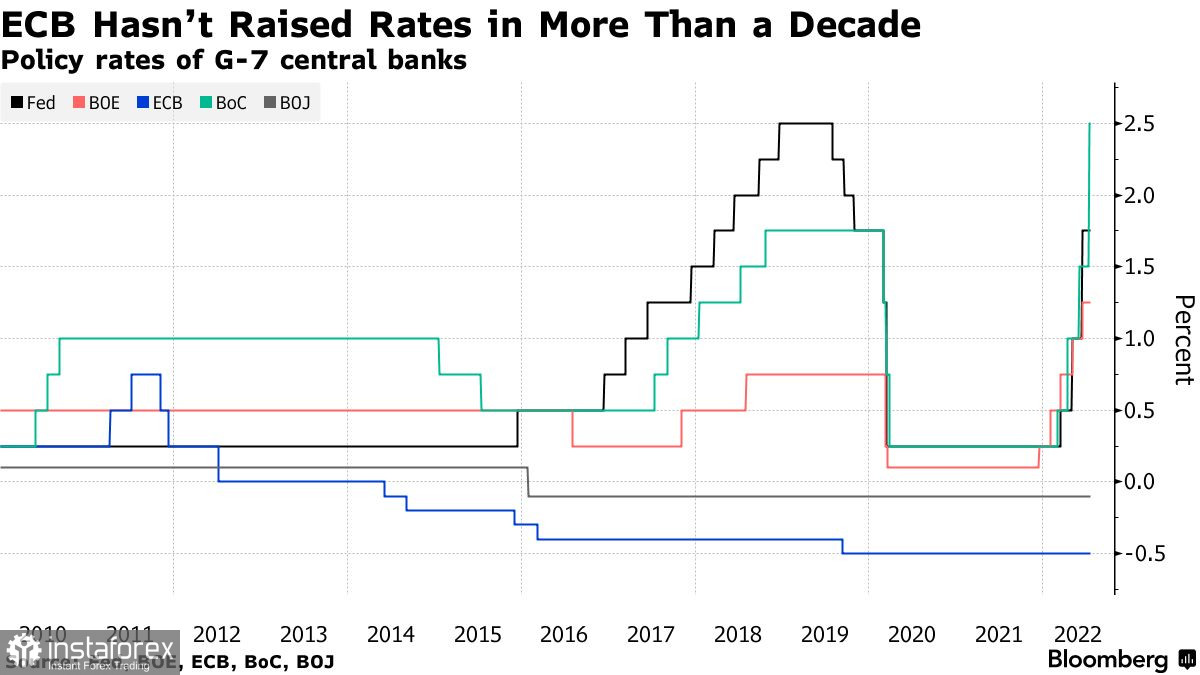

The euro regained some of its positions after yesterday's major sell-off amid profit-taking ahead of an important meeting of the European Central Bank. The further direction of the pair will depend on the decisions made on it. I think you all know that the European Central Bank is going to raise interest rates for the first time in 11 years, joining other central banks worldwide to fight a historic surge in inflation.

The price increases in the eurozone are of ever-growing concern to households, companies, and governments. There are rumors that managers may even deviate from the set course, considering at today's meeting an increase in interest rates immediately by 0.5% compared to the planned 0.25%.

But whatever the solution, this step will be accompanied by the presentation of a new tool to stimulate further economic growth in the region, which will help to contain volatility in the debt market as the cost of borrowing increases. It is unclear in what form the new instrument for buying bonds will be presented, as officials continue to argue about its terms: some countries benefit from the introduction of this instrument, but others, stronger ones, represented by Germany, do not.

The ECB's long-awaited rate hike puts it on par with other banks that have already raised rates this year. But this is far from enough for a confident fight against inflation. For example, the same Federal Reserve System started raising the rate in March and recently decided to increase the cost of borrowing by 0.75% at once. However, this still does little to help in the fight against inflation. It recently became known that the consumer price index has risen to a record level.

It is worth saying that as interest rates rise, there are more and more reasons for caution. While the immediate threat of economic chaos caused by the termination of Russian gas supplies has decreased due to the resumption of supply via the Nord Stream gas pipeline, the risks of recession in Europe remain high. They will increase if the authorities do not ease sanctions against Moscow, which may eventually stop supplying energy resources in winter.

On the other hand, if the European Central Bank leaves countries like Italy or Spain without support, the panic in the government bond market will only increase. This will certainly put pressure on the European currency, which has recently fallen to parity with the US dollar, fueling record inflation, which is four times higher than the ECB's 2% target.

At today's meeting, the President of the European Central Bank, Christine Lagarde, will discuss this topic. The reason for more hawkish statements will be inflation, which reached a new record in June. Economists say that, despite economic difficulties, price growth has not yet reached its peak and that the worst for the eurozone is yet to come.

Of course, if we talk about the technical picture of the euro, then the pair has a fairly good prospect of continuing the upward correction. However, now it is hardly possible to talk about building a more global upward trend when a meeting of the Federal Reserve System is on the nose, and it is not known how the committee members will behave at it. If today the ECB decides to raise rates by 0.5% immediately, a return to 1.0270 will help the bulls to continue the correction. Consolidation at this level opens prospects for recovery in the areas of 1.0340 and 1.0370. In the event of a decline in the euro, buyers need to show something around 1.0160. Otherwise, the pressure on the trading instrument will only increase. Having missed 1.0160, you can say goodbye to hopes for the pair's recovery, which will open a direct road to 1.0120 and 1.0080. A breakthrough at this support level will certainly increase the pressure on the trading instrument, opening an opportunity for the 1.0040 test.

The pound has every chance of continuing to grow, especially after it was actively bought off yesterday against the background of the fall that occurred after the inflation data in the UK. It is possible to talk about a larger growth in the current conditions, but only after the bulls achieve an exit beyond the resistance of 1.2005. Only after that can you count on a breakthrough in the areas of 1.2040 and 1.2080, where buyers will face much greater difficulties. In the case of a larger upward movement of the pound, we can talk about the update of 1.1220 and 1.2160. If the bears break below 1.1960, the road is straight to 1.1920. Going beyond this range will lead to another downward movement already to a minimum of 1.1880.