EUR/USD

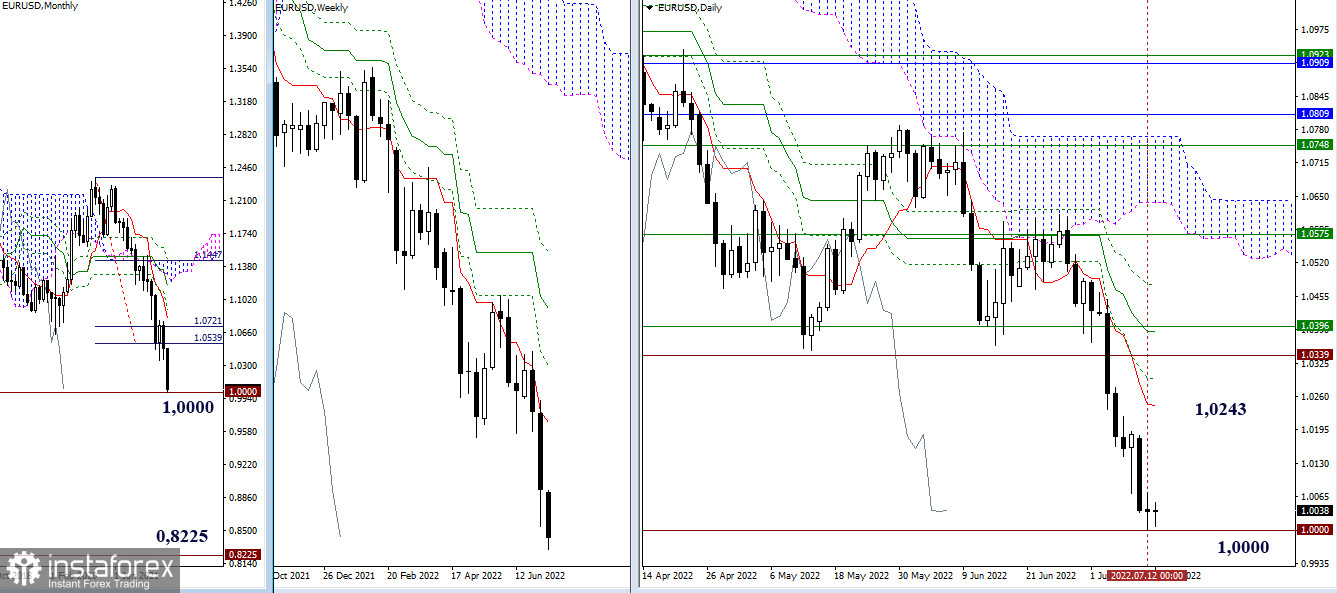

Higher timeframes

During testing, the level of 1.0000 appeared on the daily timeframe, the result of the interaction is being formed. Bulls are still interested in slowing down with a transition to consolidation or rebound. Having realized this, they will be able to count on the further development and strengthening of their moods. The resistances of the higher timeframes are now still located quite far from the price chart and are of little relevance so far. The nearest resistance is the daily short-term trend at 1.0243. The breakdown of the met support at 1.0000 will open opportunities for bears to move to the next benchmark—the local low of 2000 (0.8225).

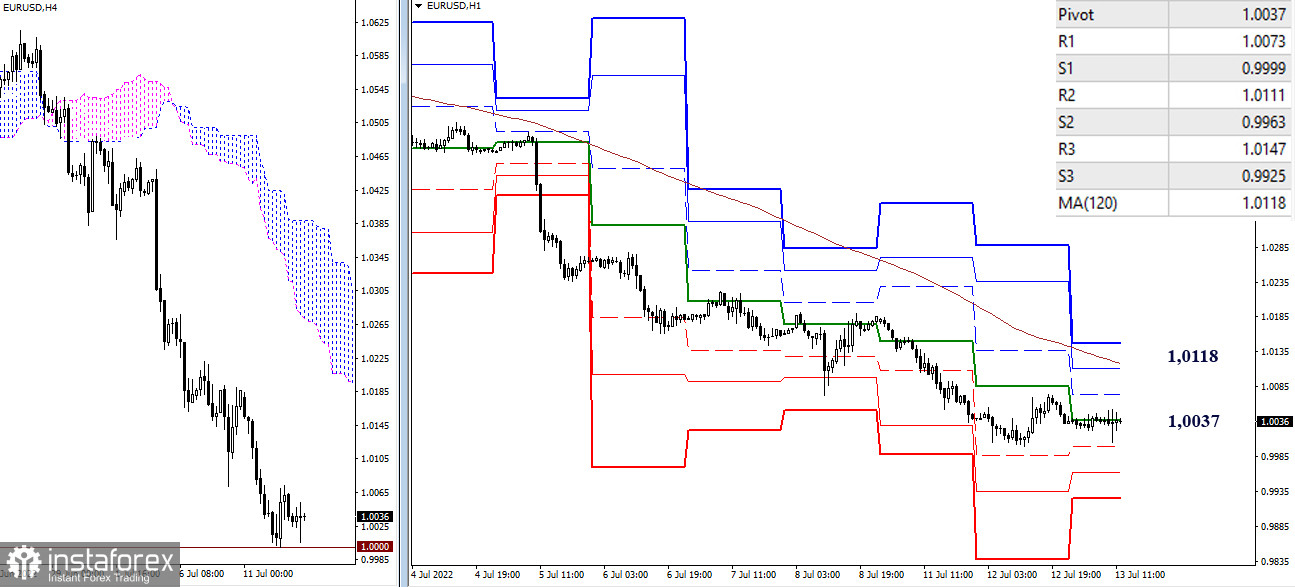

H4 – H1

On the lower timeframes, the pair is in the upward correction zone, now trying to overcome the attraction and resistance of the central pivot point of the day (1.0037). With the development of the correction, the resistance of the weekly long-term trend (1.0118) will be of primary importance since this level is responsible for the current balance of power in the lower timeframes. In case of exit from the correction zone and continuation of the decline, the support of the classic pivot points (0.9999 – 0.9963 – 0.9925) will serve as reference points within the day.

***

GBP/USD

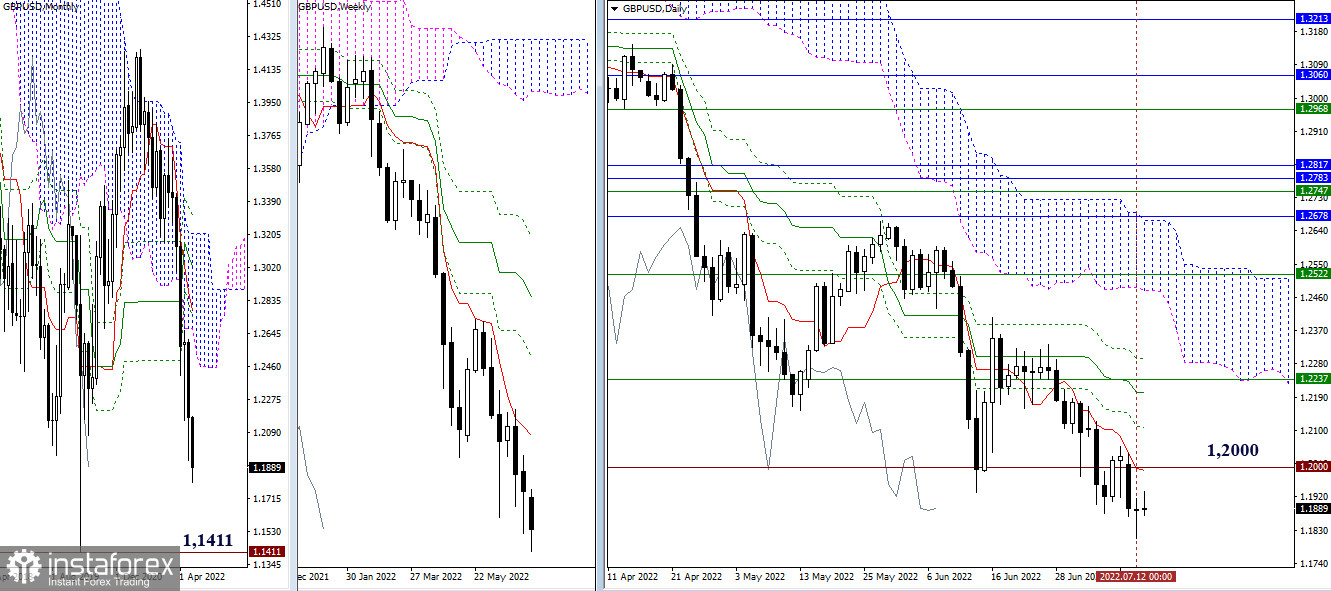

Higher timeframes

The pair continued to decline yesterday, but the final nature of the daily candle has the prerequisites for slowing down and the emergence of a correction. It is important for bulls in the current situation to rise and gain a foothold above the 1.2000 mark. Having seized the daily short-term trend (1.1992), the bulls will be able to count on the continuation of the rise to new benchmarks, while their most important task, in this case, will be the elimination of the daily death cross (its final levels today are 1.2203 – 1.2295) and gaining support for the weekly short-term trend, which is now at 1.2237. The continuation of bearish activity in the current environment is still focused on the support area of 1.1411 (the local low of 2020).

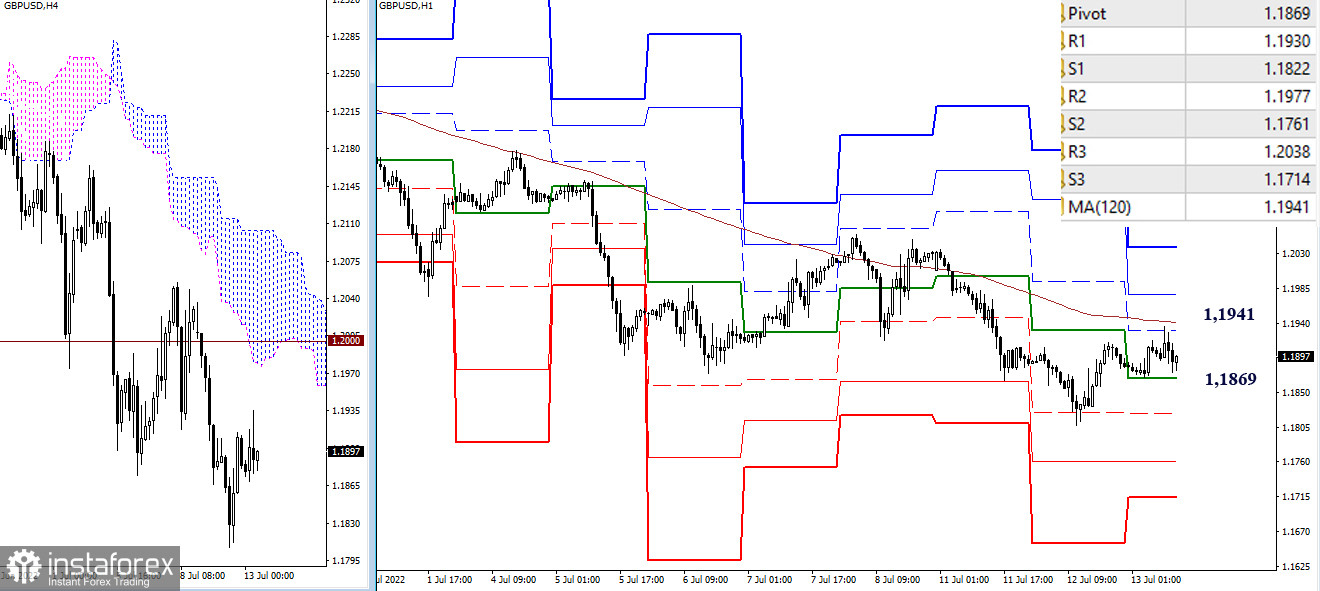

H4 – H1

The slowdown led to the development of a correction in the lower timeframes. Bulls have taken over the central pivot point of the day and are now using it as support (1.1869). Further, the conquest and reversal of the weekly long-term trend (1.1941) is important. The classic pivot points R2 (1.1977) and R3 (1.2038) can serve as additional upward reference points today. The return of bearish sentiment within the day will bring back the relevance of the support of the classic pivot points (1.1822 – 1.1761 – 1.1714).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)