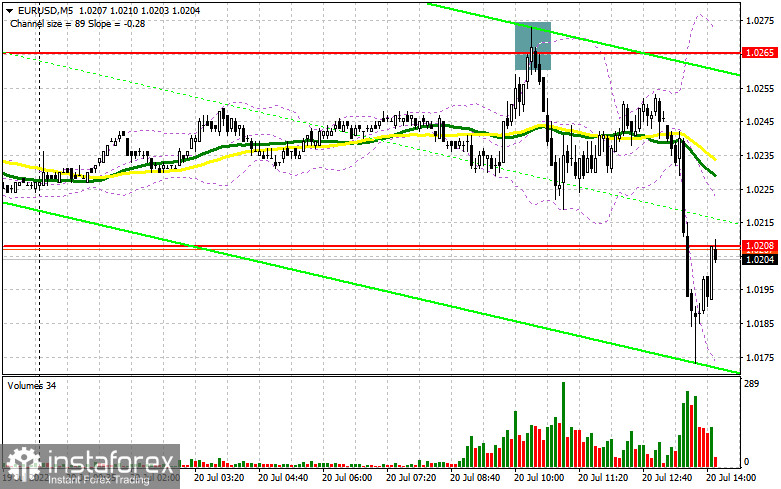

In the morning article, I highlighted the level of 1.0265 and recommended making decisions with this level in focus. Now let's look at the 5-minute chart and try to figure out what actually happened. A rally of the euro was relatively short-lived. A false breakout of 1.0265 and a drop below this level gave an excellent sell signal. I draw attention to this level in my previous article. Shortly after, the euro faced a sell-off, declining to 1.0175. The profit totaled 90 pips. The technical outlook has partially changed for the second half of the day.

What is needed to open long positions on EUR/USD

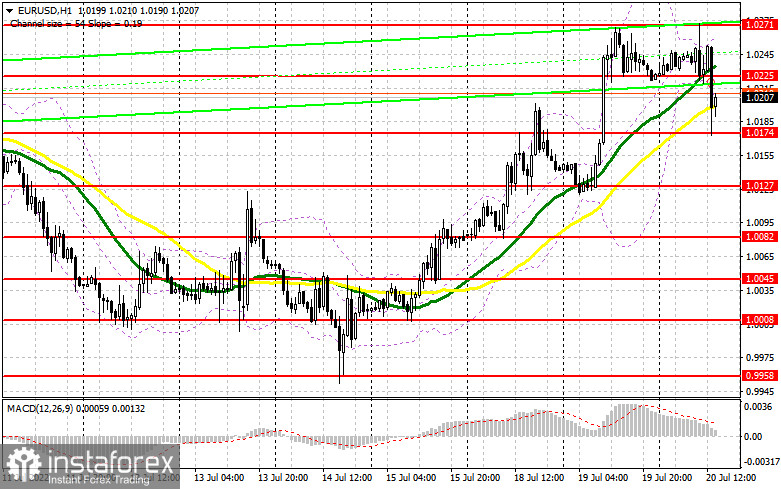

The bulls have to vigorously defend the support level of 1.0174 due to the absence of economic reports which could have supported the euro. The indicated level appeared at the end of the first half of the day after a sharp decline in the pair. Although there will be no macro stats during the American session that would help the US dollar regain momentum, it is still necessary to pay attention to data on US Existing Home Sales and the MBA Refinance Index. Strong reports will surely trigger a new decline in the euro. If the bulls want to hold the upper hand, they should push the pair to an intraday low of 1.0174. The quotes may rise to the nearest resistance level of 1.0225 only after a false breakout of this level. The further trajectory of the pair depends on this level. So, EUR bears will not miss the opportunity to tussle for this level. Only a breakout and a downward test of this level will force sellers to close their slop-loss orders. It will give a good buy signal with the prospect of a rise to the upper border of the new sideways channel of 1.0271. Intraday traders are likely to start leaving the market at this level, which will limit the upward potential of the pair. A more distant target will be the 1.0321 level where I recommend locking in profits. If EUR/USD declines and bulls show no activity at 1.0174 in the afternoon, the pressure on the euro will escalate. In this case, it is better to cancel long positions until a false breakout of 1.0127. You can buy EUR/USD immediately at a bounce from the level of 1.0082 or even a low of 1.0045, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open short positions on EUR/USD

As widely expected, the euro has lost momentum. However, traders began to open long positions again rather quickly. Yet, by the middle of the day demand had significantly decreased. Now, trading is carried out near the moving averages. It is quite difficult to predict the further trajectory of the pair. On the one hand, it may return to an intraday high if it grows above 1.0225. On the other hand, if the pair fails to do so, it will face strong bearish pressure. Do not forget that recently more and more Fed policymakers have been hinting about a more aggressive key rate hike. The Fed meeting is scheduled for the next week. This is why the ongoing upward correction may also end quickly. If EUR/USD makes attempts to edge higher in the afternoon, a false breakout of 1.0225 will provide an excellent sell signal. If so, the price is likely to slide to the support level of 1.0174, which is the lower border of the current sideways channel. A breakout and a drop below this level, as well as an upward test, will generate an additional sell signal. EUR bulls will have to close their stop-loss orders, pushing the pair down to the 1.0127 level. Such a decline will significantly affect the positions of traders who expect the pair to remain at previous highs. A drop below 1.0127 will open the way to 1.0082 where I recommend closing all short positions. A more distant target will be the 1.0045 level. If EUR/USD rises during the American session and bears show no energy at 1.0225, it is better to postpone short positions to a more attractive resistance level of 1.0271. Only a false breakout will single short positions on the euro. You can sell short positions after a bounce from a high of 1.0321 or even a high of 1.0374, keeping in mind a downward intraday correction of 30-35 pips.

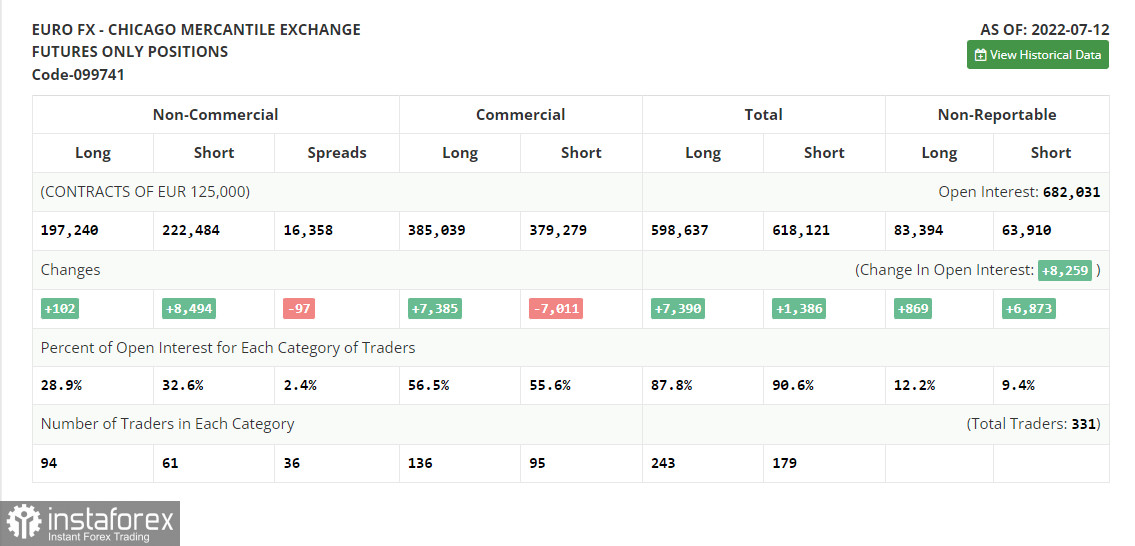

COT report

The COT report (Commitment of Traders) for July 12 logged an increase in both long and short positions. however, the number of short positions exceeded the number of long ones. It means that the bears are still in control. It also led to an increase in the negative delta. It seems traders are unwilling to buy the euro even at the current lows. The main reason is strong macro stats from the US. Rising inflation and retail sales facilitated bullish sentiment for the US dollar. As a result, there was a drop in demand for risk assets. as long as the Fed raises the key rate, the US dollar will maintain its bull run. In the near future, the eurozone will unveil its inflation data, which may trigger new sharp price swings. If this scenario comes true, a small upward correction of the pair may take place. Yet, it is will be a short-lived rise. the pair will eventually decline and test the parity level again. The COT report revealed that the number of long non-commercial positions increased by only 102 to the level of 197,240, while the number of short non-commercial positions jumped by 8,494 to the level of 222,484. Despite the low exchange rate of the euro, the US dollar is approaching new highs amid further aggressive monetary tightening by major central banks and the recession in many developed countries. At the end of the week, the total non-commercial net position remained negative and amounted to -25,244 against -16,852. The weekly closing price dropped to 1.0094 against 1.0316.

Signals of technical indicators

Moving averages

EUR/USD is trading near 30- and 50-period moving averages, signaling the market equilibrium.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the upper border of 1.0260 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.