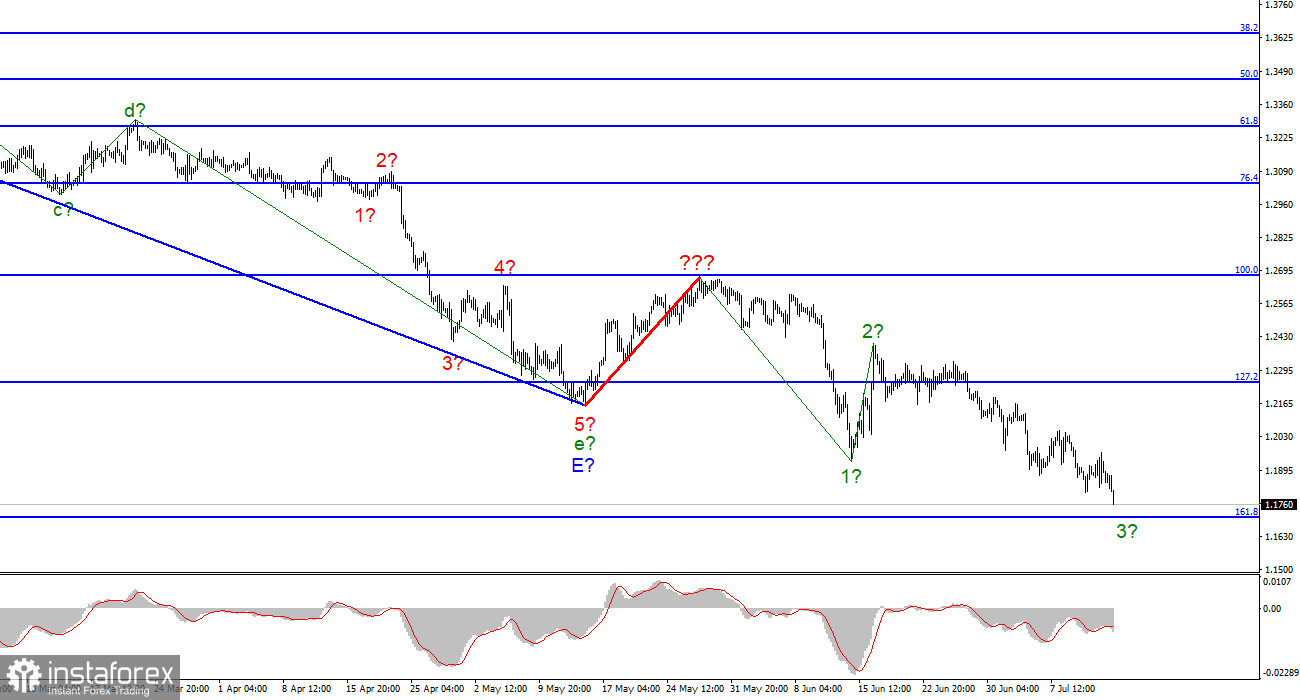

The wave marking on the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be considered corrective as a segment of the downward trend. Thus, we can now definitively state that the construction of the upward correction section of the trend has been canceled, and the downward section of the trend will assume a longer and more complex shape. I am not a big fan of continually complicating the wave marking when dealing with a trend zone that is significantly elongating. I believe it would be considerably more efficient to identify rare corrective waves, after which new impulse structures could be constructed. Currently, there are waves 1 and 2, so we can assume the instrument is in the process of constructing wave 3. If this is the case, the decline may continue with targets near the 161.8% Fibonacci level. The market has demonstrated that it is now more important to adhere to the trend than to mark waves.

British decline is less rapid than European

In July, the pound and dollar exchange rate decreased by 100 basis points. I can assume that the new decrease in the instrument results from yesterday's report of 9.1 percent inflation in the United States. If the market was uncertain about what to do with the euro and the dollar last night, it was no longer uncertain today. The construction of descending wave 3 continues, and the 161.8 percent Fibonacci level should not sustain the decline for too long; otherwise, the construction of a corrective wave may commence, surpassing the low of wave 1. In such a scenario, the wave structure of even the most recent descending segment of the trend will become increasingly complex and cannot be considered impulsive.

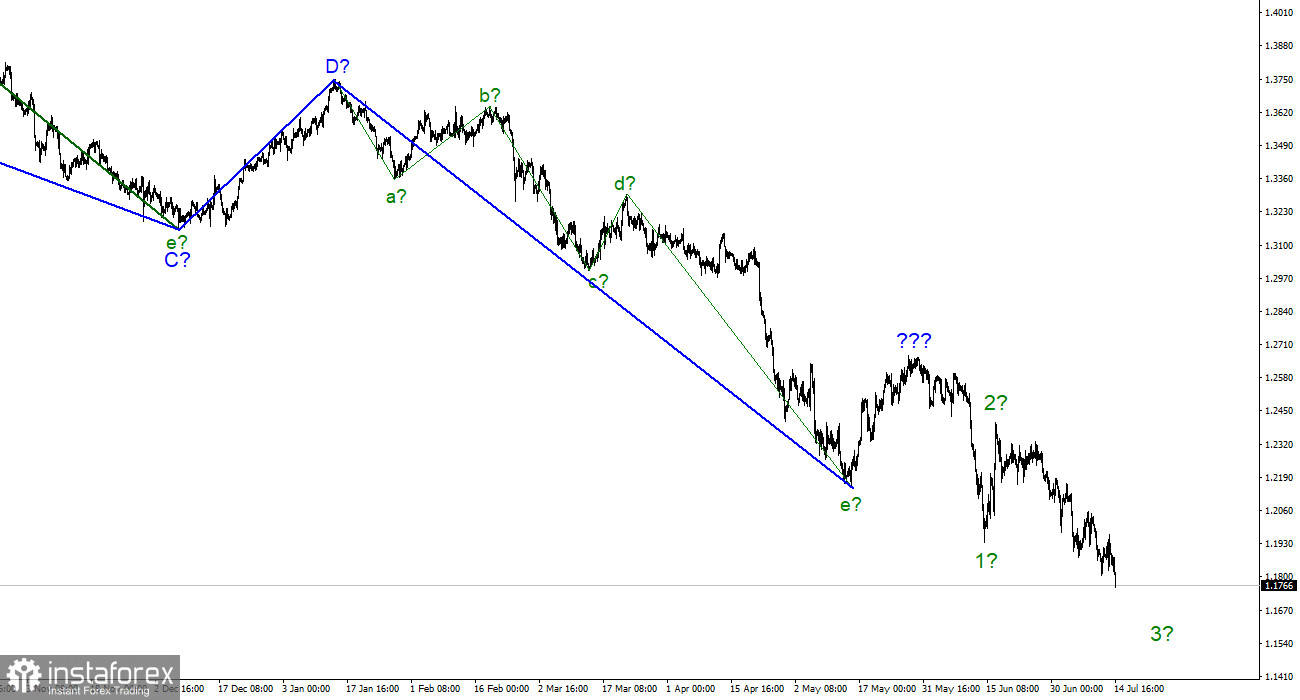

The euro and the pound continue to exhibit nearly identical movements, but the pound continues to fall slower than the euro. This is readily apparent in the graphs. Regarding the euro, there are no concerns regarding the complexity of the wave marking of the descending segment. Thus, both currencies appear to continue a steep decline, but the British are still attempting to gain ground against the US dollar. Today, only one report was published in the United States and none in the United Kingdom. Despite this, the amplitude is relatively high, and the market is active. The number of initial claims for unemployment benefits reached 244,000 last week, exceeding expectations of 235 thousand. Tomorrow, the market will digest reports on retail sales and industrial production in the United States, as well as the consumer sentiment index from the University of Michigan. However, it is unlikely that these reports will be able to replace the inflation report, which has long-term consequences in the form of monetary policy changes. I believe the market will respond slowly to this information. On Friday, there will be no interesting events in the United Kingdom.

General conclusions

The increased complexity of the wave pattern of the pound/dollar pair now suggests a further decline. Consequently, I recommend selling the instrument with targets near the estimated mark of 1,1708, which corresponds to 161.8 percent Fibonacci for each "down" MACD signal. An unsuccessful attempt to surpass 1.1708 may result in a departure of quotes from the reached lows, but it is unlikely to produce a corrective wave 4, as the final descending segment of the trend will assume a non-standard shape in this case.

The image closely resembles the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, followed by the same three descending waves. Thus, one thing is unmistakable: the downward segment of the trend continues to develop and can reach almost any length.