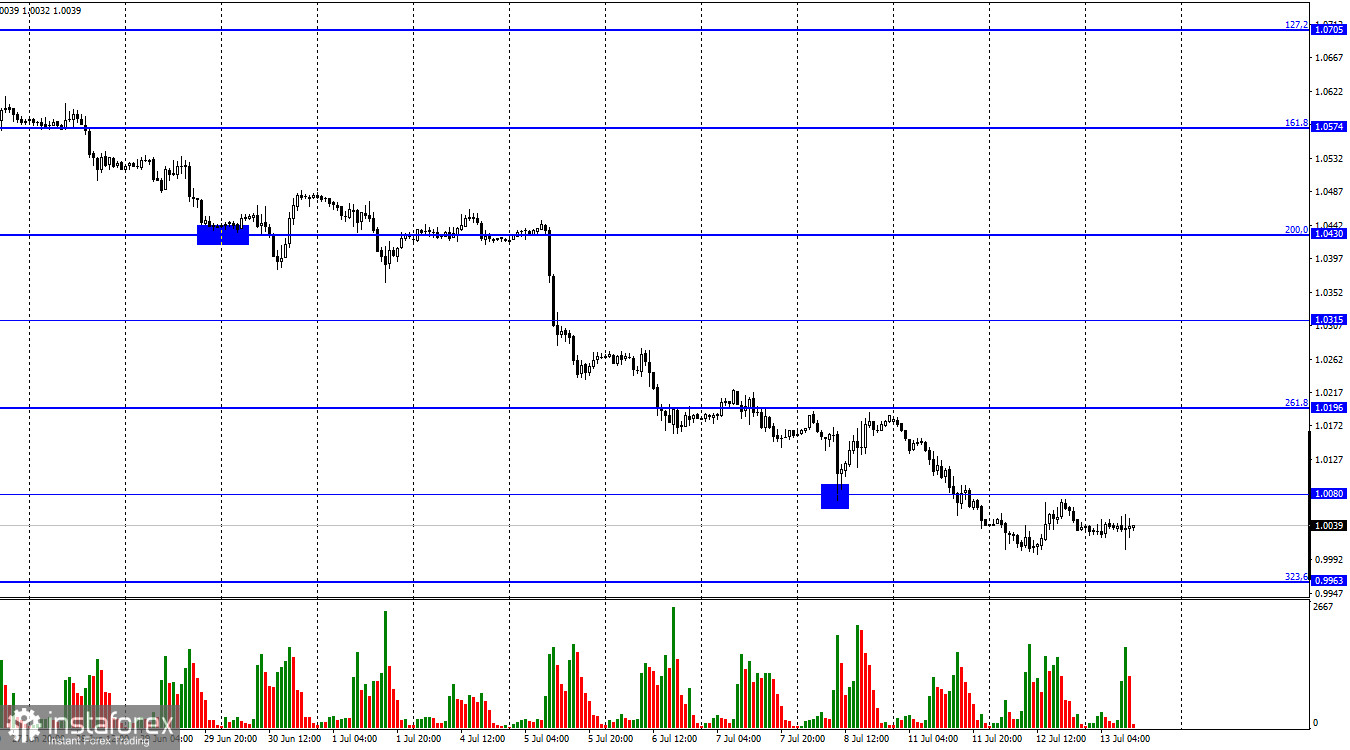

The EUR/USD pair continues to decline after consolidating below the level of 1.0080 in the direction of the corrective level of 323.6% (0.9963). The first two days of the new week demonstrated that bear traders continue to aggressively sell the European currency, which has led to a decline to the significant level of 1.0000. Now that more than a day has passed since yesterday's testing, and the euro currency has not even been able to rise to the nearest level of 1.0080, traders will attempt to gain a foothold below this level. During the first two days of the week, there was no informational context. There was not a single event that would influence the sentiment of traders. But why are these events necessary if traders already know what to do? Today, for instance, an important inflation report for the United States will be published. In normal circumstances, I would wager on it, as it determines the pair's dynamics in the coming days or weeks.

The Fed's monetary policy is currently dependent on US inflation, while the dollar exchange rate is dependent on the Fed's PEPP. However, under the current circumstances, this report has lost nearly all of its value. Traders will react to virtually any inflation value released today, but even if the European currency appreciates in response to this report, will anyone conclude that its decline has ended? Consequently, I believe the European currency will continue to fall. If not today, tomorrow will do. If not tomorrow, then the following week. The Federal Reserve has nearly finalized the decision that will be made at the end of the month. The ECB may also increase the interest rate at the end of the month, but it will be the first increase in a long time, and the increase will be only 0.25%. It is unlikely that such information will be sufficient to prevent the euro from falling into the abyss.

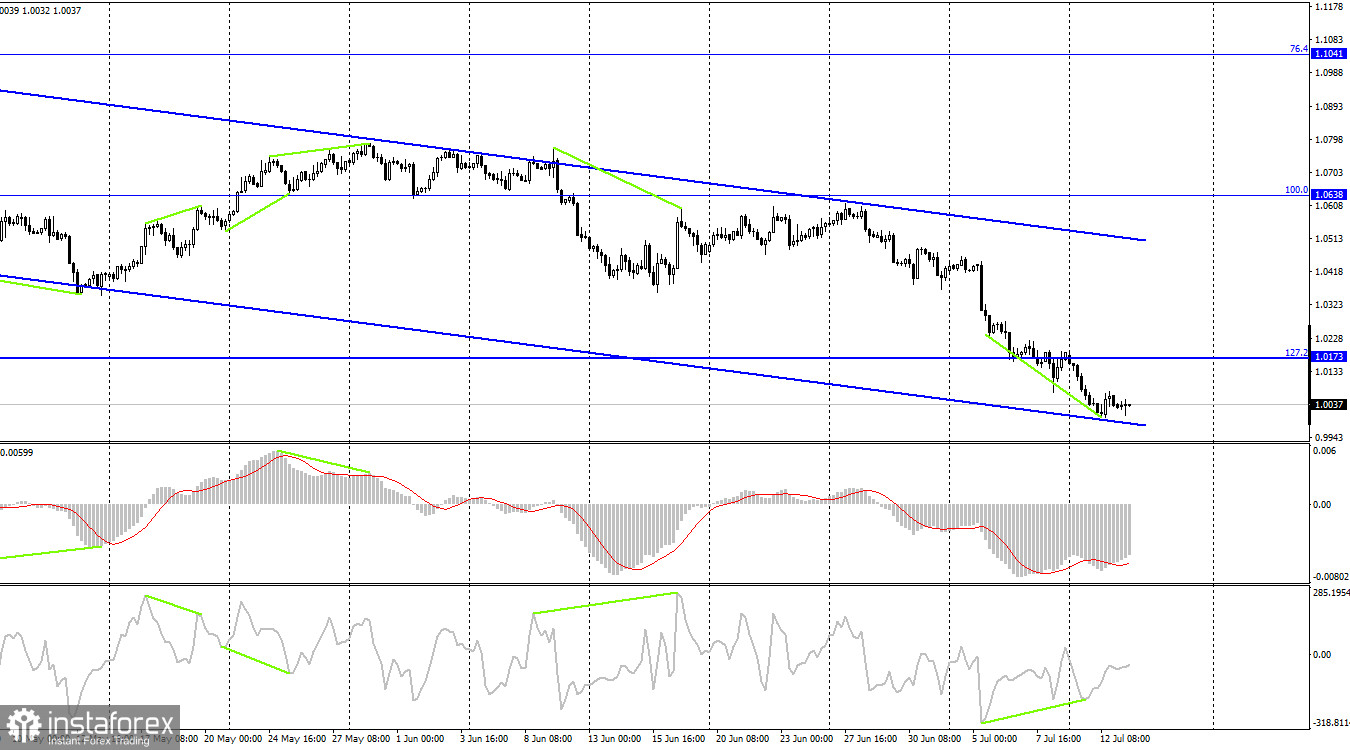

On the 4-hour chart, the pair has positioned itself below the corrective level of 127.2% (1.0173). Consequently, the decline in prices can continue in the direction of the subsequent corrective level of 161.8 percent, or 0.9581. The downward trend corridor continues to characterize "bearish" sentiment among traders. Both indicators exhibited "bullish" divergences, which had no effect on traders' sentiment as of this moment.

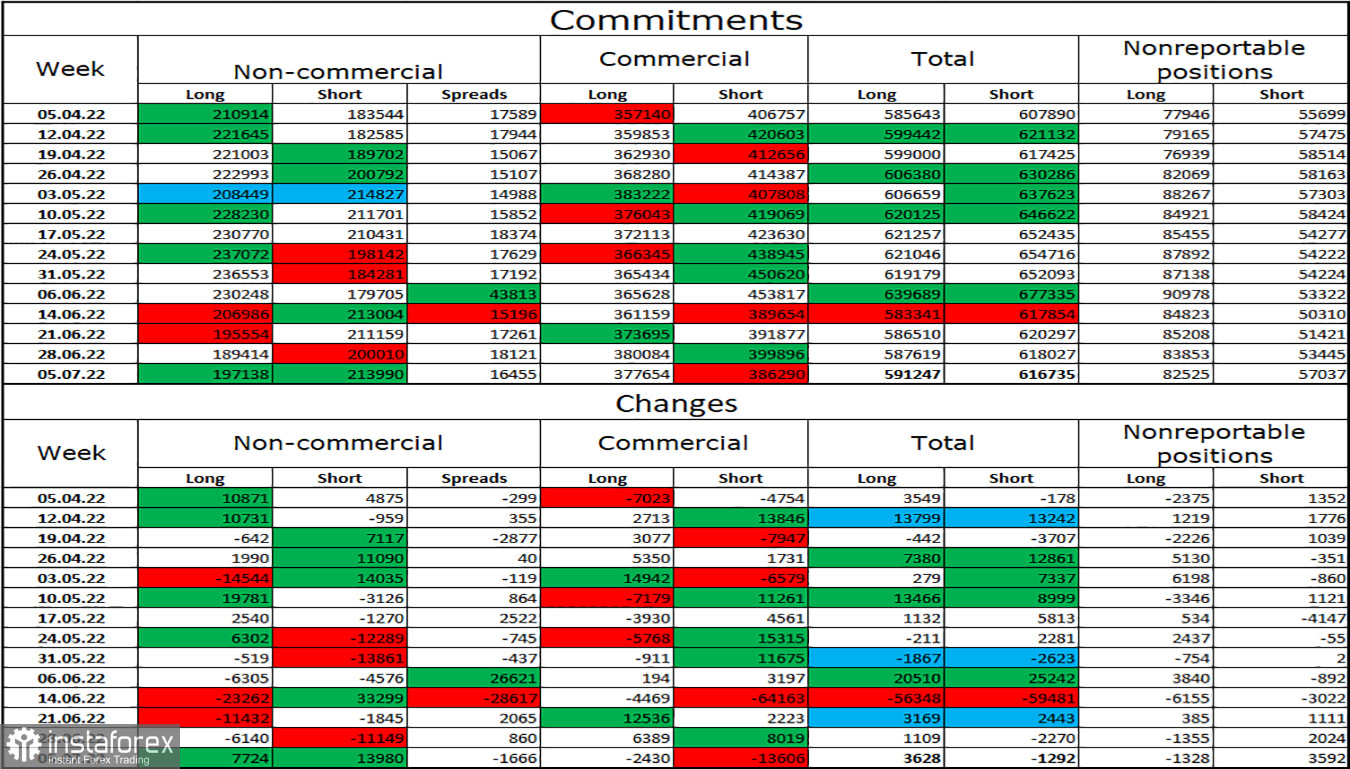

Report on Commitments of Traders (COT):

Last reporting week, 7,724 long contracts and 13,980 short contracts were opened by speculators. This indicates that the "bearish" sentiment of the major players has again intensified and continues to be "bearish." The total number of long contracts held by speculators is now 197 thousand, and the number of short contracts is 214 thousand. The disparity between these numbers is slight, but it does not favor the bulls. The majority of "Non-commercial" traders have maintained a "bullish" outlook on the euro in recent months, which has not helped the euro currency. Recent COT reports indicate that new sales of the EU currency may follow, as speculators' sentiment has shifted from "bullish" to "bearish" over the past few weeks. This is the exact development of events that we are currently witnessing.

News calendar for the United States and Europe:

EU - industrial production volume (09:00 UTC).

US - consumer price index (CPI) (12:30 UTC).

US - Fed's "Beige Book" (18:00 UTC).

The economic calendars of the European Union and the United States contain several intriguing entries for the 12th of July. I suggest paying particular attention to the US inflation report. Today, the impact of the information context on the sentiment of traders is likely to be average.

EUR/USD forecast and trader recommendations:

I suggested selling the pair when it reached a closing price of 1.0196, with targets of 1.0080 and 0.9963; the first target has been reached, and the second can be reached today. On a 4-hour chart, I advise buying the euro when the price is above the corridor with a target of 1.1041.