The euro-dollar pair for the first time since December 2002 plunged below the parity level, denoting at around 0.9999 on Wednesday. For the first time in almost 20 years, the dollar has become more expensive than the euro. And although this advantage lasted only a few minutes, this event is significant. And not only in terms of the very fact of breaking through the support level of 1.0000 - in my opinion, here special attention should be paid to the behavior of traders after the direct assault on the parity zone. The pair immediately reversed 180 degrees and showed a 100-point corrective growth. Although the fundamental background "in the moment" assumed a further price decline, since the initial downward momentum was due to a strong release on US inflation. And yet, despite such a significant trump card in the hands of EUR/USD bears, they did not dare to keep short positions below 1.0000. The bears took profit en masse, thus triggering an upward pullback.

And now the question arises about the prospects for a downward movement. Is it possible to say that traders carried out reconnaissance in force and the upward rebound was part of the strategy to siege the parity level? Or will the 1.0000 mark still become a price bottom, from which the pair will bounce like a ball?

At the moment it is difficult to answer this question. The facts show that two attempts to overcome the parity level were not crowned with success. The price reversed at 1.0001 on Tuesday, and it reversed two points lower on Wednesday. De facto EUR/USD bulls continue to hold the line, using the 1.0000 mark as a reliable price outpost. At the same time, bulls are holding back the bearish onslaught in the face of record growth in US inflation. The latest release does not have any "pitfalls": it only indicates that the Federal Reserve is likely to raise interest rates in July by 75 points. Moreover, following the report, the probability of a 75-point increase in September will also increase. At least the June figures allow "opening a discussion" on this matter (and this will be quite enough to strengthen the positions of the dollar bulls). However, despite such powerful fundamental trump cards, EUR/USD bears did not dare to settle within the 99th figure. This suggests that it is necessary to designate downward targets below parity only after the bears consolidate below the 1.0000 support level.

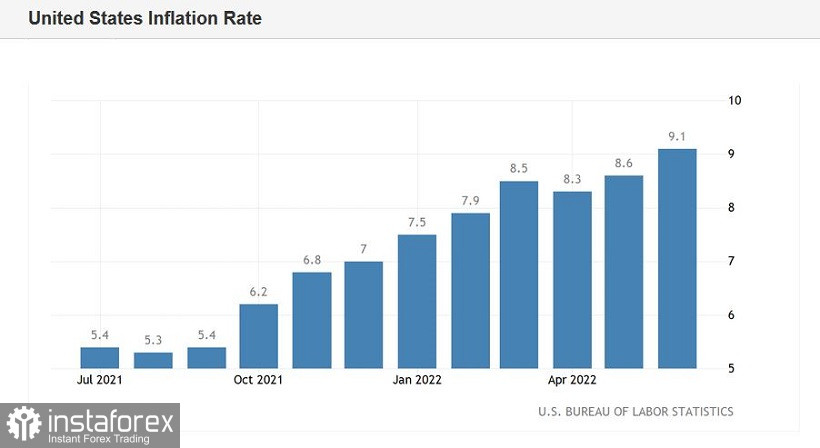

But back to today's report. US inflation really impressed - again, once again. The overall consumer price index in annual terms exceeded 9% for the first time in 41 years. The last time the consumer price index was at this height was in December 1981. In June 2022, the indicator was again at around 9.1% (y/y). The core index, excluding food and energy prices, also showed record growth, reaching 5.9% year on year (most experts predicted a decline to 5.6%). Compared to May, prices in June rose by 1.3% (on a monthly basis), the strongest growth rate since September 2005.

If we talk about the structure of the report, then it is necessary to note energy prices, which jumped by almost 42% last month. This is the highest growth in the last 42 years. In particular, the cost of gasoline rose by 60% (a record since March 1980), electricity by 14% (the highest increase since April 2006), and natural gas by almost 40% (a 17-year record in growth rates). Food prices have also gone up significantly. This component of the inflationary release came out at 10.4%, the strongest growth rate since February 1981. New cars (by 11%) and used cars and trucks (almost 2%) grew in price. Closing the topic of transport, one should also note the rise in prices for air tickets - they immediately went up by 34%.

Thus, the report suggests that inflationary pressure in the US is not easing. Fed Chairman Jerome Powell's optimistic hopes that inflation would "flatten out" in the second half of the year appear to have collapsed. All components of the data came out in the green zone, exceeding the predicted estimates of most experts.

Such an outcome will surely force many hesitant members of the Fed to join the hawk wing of the Open Market Committee. And if earlier Powell spoke about a possible choice between a 50-point and 75-point increase in July, then after the June report on CPI growth, the choice became obvious. I believe that at the September meeting the central bank will also resort to increasing the rate by 75 points.

Thus, the fundamental background for the EUR/USD pair remains bearish: the inflationary release will strengthen the hawkish mood regarding the further actions of the Fed. But at the same time, traders do not risk (yet) holding short positions below the parity level, even despite the spike in US inflation. This suggests that short positions should be closed around the 1.0000 mark. In my opinion, it is expedient to open short positions on the upward corrective rollbacks with the downward targets of 1.0050, 1.0010.