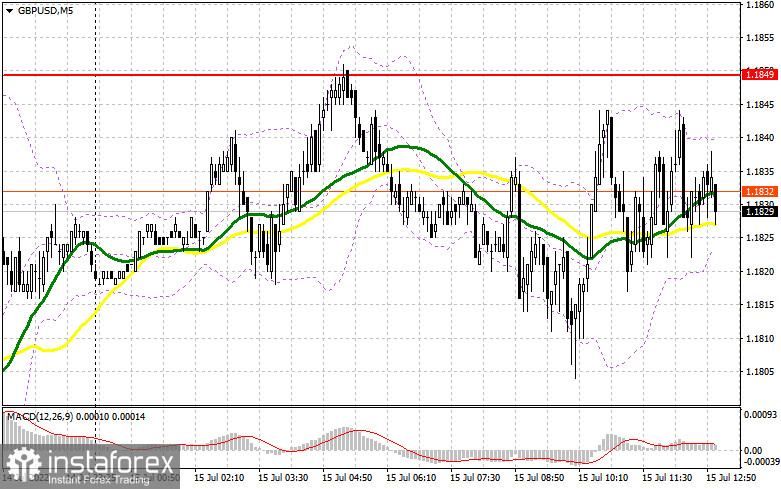

In my morning article, I focused on the level of 1.1849 and recommended making decisions to enter the market, taking it into account. Let's observe the 5-minute chart and analyze it. GBP buyers did not manage to reach the level of 1.1849 due to low volatility of the market. Therefore, they could not enter short positions as there was no failed break at this level. I also did not see any buy signals from 1.1785. Moreover, neither the technical picture nor the strategy did not change significantly in the afternoon.

To open long positions on GBP/USD, you need:

Key US retail sales and industrial production reports for June 2022 were released during the American session. Moreover, they will definitely affect the market. Rising sales will increase pressure on the pair, pushing it to the nearest support at 1.1785. The consumer expectations index and consumer sentiment index from the University of Michigan are not significant for an intraday benchmark. However, I also recommend focusing on them. In case the GBP/USD pair drops in the second half of the day, bulls should be active near the nearest support at 1.1785, which was formed yesterday. A failed break at this point would be a clear signal to open long positions for an upward correction to the nearest resistance at 1.1849. The moving averages are above this level, and they favor sellers. A breakout of 1.1849 will create a stronger bullish momentum, and a top-down test will give a buy signal, with the target of a dramatic surge and updating the level of 1.1917. A similar breakout of this level will be possible only in case of extremely weak US data. Moreover, they will reduce the Fed's pressure. This aspect will provide a chance to reach 1.1980, where I recommend locking in profits. The area of 1.2034 will become a more distant target and will be considered a clear bid to build a new uptrend. The GBP/USD pair's decline and absence of buyers at 1.1785 will increase pressure on the pair. Therefore, I recommend not to open long positions before the pair reaches 1.1707. It is advisable to buy the pair only in case of a failed break. It is possible to open long positions on GBP/USD immediately on a rebound from 1.1643, or even lower around 1.1575, with a target of 30-35 pips intraday correction.

To open short positions on GBP/USD, you need:

The sellers have not been active so far. Therefore, the major focus remains on the nearest resistance at 1.1849, and the pair must not break through it. The best scenario to open short positions would be a failed break at 1.1849, with the moving averages increasing the pressure on the pair, with the target to decline to a key support at 1.1785. In case bulls show no activity and the pair consolidates lower, a reverse bottom-up test will give an additional point to sell the pound with decline to 1.1707 where I recommend locking in profits partially. A more distant target will be 1.1643. Moreover, the test of this level will indicate a further downtrend. If the GBP/USD pair rises and there are no bears at 1.1849 in the afternoon after the weak US statistics, a more significant upward correction will be likely. In that case, I advise traders not to sell the pair. Only a failed break near the next resistance at 1.1917 will provide an entry point to short positions, counting on the pair's rebound. If traders are not active, the pair will likely surge upward again amid the demolition of stop orders of speculative sellers. In that case, I recommend not to open short positions till 1.1980, where it is possible to sell the GBP/USD pair immediately on the rebound, counting on the pair's downward rebound by 30-35 pips within a day.

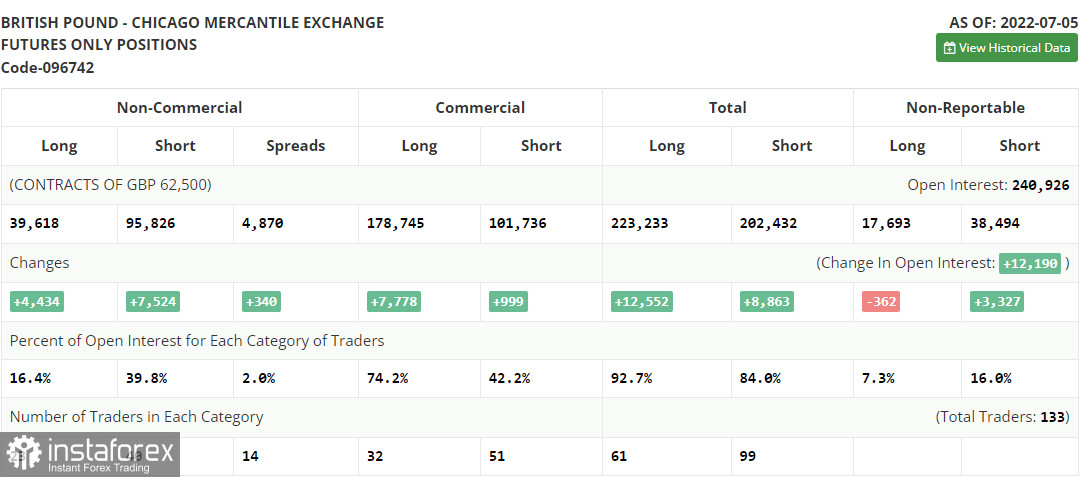

The COT-report for July 5 recorded an increase in both short and long positions. However, short positions were much more numerous, which led to a rise in the negative delta. Another attempts to buy the annual low failed after it became obvious that the Bank of England planned to fight inflation by raising interest rates. These actions will definitely slow the UK economy significantly and push it into recession. The UK cost of living crisis continues to escalate, and the recent resignation of British Prime Minister Boris Johnson is unlikely to change the situation. There are no reasons for buying the British pound, except for the fact that it has updated the next annual lows. The Federal Reserve policy and the pace of interest rate hikes in the US provide more support to the dollar, as US economy is not facing the similar problems. The recent US labor market data for June 2022 confirmed that fact. The COT report shows that long non-commercial positions rose by 4,434 to 39,618, while short non-commercial positions jumped by 7,524 to 95,826. This resulted in an increase of the negative non-commercial net position to -56,208 from -53,118. The weekly closing price was down to 1.1965 versus 1.2201.

Indicator Signals:

Moving averages

Trading is conducted below the 30 and 50 day moving averages, indicating that the pair continues to drop further.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands

In case the pair rises, the upper boundary of the indicator near 1.1850 will act as resistance. A breakout of the bottom boundary at 1.1785 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9;

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.