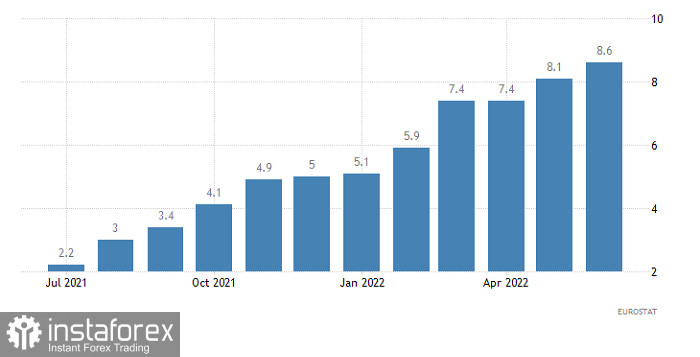

The single European currency quite easily exceeded 1.0200, so the local correction can be considered complete. At the same time, the market basically ignored the data on inflation in the euro area, although the growth rate of consumer prices accelerated from 8.1% to 8.6%. But the fact is that the final data was published yesterday, which only confirmed the preliminary assessment. So there is nothing new in these data.

Inflation (Europe):

Today, we don't have any report that could somehow seriously affect the market. Moreover, the meeting of the board of the European Central Bank will take place tomorrow, and investors clearly do not intend to take risks. Although the issue of raising the refinancing rate is generally considered closed, there is some uncertainty about the ECB's succeeding actions. Much will depend on the subsequent statements of ECB President Christine Lagarde. And the most important issue is the pace and scale of the interest rate hike. They will determine not only the scale of growth of the single currency right at the moment, but also the direction of the market in the medium term. The results of tomorrow's meeting will determine the mood of investors for the coming year. So it is not surprising that the market is now frozen in place. Investors do not intend to take risks without a reason.

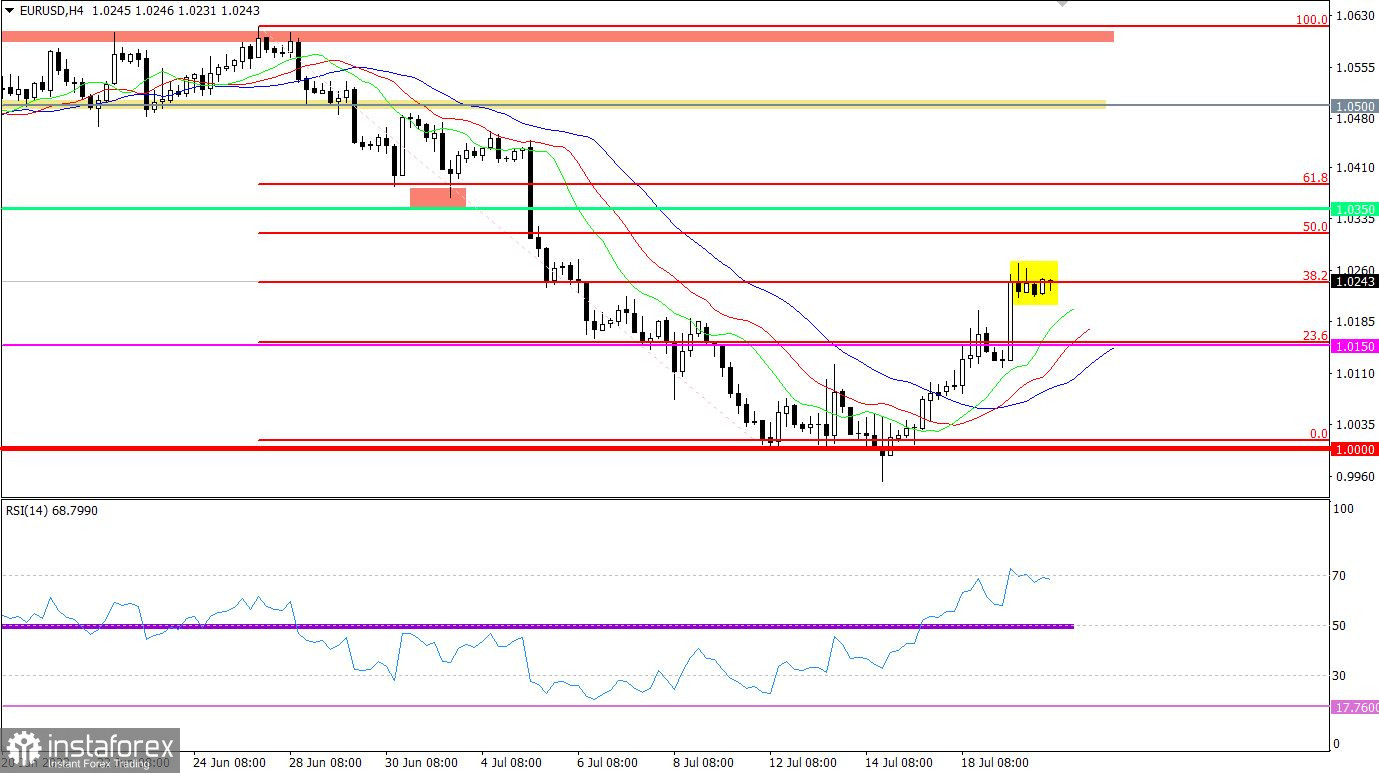

The EURUSD currency pair managed to overcome the resistance level of 1.0150 during the corrective movement. As a result, a subsequent increase in the volume of long positions appeared on the market, which led to the prolongation of the current correction. In less than a week, the euro has appreciated in value by more than 300 points. This is a strong price move that could well lead to overheating of long positions in the short term.

The technical instrument RSI H4 is moving within the oversold zone, which indicates that long positions are overheated. RSI D1 approached the middle line 50 during the correction. There is no signal about the transition to the elongated correction mode.

The moving MA lines on the Alligator H4 indicators are directed upwards, which corresponds to a corrective move. Alligator D1 ignores intraday reversals. The medium-term trend is still downward.

Expectations and prospects

Stagnation at the peak of a corrective move is a process of accumulation of trading forces. As a result, a new wave of speculation will appear on the market, where, based on the price fixation points relative to stagnation, the subsequent price movement will be clear.

We concretize the above into trading signals:

Long positions on a currency pair are taken into account after keeping the price above the value of 1.0280 in a four-hour period.

Shorts should be considered after keeping the price below 1.0200 in a four-hour period.

Complex indicator analysis has a variable signal in the short term due to stagnation. Indicators in the intraday period signal a long due to the current corrective move. Technical instruments in the medium term give a sell signal due to a downward trend.