Stagflation, recession, or soft landing? What awaits the American and global economy in the near future? Only by answering this question can we find out the fate of gold. Even though the markets are increasingly talking about the fact that the precious metal has lost its functions as a safe-haven and an inflation hedging tool, the dynamics of an asset cannot depend on a single factor.

A stagflationary environment, or a combination of high inflation and sluggish economic growth, is favorable for gold. In such conditions, a strong US dollar is offset by a drop in the Treasury yields. In addition, rumors about a pause in the process of monetary restriction by the Fed could undermine the strength of the US currency.

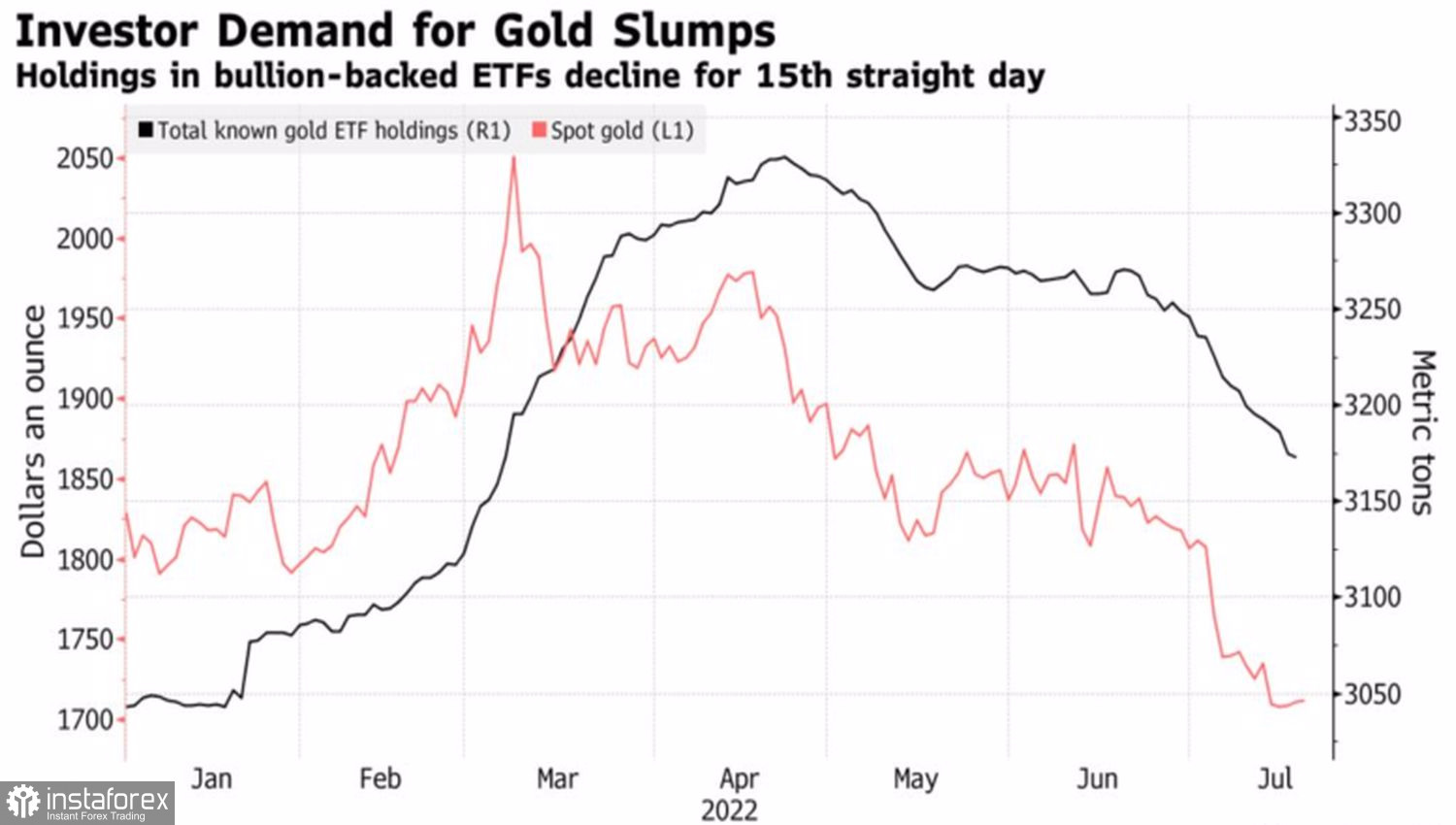

On the contrary, the demand for it as a safe-haven asset increases sharply during the expected recession. Especially when investors are confident that the Fed will deliberately provoke a recession in the US economy in order to fulfill its mission of returning inflation to its 2% target—this is exactly what has been happening in the markets since mid-June, when the precious metal plummeted, and the outflow of capital from ETFs did not stop for 15 days, which is the longest losing streak since March 2021.

Dynamics of gold and ETF stocks

Finally, a soft landing, a situation in which the Fed will be able to avoid a recession and at the same time overcome inflation, is generally neutral for gold. There is a reverse stagflation process of the growth of Treasury yields against the background of the weakening of the US dollar. Investors believe that consumer prices have peaked at 9.1% and will decline in the future, which is confirmed by falling inflation expectations. The Fed does not need to tighten monetary policy as aggressively as it is currently supposed to. At the same time, strong data on employment, business activity and retail sales indicate that the US economy can withstand higher borrowing costs.

Dynamics of gold and US dollar

MKS PAMP believes that in the near future, there will be a "dovish" shift in the outlook of the Central Bank. According to the company's research, when the ratio of copper and gold, on the one hand, and the yield of US Treasury bonds, on the other, fell below 4, the Fed ended tightening monetary policy. Currently, the coefficient is 4.3 and continues to fall. Copper has dropped by 26% since the start of the year, while gold has only lost roughly 7% of its value.

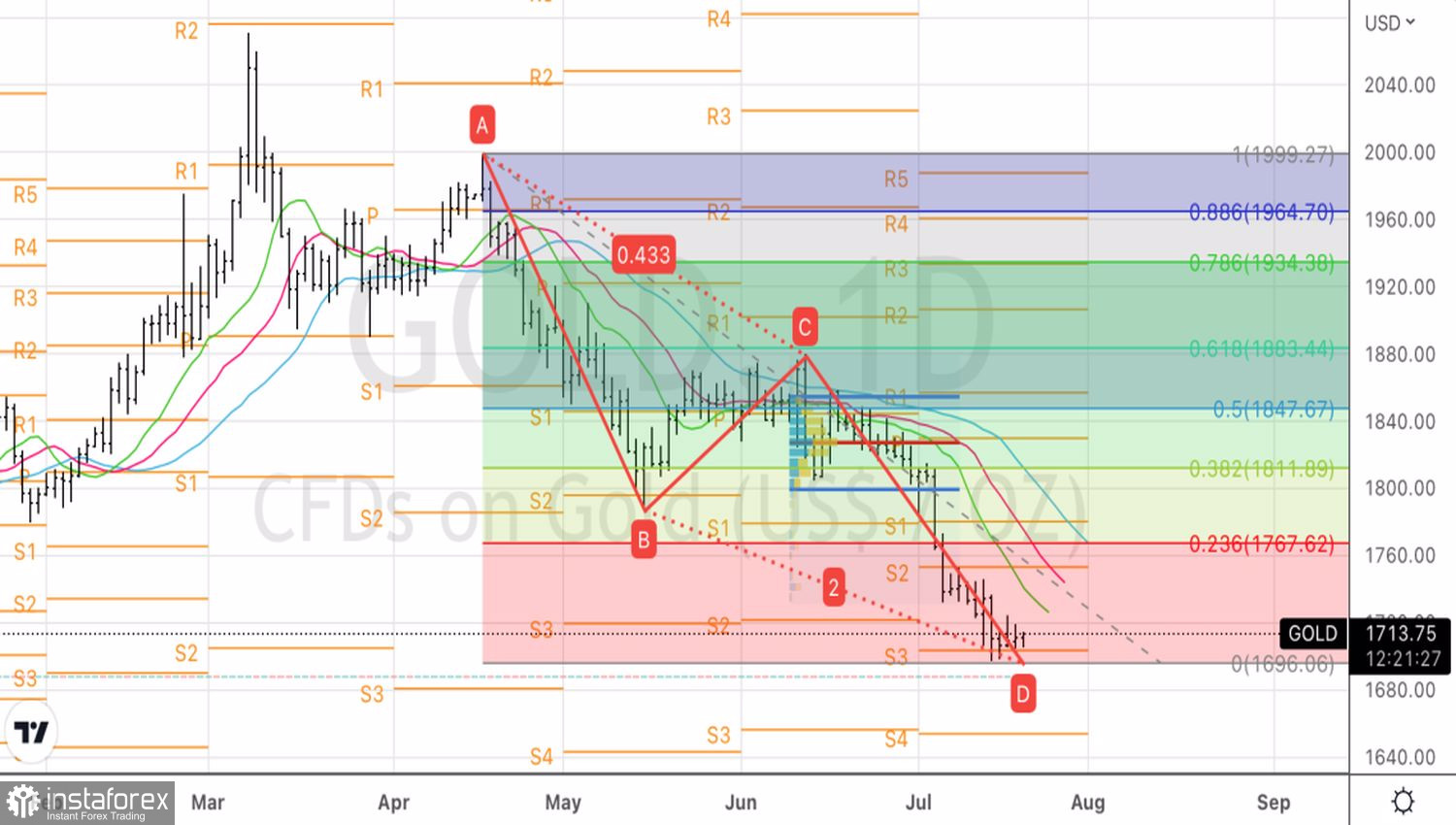

The hopes for a soft landing of the US economy may be somewhat overstated. The worsening macro statistics for the US will bring back talk of a recession to the markets, forcing gold to continue its peak in the medium term. Short-term growth of XAUUSD is possible.

Technically, on the daily chart, gold reached the target by 200% based on the AB=CD pattern, which increases the risks of a pullback towards $1750–1765, where it can be sold. In the meantime, a break of resistance at $1,725 is a reason to buy.