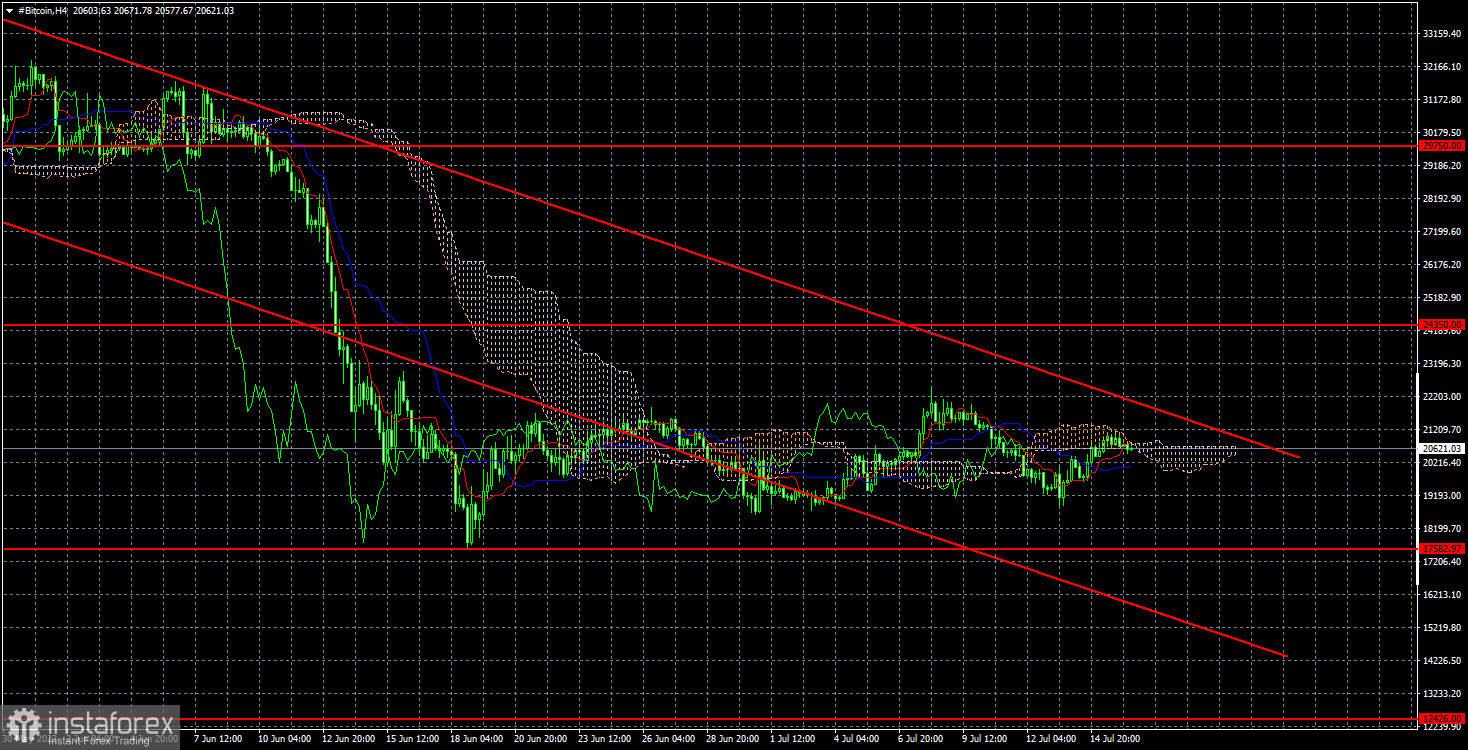

On the 4-hour TF, the current picture on bitcoin is also extremely eloquent and does not create any issues. A clear descending channel has been maintained for a long time. The cryptocurrency is not even trying to get a foothold above it, although it has been heading toward its upper limit in the previous several weeks. However, one should also take into account the fact that the upper bound itself gradually shrinks over time. In the following days, they may meet, and then, in some way, the fate of bitcoin will be decided in the near future. At the same time, we remind you that when the price exits the trend channel while moving in a flat, such consolidation is not regarded as a quality in general indications. We are seeing a flat right now.

This week, one of the most noteworthy announcements (in addition to the US inflation report) was the disclosure of a reduction in the cost of production of JP Morgan's "bitcoin." The bank reported that the cost of mining one bitcoin currency might reduce from $ 20,000 to approximately $ 13,000. Let's analyze it. First, bitcoin is now considerably cheaper for miners. This means they can make a profit even at present market values. Second, most miners get rid of the bitcoin coins accessible to them, as they predict an even bigger decrease. Thus, it turns out that the amount of supply has not altered and remains high. And demand remains modest since, otherwise, bitcoin would become more expensive. Based on this, we feel that "bitcoin" can and should continue its decline.

I would also like to remark that the decline in the cost price itself says a lot. Imagine, for example, a circumstance where gold mining costs are lower by 30–35 percent. You may ask, how can this be? And you get the answer: indeed, it cannot be so because gold has been mined for many years and has been a precious metal for many years. Thus, humanity has long ago established all the cheapest and most successful means to extract it. But in the case of bitcoin, a situation is completely acceptable in which energy consumption lowers due to more high-tech and efficient mining equipment, and its cost price sags quite substantially. Theoretically, if you use free energy from the sun, wind, or water, the cost can generally be a penny. And the cost price is essential for the item's final worth. The lower it is, the cheaper the real cost. In the case of bitcoin, this circumstance, as it turns out, is quite true.

On the 4-hour timeframe, the quotes of the "bitcoin" went below the level of $ 24,350. It was not feasible to acquire a foothold above the downward channel. Therefore currently, the aim remains at the level of $ 12,426. It is not advisable to contemplate buying bitcoin currently. You need to wait for at least a consolidation above the channel generally. There is also an intermediate level of $ 17,582, which is a local minimum. When the price overcomes it, it will be a signal for new sales.