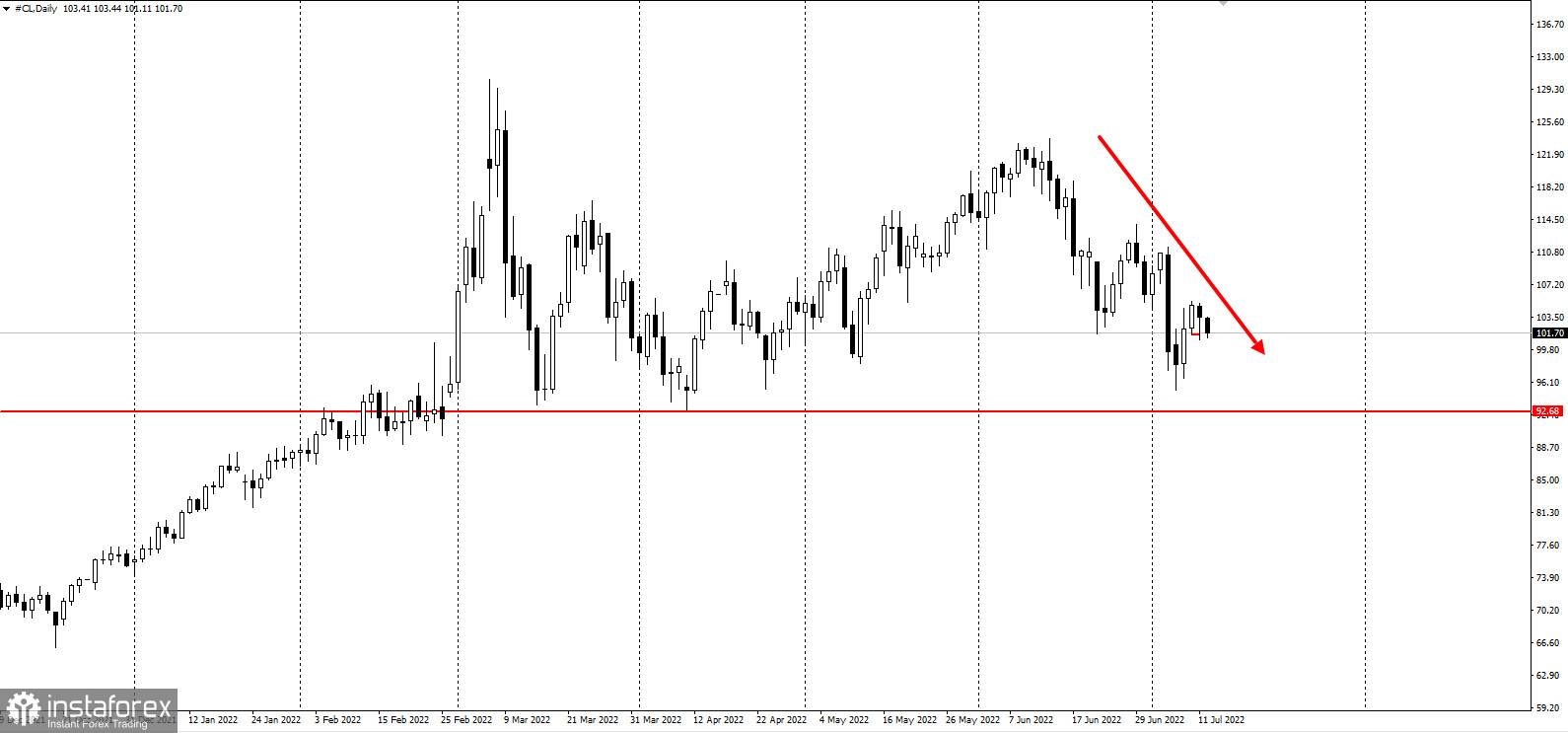

WTI lost nearly 2%, trading around $102 a barrel. Bearish sentiment has obviously seeped into commodities as coronavirus cases increased in China and looming US inflation are fueling concerns over the demand outlook. The continued growth of dollar added pressure, making oil less attractive to investors.

Crude oil has also fallen since early June amid growing fears that the US could slide into recession as central banks aggressively raise rates to fight inflation. IEA Executive Director Fatih Birol said countries are experiencing the first global energy crisis and perhaps, the worst is yet to come.

"Recession fears remain a dominant theme in the oil complex," said Vandana Hari, founder of Vanda Insights. She mentioned that the market is facing the challenge of balancing changing demand expectations and supply prospects in what is likely to be an unstable process.

US President Joe Biden plans to visit Saudi Arabia this week in an attempt to curb high energy prices that have roiled the global economy. The US believes that OPEC has room to increase production, and Biden's visit could lead to some kind of a deal.

Going back to China, around 30 million people are under some form of travel restrictions as more cities and counties seek to quell resurgent Covid-19 outbreaks. China reported 347 new cases on Monday.