Today, the Labor Department will release its latest report on headline inflation. Headline inflation differs from core inflation in that it includes food and energy costs. Food, energy, and housing costs have greatly impacted the day-to-day lives of lower- and middle-class citizens globally.

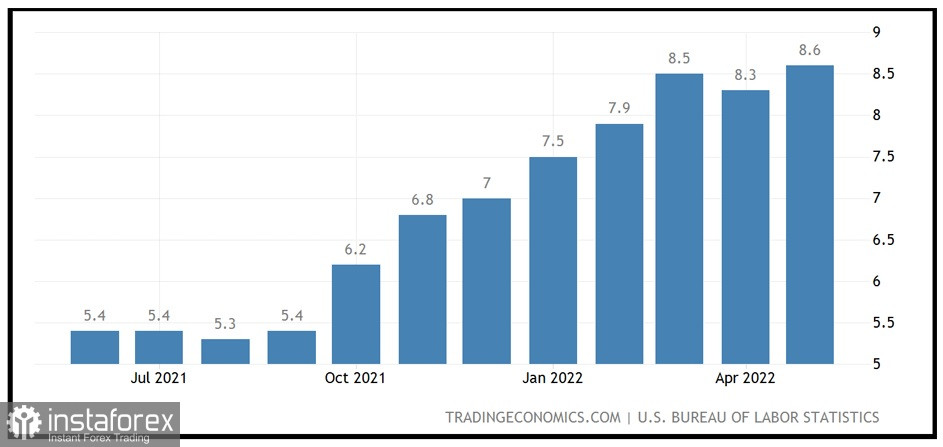

The advanced forecasts released emphasize that inflation will continue to run exceedingly hot. Headline inflation, which includes changes in the cost of food and energy, is expected to rise by 1.4% compared to the previous month and to an annualized rate of 8.7%.

The advanced forecasts released emphasize that inflation will continue to run exceedingly hot. Headline inflation, which includes changes in the cost of food and energy, is expected to rise by 1.4% compared to the previous month and to an annualized rate of 8.7%.

The Federal Reserve, and central banks globally, have begun to raise interest rates in an attempt to reduce the spiraling level of inflation. However, it is acknowledged by the Federal Reserve that regardless of how aggressive central banks tighten their monetary policy by raising interest rates and limiting the money supply it will not in any way shape, or form stop headline inflation from becoming persistent.For too long the United States administration has been looking to the Federal Reserve to be the only component pressured to address inflation.Moreover, governments worldwide are aware of the fact that raising interest rates will contract the demand for nonessential goods and services. It does not address reducing the cost of day-to-day necessities such as food and energy.The spiraling level of headline inflation began from pent-up demand as the pandemic ended its most severe stage on global citizens. By June 2021, the consumer price index was already above 5%. Supply chain bottlenecks that resulted from the pent-up demand of global citizens moved inflation to 7.5% in January. As those supply chain issues began to unwind in February, Russia attacked Ukraine. The Russian-Ukraine conflict has had a dramatic impact on global inflation. It choked the supply of agricultural exports by those two countries and fertilizer from Russia raising the cost of food globally. However, it is the world's addiction to Russian oil and Russian fertilizer that had a profound impact on food and energy costsThe Russian invasion of Ukraine substantially elevated the risk of disruptions in the global fertilizer and oil exports from Russia. This conflict has had a huge impact on the price of oil. As Russia is the second-largest exporter of oil it has led to the cost of crude oil moving above $100 per barrel. Russia is also the world's largest exporter of fertilizer. They account for 23% of the ammonia exports 14% of the urea exports, 10% of process phosphates, and 21% of potential exports. This is according to data from the fertilizer Institute.The high cost of oil and fertilizer has had the greatest impact on the production of food globally. The largest spikes in headline inflation have been food and energy costs. Therefore, it is important to admit that to bring inflation to acceptable levels we need to address the Russia-Ukraine war and realize that without resolving this conflict it is impossible to reduce inflation to an acceptable level.