The GBP/USD currency pair adjusted steadily throughout Wednesday's trading session. Certainly, when the American inflation report was released, there was a surge of emotion, but overall, the pair traded as usual. We will discuss inflation in the United States separately, but for now, I'd like to analyze how it may affect the technical picture of the pound/dollar (and euro/dollar) pair. From our perspective, nothing will change under any circumstances. We are currently considering a trend, not a single report. At least two or three reports will be required to conclude a decrease in inflation. Without this, it will be impossible to assert that inflation has begun to decelerate. A couple of months ago, it showed a decrease of 0.2%, after which it resumed accelerating steadily. Thus, it is evident that the Federal Reserve will not adjust its course to tighten monetary policy based on a single report. Consequently, the Fed rate will increase by 0.75 percent on July 26-27.

Recall that the positions of the Federal Reserve's monetary policy committee members are currently at odds. Someone is optimistic about the future and does not anticipate a recession in the economy. On the other hand, someone believes that the likelihood of a recession is high and does not anticipate that inflation will begin to fall sharply and quickly. This demonstrates that the Fed was unprepared for the highest inflation rate in forty years. This indicates that the Fed and many other central banks have miscalculated, as they do not understand how to handle the consumer price index. The Bank of England is a vivid example of this, incidentally. They began raising interest rates before the Federal Reserve and have yet to achieve a 0.1% decline in inflation. In addition, the Bank of England predicts that the maximum levels are still to come. In 2022, experts anticipate at least 10 percent growth. Consequently, it is necessary to prepare for a protracted struggle with rising prices, which will depend heavily on the geopolitical conflict in Ukraine.

Scotland has not ruled out holding a referendum.

Today, the first round of voting will take place in the United Kingdom for the election of the leader of the Conservative Party, who will succeed Boris Johnson as Prime Minister. However, yesterday's news from Scotland has diminished the significance of another political crisis. On October 19, 2023, First Minister Nicola Sturgeon scheduled a referendum on Scotland's independence from the United Kingdom. The population of Scotland will be asked, "Should Scotland achieve complete independence?" Nevertheless, we are only discussing a consultative referendum. In other words, a poll of the population will be conducted. The Scottish Parliament is concerned that the results of the new referendum may be identical to 2014 when the majority of Scots voted to remain under London's control. However, there was no Brexit, and the United Kingdom remained a member of the European Union.

Since then, nearly a decade has passed, and the Scots' desire to leave the United Kingdom and return to the EU grows each year. Thus, a consultative referendum will be held to determine whether Scots support independence from the United Kingdom. If the answer is unequivocally affirmative, the Scottish government can begin legislative preparations for the main referendum, which will serve as the basis for Scotland's withdrawal from London's jurisdiction. Recall that Edinburgh must obtain official permission from London to hold an independence referendum. Under Boris Johnson, such a possibility was almost inconceivable, and it is likely that the new Prime Minister will not be eager to cede one-third of the United Kingdom's territory. Therefore, it remains unclear how Edindurg intends to conduct an official referendum without permission. Perhaps he is prepared for an open conflict with London, but then a new "hot spot" appears on the world's political map. Current law is on England's side: it is impossible to hold a referendum without authorization!

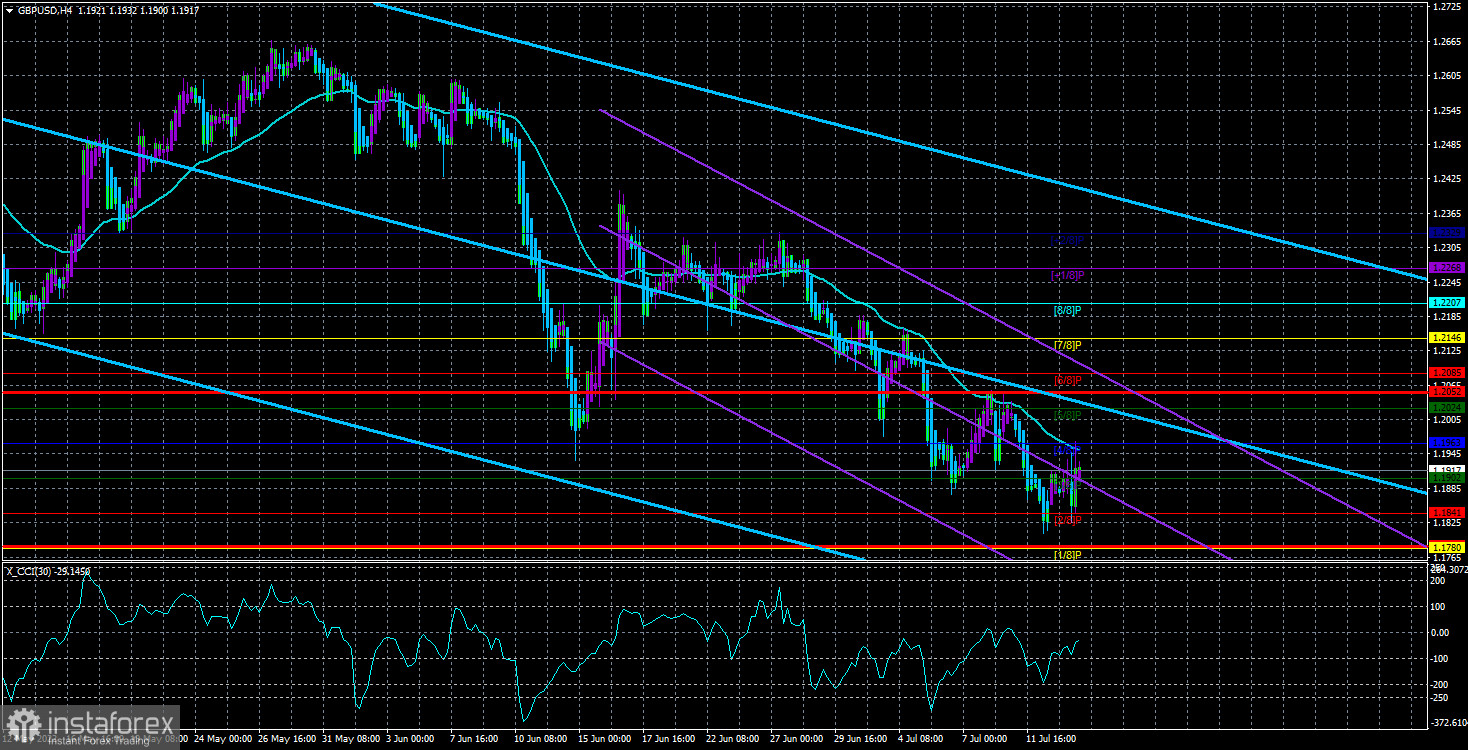

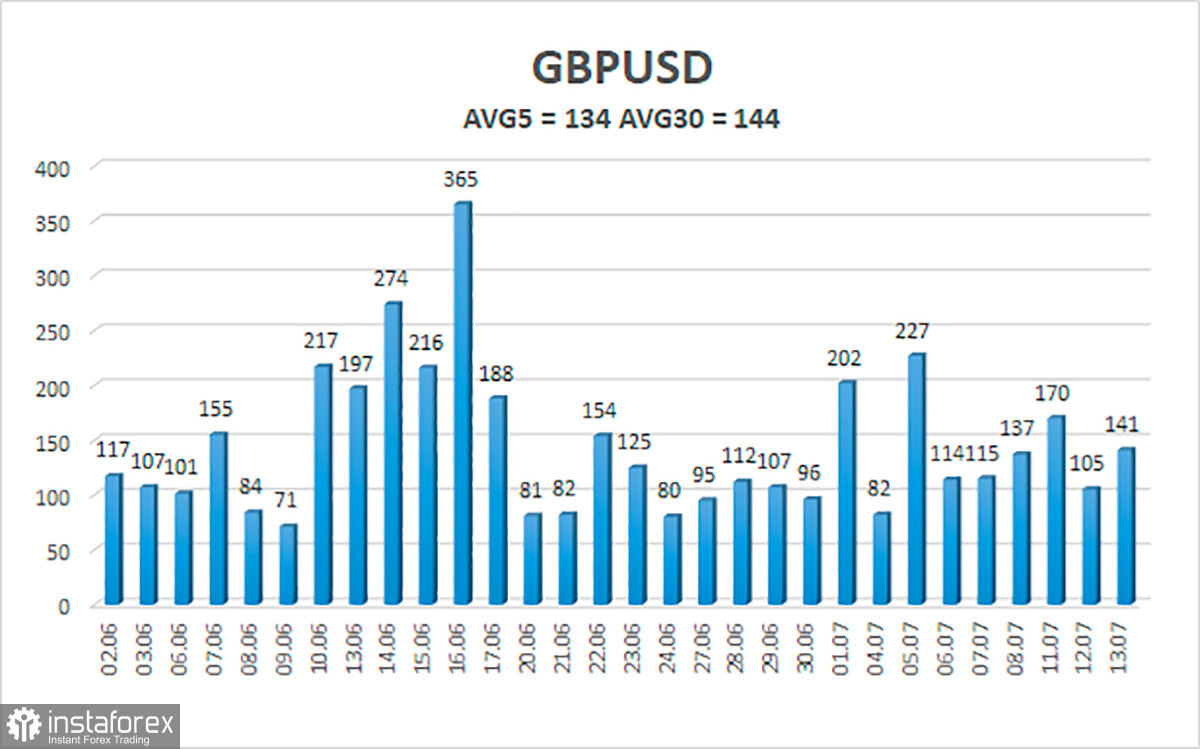

During the last five trading days, the average volatility of the GBP/USD pair was 134 points. This value for the pound/dollar pair is "high." Thus, we anticipate intra-channel movement on Thursday, July 14, bounded by the levels of 1.1783 and 1.2052. The downward reversal of the Heiken Ashi indicator suggests a possible continuation of the decline.

Nearest support levels:

S1 – 1.1902

S2 – 1.1841

S3 – 1.1780

Nearest resistance levels:

R1 – 1.1963

R2 – 1.2024

R3 – 1.2085

Trading Recommendations:

The GBP/USD pair has initiated a new correction attempt on the 4-hour time frame. Therefore, we should continue to consider sell orders with targets of 1.1841 and 1.1783 until the Heiken Ashi indicator reverses to the downside. When the price is above the moving average, buy orders should be placed with targets of 1.2024 and 1.2052.

Explanations for the figures:

Channels of linear regression – aid in determining the current trend. The trend is currently strong if both are moving in the same direction.

The moving average line (settings 20.0, smoothed) identifies the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the likely price channel the pair will trade within for the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.