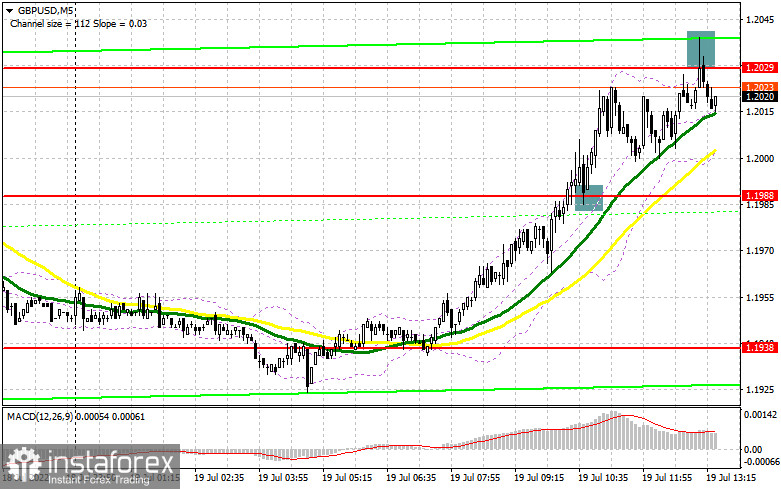

In my morning review, I mentioned the level of 1.1988 and recommended entering the market there. Let's take a look at the 5-minute chart and figure out what actually happened. A break and a retest of the 1.1988 level generated a good signal to buy the pound according to the current bullish trend. As a result, the pair went up by another 30 pips to the area of 1.2029 where the main trading activity is observed at the moment. In the second half of the day, the technical picture has slightly changed.

For long positions on GBP/USD:

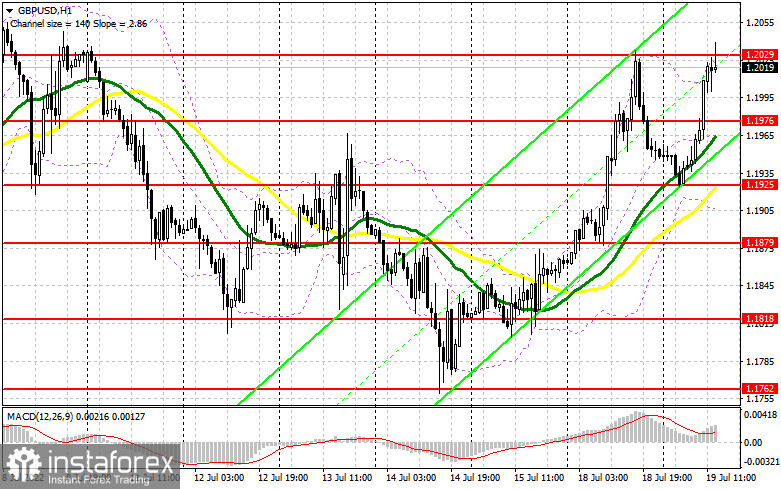

The employment data in the UK showed that if not for soaring inflation, the country could have successfully recovered from the coronavirus crisis. Amid a robust labor report, the pound advanced to test the resistance level of 1.2029. There are no major reports in the afternoon that could support the US dollar. The data on US housing permits and new housing starts will most likely be downplayed by traders. The best scenario in this case would be to buy the pair after a downward correction towards the support of 1.1976. Two moving averages that are in favor of the bullish trend are passing just below this level. A false breakout will form a good signal for going long with the next upside target found at 1.2029. If the price breaks through this level and tests it downwards, the pair may develop stronger upside momentum, generating a buy signal with the next target at 1.2081. A breakout of this level will pave the way to the level of 1.2119 where I recommend profit taking. The area of 1.2160 will serve as a more distant target. If GBP/USD falls and bulls won't open any new positions at 1.1976, the downward pressure on the pound will increase. In this case, the pair may enter a sideways channel of 1.1925-1.2029. If so, I wouldn't recommend buying the pair at least until it reaches the mark of 1.1925. It is better to go long at this point only after a false breakout. You can open long positions right after a rebound from 1.1879, or even lower from 1.1818, considering an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Bears were slightly disappointed with the labor market report. Yet, they managed to protect the key resistance of 1.2029. The best scenario for going short will be a false breakout of this level after the data from the US is out. If so, the downward pressure will resume which may push the pair lower to the key support of 1.1976. A lot will depend on whether the bulls are still there or not. If bulls are weak and if the pair settles below this level, an upward test will create an additional entry point to sell the pound with the downward target at 1.1925. I would advise you to take profit at this point. The level of 1.1879 will act as a more distant target. If GBP/USD rises further and bears don't open any new positions at 1.2029 later in the day after the weak data from the US, buyers will remain in control of the market. If this is the case, I wouldn't recommend entering the market at least until a false breakout of the next resistance at 1.2081. This will create an entry point for opening short positions, considering a downside pullback. If nothing happens there as well, the pair may surge to the upside. If so, I would advise you to go short on the pair only when the price hits the mark of 1.2119. At this point, you can sell GBP/USD right after a rebound, considering a possible downside correction of 30-35 pips within the day.

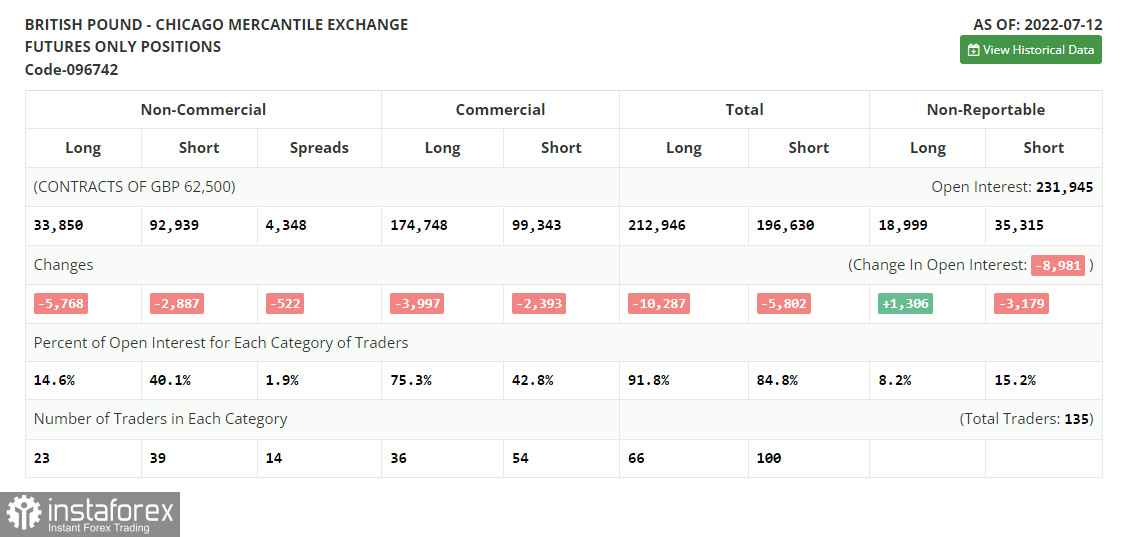

COT report

The COT (Commitment of Traders) report for July 12 showed a decline in both short and long positions. However, the short ones prevailed which led to an increase in the negative delta. Another attempt to buy the pair at yearly lows failed although traders started to take profit at the end of the week, encouraged by the strong macroeconomic data from the US. This resulted in a slight correction in the pound which has been developing for some time already. The cost of living crisis in the UK is getting more acute every day, and the government is struggling to tackle it. At the same time, the Fed's policy and the pace of monetary tightening in the US provide significant support to the US dollar and put more pressure on the pound. The US regulator is expected to raise the rate straight by 1.0% next time. According to the COT report, long positions of the non-commercial group of traders decreased by 5,768 to 33,850, while short positions declined by 2,887 to 92,939. As a result, the negative non-commercial net position increased to -59,089 from -56,208. The weekly closing price declined to 1.1915 from 1.1965.

Indicator signals:

Moving Averages

Trading above the 30 and 50-day moving averages indicates that the pair is going through a correction.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the medium band at the 1.1970 level will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;• Bollinger Bands: 20-day period;• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;• The total non-commercial net position is the difference between short and long positions of non-commercial traders.