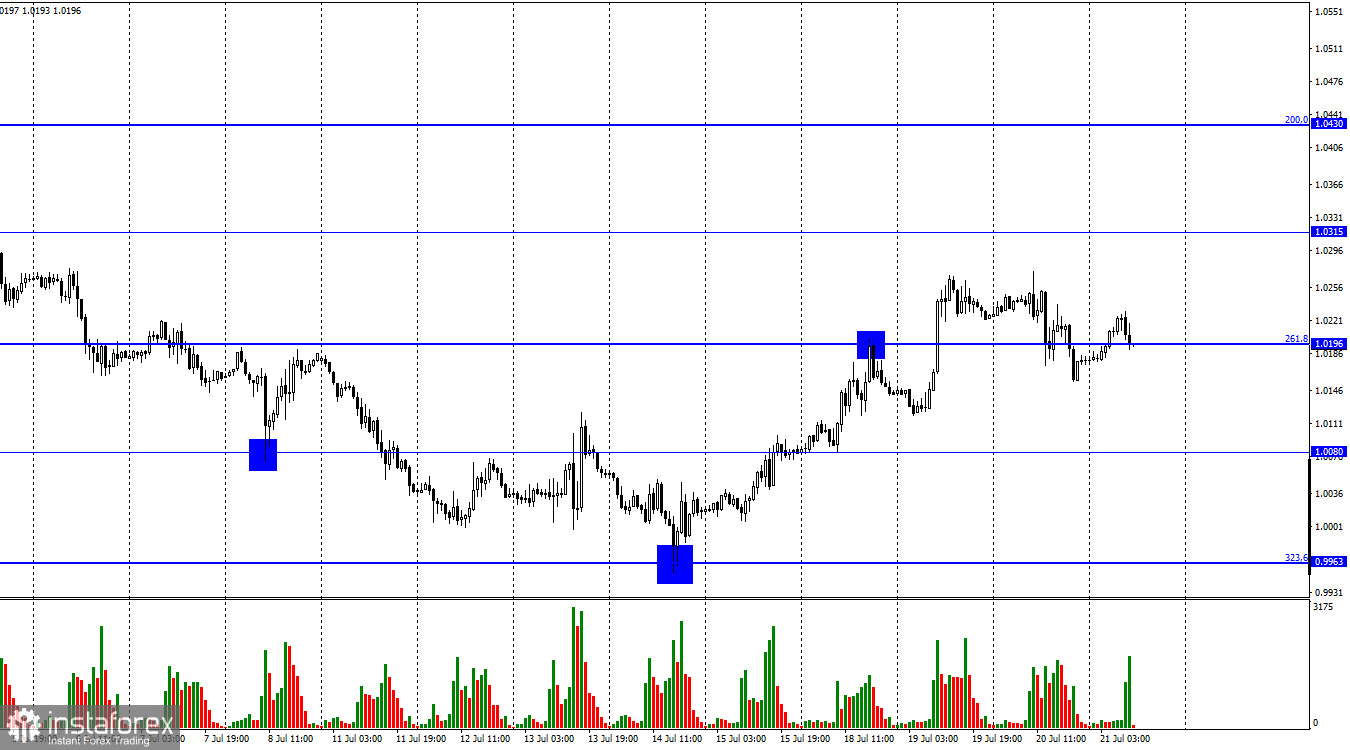

Good afternoon, dear traders! The EUR/USD pair halted its rise on Wednesday after a winning streak started a few days before. As a result, it fell below 1.0196 - the Fibonacci correction level of 261.8%. Today, it dipped again below this level. So, the euro is likely to decline to the 1.0080 level. However, I would not jump to conclusions as in a few hours the ECB will announce the key rate decision. The regulator is projected to raise the interest rate by 0.25%. However, analysts believe that the central bank may even undertake a 0.50% rate hike against the backdrop of fresh inflation data. The report showed a new surge in consumer prices. In my opinion, the ECB, which has been indecisive in recent months, will hardly raise the key rate by 0.50%.

Nevertheless, as we know, everything is possible. What to expect from the euro/dollar pair today? I think that with a rate increase of 0.25%, the euro will continue its downward movement. Traders, who have been actively buying the euro since the beginning of the week, have already priced in this key rate increase. If the ECB hikes the benchmark rate by 0.50 basis points, it may come as a surprise to market participants. If so, the euro may lift to 1.0315 and consolidate there for some time. Christine Lagarde's speech at the press conference could be even more important than the results of the meeting. Lagarde is expected to provide comments on the future plans for monetary policy. If, for example, Christine Lagarde hints at more aggressive tightening, the euro is sure to rise. Thus, the trajectory of the pair will largely depend on the ECB meeting. The euro needs new fundamental drivers to maintain bullish momentum. Otherwise, it will quickly slide back to parity as the US dollar is quite strong right now.

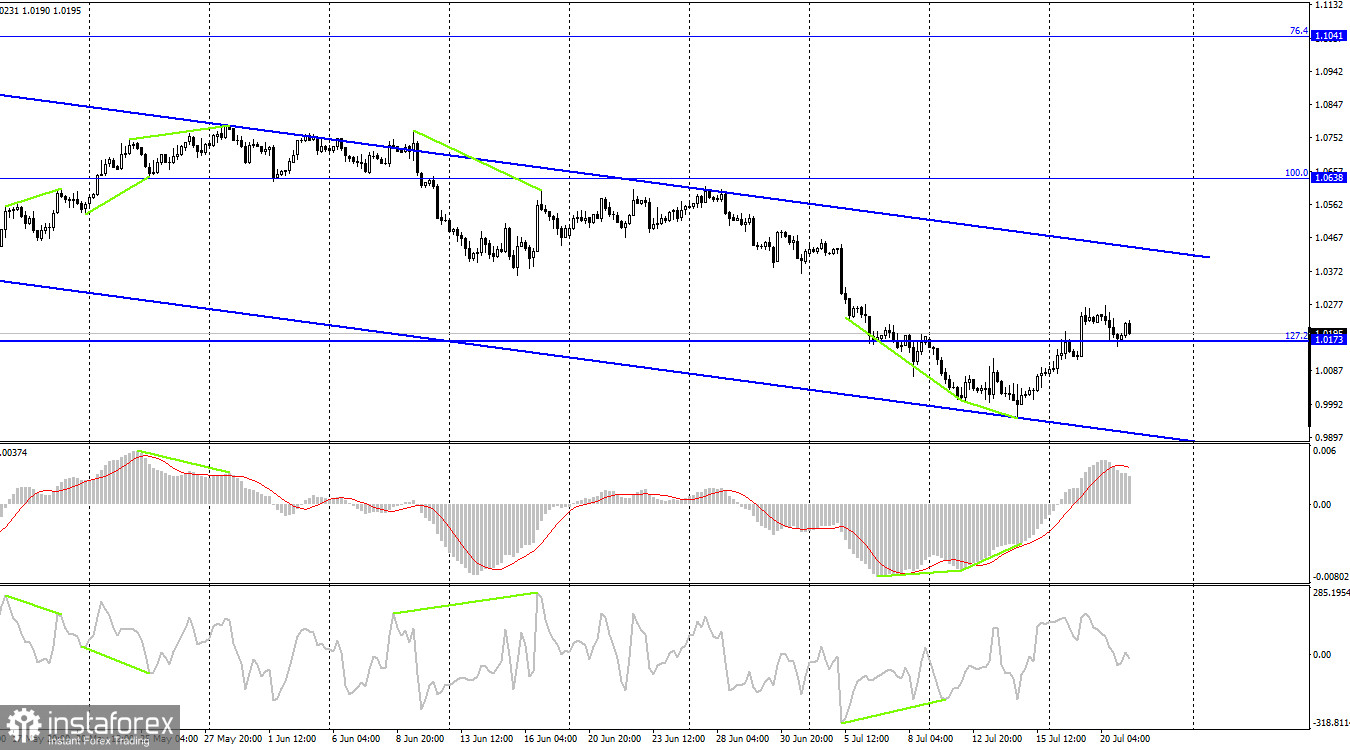

On the 4H chart, the pair performed an upward reversal and consolidated above the Fibonacci correction level of 127.2% - 1.0173. It may climb to the upper border of the descending channel, which will signal bearish sentiment. There are no divergences in the indicators today. Thus, the euro is likely to start a steady rally only after the consolidation over the descending channel.

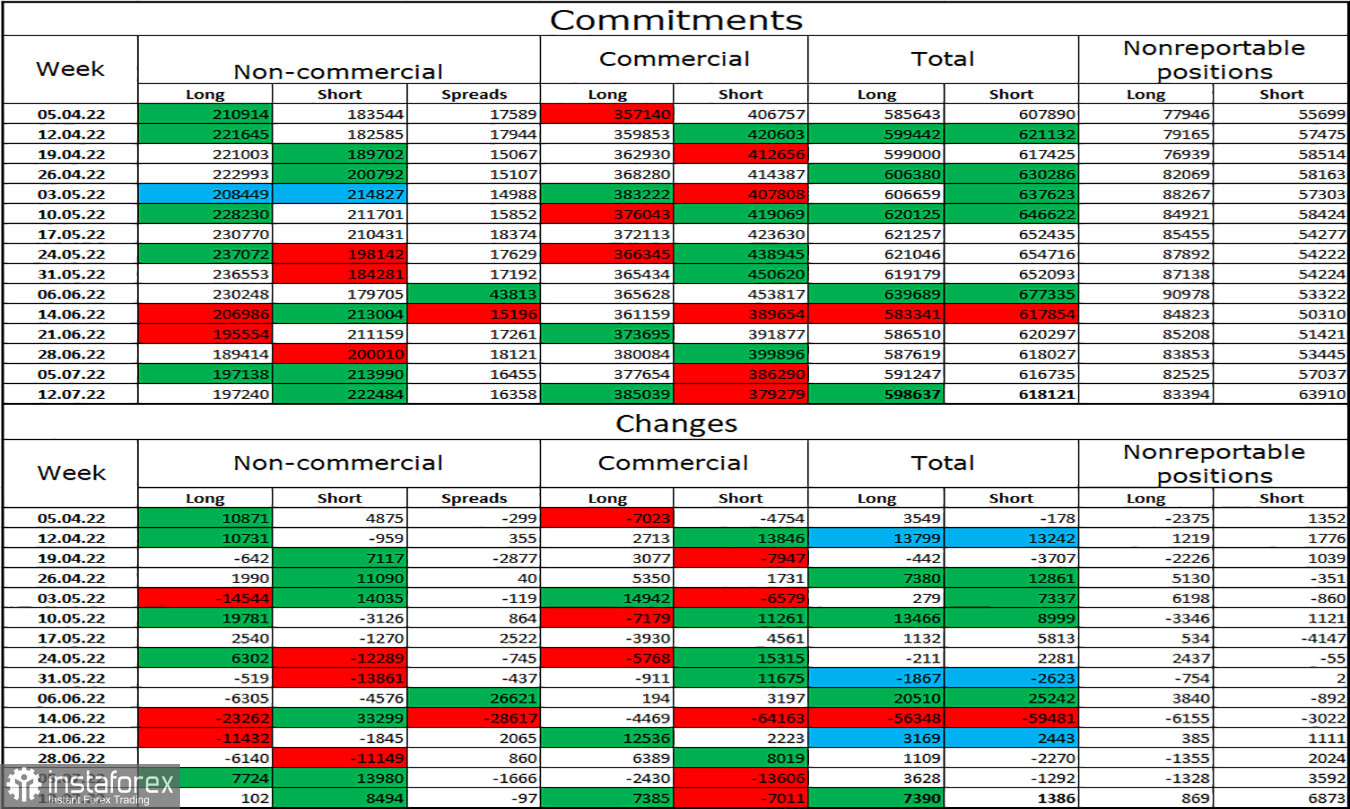

Commitments of Traders (COT):

Last week, speculators opened 102 Long contracts and 8,494 Short contracts. It means that the bearish sentiment has intensified again. The total number of Long contracts amounts to 197,000, and the number of Short contracts totals 222,000. The difference is not too big but it is not in favor of the bulls. In recent months, "Non-commercial" traders, have remained mainly bullish on the euro. Yet, it did not significantly help the euro. In the last few weeks, the likelihood of a rally has been gradually growing. However, recent COT reports have shown that a new sell-off may take place as the sentiment has changed from bullish to bearish. This is exactly what we are witnessing at this moment.

The economic calendar for the US and the EU:

EU – ECB Interest Rate Decision (12:15 UTC).

EU- Results of the ECB meeting (12:15 UTC).

US – Initial Jobless Claims (12:30 UTC).

EC – Christine Lagarde's speech (14:15 UTC).

The main highlight of the day will be the ECB meeting. Traders are likely to ignore the US initial jobless claims report. So, fundamental factors will considerably impact the market sentiment today.

Outlook for EUR/USD and trading recommendations:

It is better to open short positions if the price retreats from the upper border of the descending channel on the 4H chart or from any level on the 1H chart, aiming at the next levels. It is recommended to open long positions if the pair consolidates above the downward channel on the 4H chart with the prospect of a rise to the target level of 1.0638.